Vertical Divider

Musing on Production

DSCC Says OLED Revenue’s 13.4% CAGR Takes it from 27.3b in

2019 to $51.2b in 2025

June 29, 2020

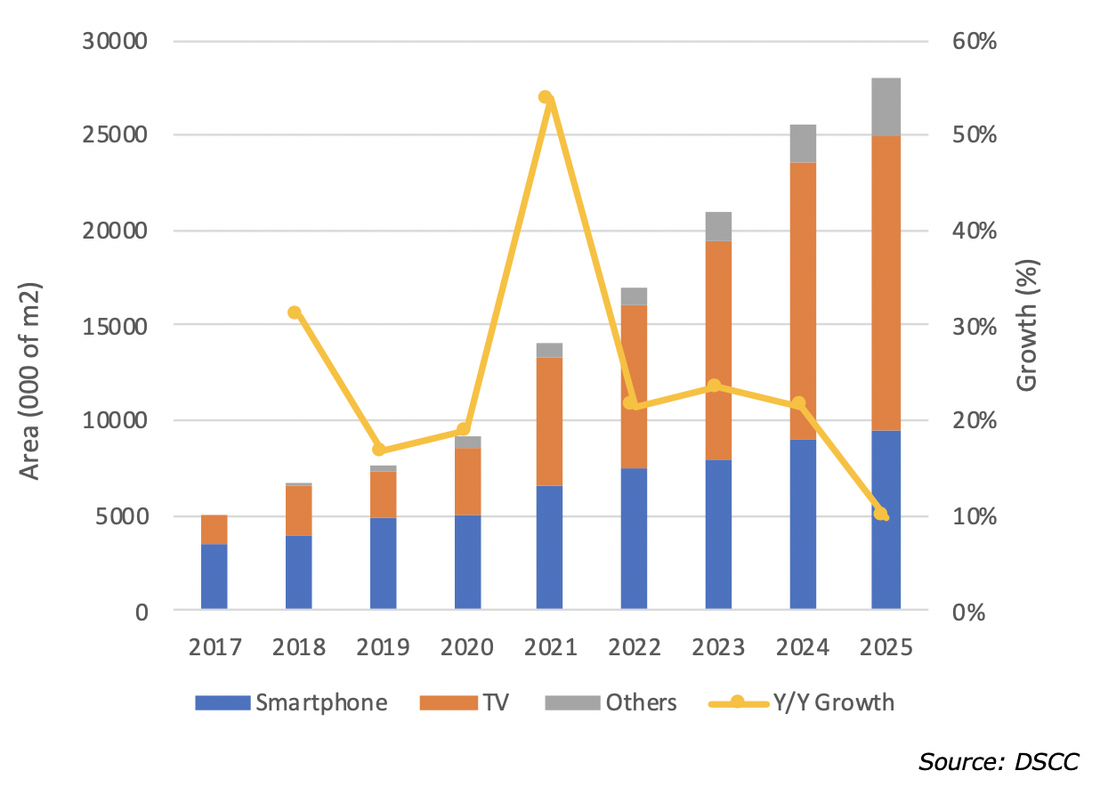

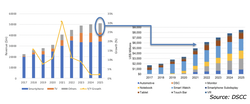

OLED panel revenues will increase by 14% in 2020 to $31.8 billion, and will grow to $51.2 billion by 2025, according to the latest update of the DSCC Quarterly OLED Shipment Report for Q2 2020. Starting from a small base of $2.9b, DSCC is forecasting OLED notebooks, automotive, tablets to have a CAGR of 25% from 2019-2025, reaching ~$8.5b.

Figure 1: OLED Revenue by Application

DSCC Says OLED Revenue’s 13.4% CAGR Takes it from 27.3b in

2019 to $51.2b in 2025

June 29, 2020

OLED panel revenues will increase by 14% in 2020 to $31.8 billion, and will grow to $51.2 billion by 2025, according to the latest update of the DSCC Quarterly OLED Shipment Report for Q2 2020. Starting from a small base of $2.9b, DSCC is forecasting OLED notebooks, automotive, tablets to have a CAGR of 25% from 2019-2025, reaching ~$8.5b.

Figure 1: OLED Revenue by Application

It would be expected hat area would grow faster than revenue as the average panel size increases, but DSCC expects a CAGR of 24% in area between 2019 and 2025.

