Vertical Divider

Final May Panel Pricing & Expectations

May 24, 2020

As production capacity returns to a more normal footing, the two biggest questions are when will demand return, and will there be component shortages? Demand is relatively strong, for notebook compounded by panel producers and OEMs facing shortages of components, limiting supply and pushing up notebook panel prices in June, but the overall increase seems to be under 0.4%, although some sizes could see higher increases.

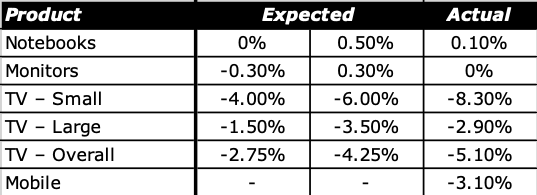

Table 1: May Panel Pricing Final

May 24, 2020

As production capacity returns to a more normal footing, the two biggest questions are when will demand return, and will there be component shortages? Demand is relatively strong, for notebook compounded by panel producers and OEMs facing shortages of components, limiting supply and pushing up notebook panel prices in June, but the overall increase seems to be under 0.4%, although some sizes could see higher increases.

Table 1: May Panel Pricing Final

Source: SCMR LLC, Omdia, WitsView

The monitor market was mixed with demand down for business and up for consumers. Little change in monitor pricing is expected in June, as panel manufacturers to shift some TV production to monitors, which could alleviate any possibility of supply/demand imbalance. TV panel prices declined on weak demand, albeit a bit more than we had expected.

TV set brands saw both supply and demand fall significantly in 1Q, and cut expectations for 2Q demand while panel producers continued to produce at levels higher than needed to maintain utilization levels. TV set demand, with a few exceptions, saw the positive impact of stay-at-home entertainment and an increase in on-line TV set sales, but such demand is transitory, and did not help panel producers offering volume discounts to brands willing to pull in orders from June and July. While 3Q and to a lesser degree 4Q are peak demand quarters for TV panel production, as panel producers push brands to borrow from 3Q and 4Q orders, they Q4 will be down Y/Y without a rise in holiday momentum.

Delays new smartphone model launches and also lengthening the lifespans of older models - are undercutting panel demand - quotes for a-Si or LTPS smartphone applications fell by US$0.2 on average in May, and those for Chinese AMOLED dropped by US$1, according to CINNO Research.

LCD smartphone panel prices declined significantly in May as small/medium panel production had higher than expected utilization, which added to relatively high inventory levels for smartphone panels as well as the need to draw demand from OLED rigid panels by lowering prices.

|

Contact Us

|

Barry Young

|