Vertical Divider

Demura Equipment Used to Raise Yields in Troubled Chinese OLED Fabs

December 22, 2019

Mura has been a constant bane in the design of OLED displays made by the Koreans. Now that the Chinese are trying to compete with the Koreans, Chinese companies demura equipment suppliers are attracting the attention of VCs and personal investors. Regardless size and market share, they get requests, offerings, and investments from varied sources constantly. This rising interest in demura equipment is due to its potential in the coming years, alongside OLED market growth. The overall market of demura equipment may be as high as $266 million in the following years.

OLEDs are very sensitive to external and internal influences and will typically undergo the demura process module phase to increase the yield. In order to meet the TACT requirement, the workload in the OLED module phase increases, thus, more demura equipment is needed. Consequently, the demura process in the OLED module phase becomes extremely important. In order to increase the yield, it is better to adopt demura process for all panels, since all panels need uniform brightness before shipment.

Figure 1: Module Equipment Layout Including Demura

December 22, 2019

Mura has been a constant bane in the design of OLED displays made by the Koreans. Now that the Chinese are trying to compete with the Koreans, Chinese companies demura equipment suppliers are attracting the attention of VCs and personal investors. Regardless size and market share, they get requests, offerings, and investments from varied sources constantly. This rising interest in demura equipment is due to its potential in the coming years, alongside OLED market growth. The overall market of demura equipment may be as high as $266 million in the following years.

OLEDs are very sensitive to external and internal influences and will typically undergo the demura process module phase to increase the yield. In order to meet the TACT requirement, the workload in the OLED module phase increases, thus, more demura equipment is needed. Consequently, the demura process in the OLED module phase becomes extremely important. In order to increase the yield, it is better to adopt demura process for all panels, since all panels need uniform brightness before shipment.

Figure 1: Module Equipment Layout Including Demura

Source: IHS

Demura equipment is typically integrated with one or multiple work stations, and AOI systems.

- Multiple work stations, usually four work stations in mass production (MP) line and one work station in research and development (R&D) line, are needed to meet the TACT requirement since the entire demura process includes several stages, including multiple image extraction, data processing, and brightness adjustment. The entire process is approximately 100 seconds to process one OLED panel.

- The automated optical inspection (AOI) equipment in the demura equipment is the key component to collect and analyze basic information for demura process. Among all processes, image extraction takes the longest time, since dozens of photos are captured in the process.

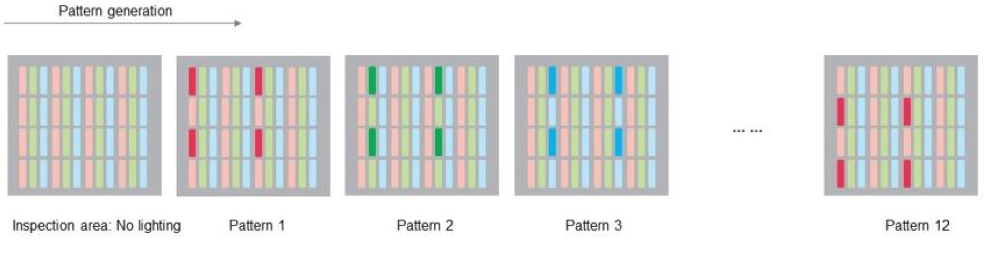

- In image extraction, a photo is taken by the spacing lighting approach.

- Once data is collected and enhanced, an algorithm will be applied to identify the defect inside the panel and adjust the current-voltage characteristic curve (I-V curve) to increase the uniformity in each pixel.

Figure 2: Spatial Lighting Approach Used by AOI and Demura

Source: IHS

For a Gen 6 OLED line with 80% yield rate and 70% uptime, at least 15 demura machines are needed to process 15k/m capacity. Each demura tool costs between $300,000 and $600,000, or $13.5 million to $27 million for a 45k/m fab. Given the number of Gen 6 OLED fabs planned in China, the potential market for demura equipment may be as high as a total of $266 million over the next a few years. Tool makers are trying to reduce TACT from 100s to 70s and add up to 5 working stations to remain competitive.

- Prior to 2018, the cost of a demura machine was around $600,000 per tool, and has been as low as $300,000 per tool in 2019.

- Currently, this market is filled with many Chinese companies, including Wuhan Jingce, Granda, Seichitech, Gaci Optical and Lead China, as well as smaller companies, such as Flexvision and may be difficult for new players to enter into the market without a major breakthrough

- However, the demand for demura equipment may be constrained by:

- Reduced demand as panel makers increase their yields

- Some applications will not require the demura process, which leads to lower demand for demura equipment. For instance, BOE B7 and B11 OLED fabs have purchased only 28 and 24 demura tools, respectively, to this date.

|

Contact Us

|

Barry Young

|