Figure 2: OLED Shipments in Area (000 of m2)

Figure 2: OLED Shipments in Area (000 of m2)

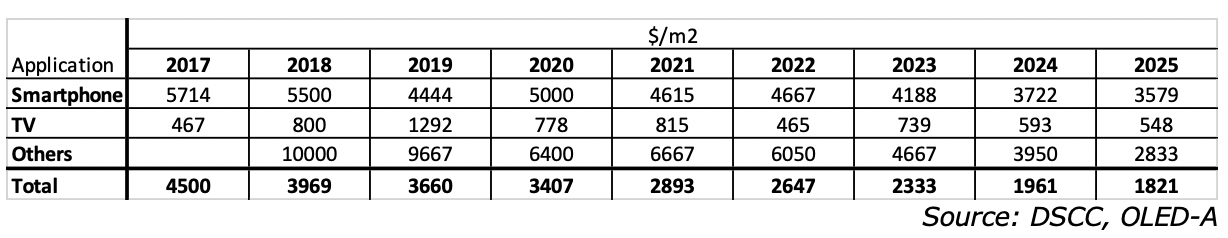

Although revenue and area are projected to grow at comparable rates, average revenue per sq. m is forecast to drop at a CAGR of 11%. DSCC didn’t explain the phenomena in their blog, but perhaps they deal with it in their report. There is a substantial difference in the CAGR deceleration of TV and Others prices /m2, which are -13% and -18% respectively, while smartphone CAGR area prices are down only 4% for the 5-year period.

Table 1: Price/m2 by Application

Table 1: Price/m2 by Application

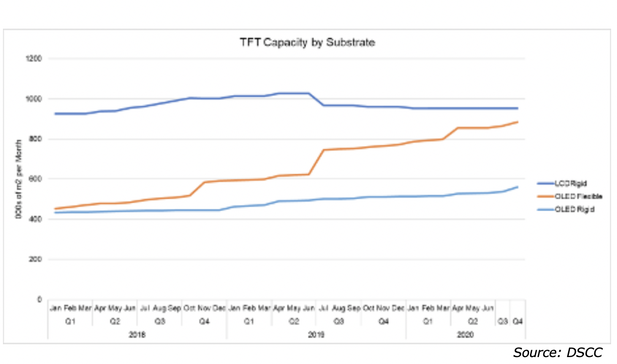

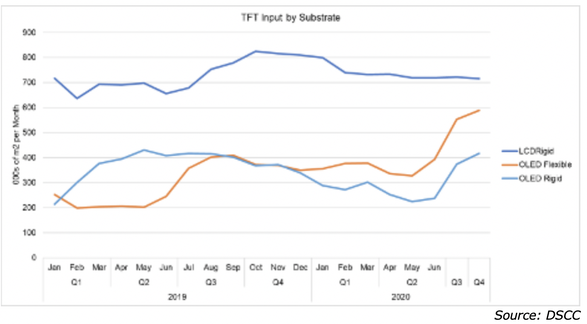

With respect to individual fabs on flexible OLED fab utilization, Samsung’s A2 and A3 fabs are by far the largest rigid and flexible OLED fabs, in terms of capacity, respectively, and lower utilization at both of these fabs in Q2 reduced the total industry utilization (%). DSCC projects higher utilization in the 2ndhalf of 2020 as Samsung builds for the iPhone 12. BOE’s B7 line in Chengdu will fare better than 2019 when it suffered through the loss of Huawei’s Mate 30 Pro business, but even with this recovery B7 utilization will remain below 60%, due to the low yields and BOE’s failure to acquire any orders from Apple or Samsung. DSCC’s Quarterly OLED and Mobile LCD Fab Utilization Report tracks TFT capacity and utilization across 41 OLED and LTPS LCD fabs across this industry, allowing segmentation by supplier, TFT Generation, country, backplane technology, frontplane technology, and substrate type

Figure 3: OLED and Mobile LCD TFT Capacity, 2018-2020

Figure 3: OLED and Mobile LCD TFT Capacity, 2018-2020

Figure 4: Area Inputs by Substrate Technology

Figure 5: OLED and Mobile LCD Utilization, 2018-2020

|

Contact Us

|

Barry Young

|