Vertical Divider

|

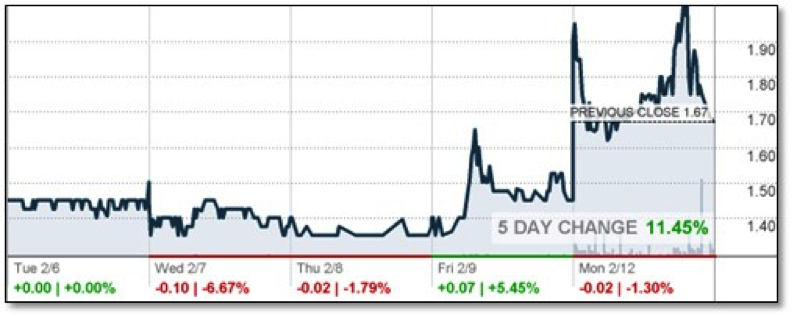

eMagin Enjoys One Day Share Price Growth Followed by Big Drop

On January 23, OLED microdisplay manufacturer eMagin filed an S-1/A Amended Registration Statement with exhibits. One of the exhibits (Ex 1-1) contained a schedule (Schedule II) that was entitled “Specified Investors” and listed 5 names and their affiliates:

The market assumed the ‘specified investors’ were involved in the $10+m financing for eMagin, but yesterday the company explained in a press release that these were companies that eMagin management was speaking with at a recent event and they have not participated in the deal, which closed on January 29th. There had been a number of reports that Apple and the others had taken a stake in eMagin because of its ability to produce high resolution and unusually bright OLED micro-displays that have applications in VR and AR products in addition to their traditional military devices. When the original stories came out, the stock spiked on what looked like spectacular news, and was picked up by a number of news services, but yesterday before the close, the stock was halted and the company released “eMagin Corporation Updates the Market” where it stated that to the company’s knowledge, none of these consumer electronics companies have taken part in the offering. While this has cast a shadow over the company, eMagin does have new high resolution, high bright OLED micro-display product. The unfortunate circumstances around the filing and its language will likely be a host for those lawyers looking to cash in on the poor document execution, and will be ‘looking for justice’ for those that purchased the stock on the spike, along with the typical 25% of the settlement… Figure 1:EMAN 5-Day Stock Chart Source: CNN Money

|

|

|

Contact Us

|

Barry Young

|