Vertical Divider

Duksan Neolux Reports Q220 Revenues Up 19.6% Y/Y

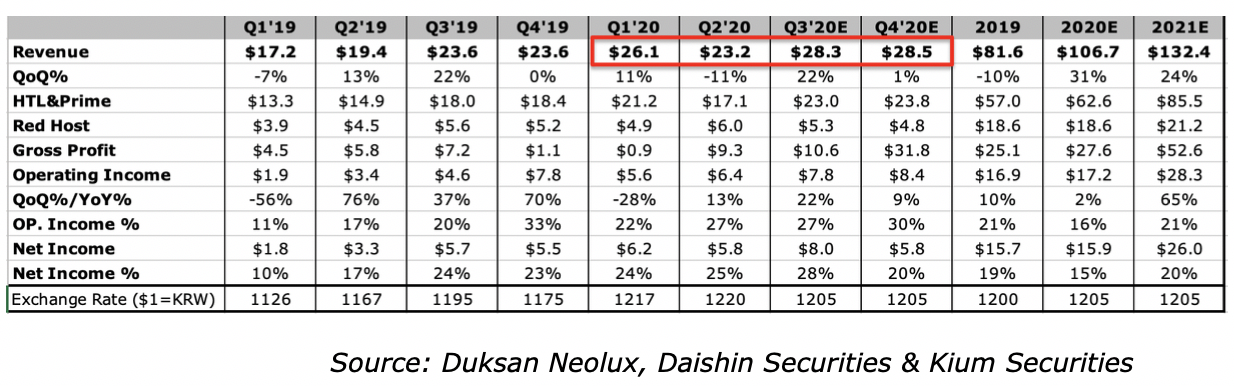

Duksan Neolux (Duksan) had Q220 revenues of $23.2m, up 19.6% Y/Y and down 11% sequentially. Operating income of $6.4m, up 88.2% Y/Y and 13% sequentially. Duksan sells to Samsung Display (SDC), BOE and LG Display (LGD). Daishin Securities reported that 54% of Duksan’s revenue came from SDC followed LGD at 42%. LGD’s share of Duksan revenue went from 16% in 2019 to > 50% in H1’20. Duksan outlooks a $107m in 2020 revenue up 26.6% Y/Y. BOE’s increased OLED panel shipments to Huawei should increase demand for Duksan OLED HTL materials. BOE’s OLED panel shipment is projected to grow from 17m in 2017 to 30m in 2020 according to Kium Securities in Korea.

Table 1: Duksan Neolux Revenue Trends

Duksan Neolux (Duksan) had Q220 revenues of $23.2m, up 19.6% Y/Y and down 11% sequentially. Operating income of $6.4m, up 88.2% Y/Y and 13% sequentially. Duksan sells to Samsung Display (SDC), BOE and LG Display (LGD). Daishin Securities reported that 54% of Duksan’s revenue came from SDC followed LGD at 42%. LGD’s share of Duksan revenue went from 16% in 2019 to > 50% in H1’20. Duksan outlooks a $107m in 2020 revenue up 26.6% Y/Y. BOE’s increased OLED panel shipments to Huawei should increase demand for Duksan OLED HTL materials. BOE’s OLED panel shipment is projected to grow from 17m in 2017 to 30m in 2020 according to Kium Securities in Korea.

Table 1: Duksan Neolux Revenue Trends

|

Contact Us

|

Barry Young

|