Vertical Divider

Exposure Shipment Trends from Canon and Nikon

June 14, 2020

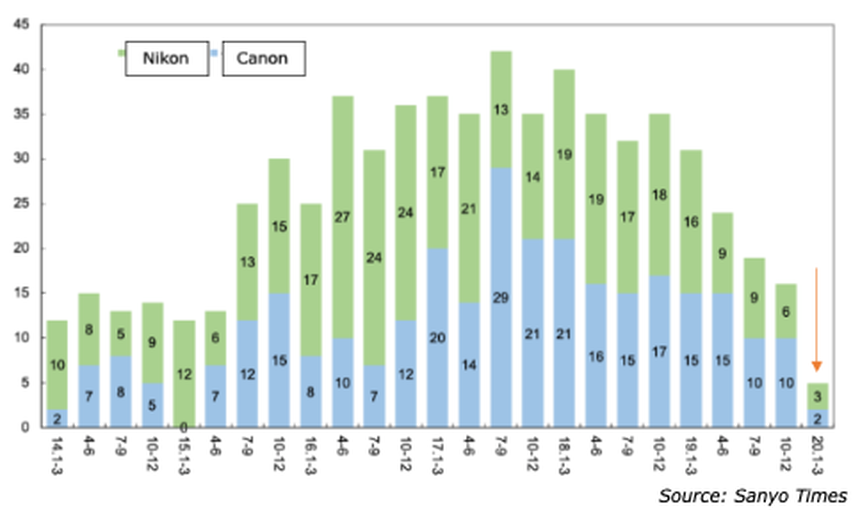

The Sanyo Times reported the number of FPD exposure equipment sold during Q120 was 5 units at Nikon and Canon. The two companies sold 31 units in the same period of the previous year.

Figure 1 Exposure Shipment Trend by Japanese Producer Canon and Nikon

June 14, 2020

The Sanyo Times reported the number of FPD exposure equipment sold during Q120 was 5 units at Nikon and Canon. The two companies sold 31 units in the same period of the previous year.

Figure 1 Exposure Shipment Trend by Japanese Producer Canon and Nikon

Shipping, loading, installation and startup work was shut-down in China. The typical number of shipments on a quarterly basis since 2010 was 6.

Chinese panel producer CEC Panda has been rumored to be in play with the additional share purchases made by parent China Electronics (state-owned. Current speculation is that the company’s production fabs will be split between BOE and ChinaStar. BOE is expected to acquire Panda’s Chengdu Gen 8.5 LCD lines and ChinaStar will acquire the Nanjing Gen 6 and Gen 8.5 LCD lines (the Gen 8 line in Nanjing was recently evaluated to have a ‘recoverable’ value of $2.34B US). CSOT’s parent TCL seems far more interested in increasing panel capacity under its control as the 2nd largest TV brand in China and in the top 5 worldwide, securing not only its own supply but growing its overall display business as a production entity. BOE has taken the opposite route, focusing forward capex on OLED and other new display technologies, raising questions as to why they would participate, although BOE is certainly interested in Panda’s IGZO backplane technology.

- Nikon Shipped 3 Units in Q1’20 -- Nikon originally planned to sell 8 units in the January to March 2020 period, but the result was only 3 units (16 units in the same period of the previous year). Each unit was either for 10.5G and for 6G. The shipment and installation of 3 units could not be completed due to restrictions such as the travel of engineers, and they are being postponed until the next period. The number of exposure equipment sold in FY2019, ended March 31, 2019, was 27 units, which was a large decrease from the 70 units in FY2018. The shipment breakdown of 2019 27 units is 18 for 10.5G (17 in the previous year), 5 for 7G/8G (37), and 4 for 5G/6G (16). On the other hand, the negotiation for "exposure business for small and medium-sized panels", "Business negotiations have begun to take shape, and negotiations are progressing in an advantage over the competition have started according to Toshikazu Madate, CEO. CEO Toshikazu Madate added that Nikon will certainly capture demand for high-definition and aim to increase profits."

- Canon Shipped 2 Units in Q1’20 --Canon also sold only two units in the January-March period (15 units in the same period of the previous year). In China, where FPD manufacturers are concentrated, movement was restricted, and it took time for customers to install them in their factories. Canon is hesitant to predict for how the shipment of exposure can be done in 2020 and beyond due to pandemic. Although the FPD exposure system will try to recover after the end, it is difficult to complete all the installation by the end of the installation due to the lengthy installation work, and the annual sales volume for 20 years will be reduced from the initially expected 54 units.

Chinese panel producer CEC Panda has been rumored to be in play with the additional share purchases made by parent China Electronics (state-owned. Current speculation is that the company’s production fabs will be split between BOE and ChinaStar. BOE is expected to acquire Panda’s Chengdu Gen 8.5 LCD lines and ChinaStar will acquire the Nanjing Gen 6 and Gen 8.5 LCD lines (the Gen 8 line in Nanjing was recently evaluated to have a ‘recoverable’ value of $2.34B US). CSOT’s parent TCL seems far more interested in increasing panel capacity under its control as the 2nd largest TV brand in China and in the top 5 worldwide, securing not only its own supply but growing its overall display business as a production entity. BOE has taken the opposite route, focusing forward capex on OLED and other new display technologies, raising questions as to why they would participate, although BOE is certainly interested in Panda’s IGZO backplane technology.

|

Contact Us

|

Barry Young

|