Vertical Divider

COVID-19 Delays but Doesn’t Disrupt China’s OLED Fab Capex

April 26, 2020

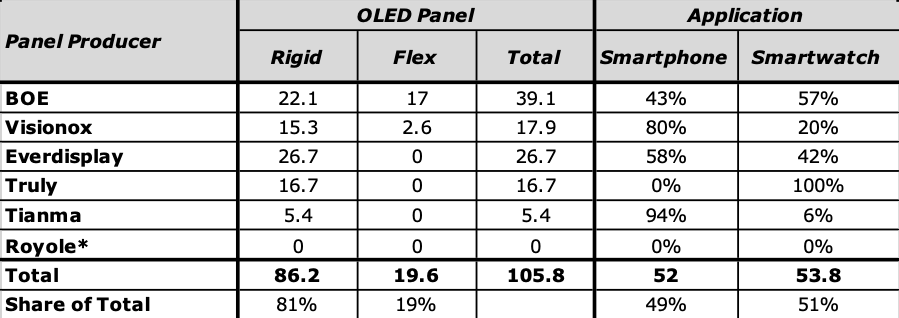

China is investing heavily to compete in the OLED business and has been planning to put pressure on small panel OLED leader Samsung Display and large panel OLED leader LG Display. China is expected to grow its OLED panel business quickly and will continue to do so in 2020 and 2021, but while 2019 saw a big increase in Chinese OLED unit volume, the country’s panel producers still represented under 21% of total OLED shipments worldwide, with the bulk going to SDC and LG Display.

This year that percentage is expected to move up to a bit over 25% (excluding the impact of COVID-19) if China is able to reach it’s OLED unit volume target of 128m units, but unit volume measurements are relative unimportant as opposed to area volume. Over 50% of Chinese OLED unit volume in 2019 was for watch displays, which are ~1/15 the size of a 6” smartphone display and over 80% of China’s OLED displays were based on rigid OLED, a far more competitive market than flexible OLED displays, so the references to China’s ‘destruction of Korea’s OLED dominance’ are still a bit premature. China is certainly not going to give up on world OLED domination, but the question remains as to whether OLED will be the growth engine it once was by the time China becomes competitive.

Table 1: China’s OLED Panel Makers Production

April 26, 2020

China is investing heavily to compete in the OLED business and has been planning to put pressure on small panel OLED leader Samsung Display and large panel OLED leader LG Display. China is expected to grow its OLED panel business quickly and will continue to do so in 2020 and 2021, but while 2019 saw a big increase in Chinese OLED unit volume, the country’s panel producers still represented under 21% of total OLED shipments worldwide, with the bulk going to SDC and LG Display.

This year that percentage is expected to move up to a bit over 25% (excluding the impact of COVID-19) if China is able to reach it’s OLED unit volume target of 128m units, but unit volume measurements are relative unimportant as opposed to area volume. Over 50% of Chinese OLED unit volume in 2019 was for watch displays, which are ~1/15 the size of a 6” smartphone display and over 80% of China’s OLED displays were based on rigid OLED, a far more competitive market than flexible OLED displays, so the references to China’s ‘destruction of Korea’s OLED dominance’ are still a bit premature. China is certainly not going to give up on world OLED domination, but the question remains as to whether OLED will be the growth engine it once was by the time China becomes competitive.

Table 1: China’s OLED Panel Makers Production

Source: Sigmaintell

As SDC winds down its LCD panel production it remains obligated to supply between ~10m and 12m panels to Samsung Visual this year. SDC is shopping for suppliers who can provide high quality TV panels on a consistent basis. SDC has been buying panels from other producers for a number of years, from AUO, BOE, Innolux and CSoT accounting for much of the company’s outside purchases. This is a very advantageous position for SDC to be in as long as panel prices remain steady or are declining, and the pricing leverage SDC would have given the number of units needed would make it quite a large customer, if not the largest for most other panel suppliers.

Samsung owns 60% of a Gen 8.5 LCD fab in China, along with the Suzhou government (30%) and TCL, the parent of CSoT. SDC has been in on and off negotiations to sell this fab, likely to TCL/CSoT and also has a ~10% stake in CSoT’s Gen 11 LCD fab, which gives CSoT at least a working relationship with SDC, with ~5% - 6% of SDC’s needs being supplied by other CSoT facilities. China’s BOE has also been a supplier to SDC, likely between 6% and 7% of Samsung’s LCD panel needs, but it is likely that AUO and Innolux will capture at least a combined 12% to 15% of SDC’s business going forward, with both having been SDC’s ‘fill-in-the-gap’ suppliers for years during periods when panels were in short supply. As reported previously, Sharp, which had arbitrarily cancelled a supply agreement with SDC is back in the mix.

While SDC is currently has a strong negotiating position, reducing the company’s LCD production to a small amount while parent Samsung Electronics is still expecting to sell 40m – 50m LCD based TV sets/year, can have the opposite effect if panel prices rise. Fortunately, for Samsung large panel pricing is expected to fall over the next 6 months as demand SDC has reduced and likely will eliminate its exposure to the LCD TV panel space as a primary supplier, but will bear the burden of paying up for panels when demand exceeds supply. Those costs would have to be passed on to Samsung Electronics who would be competing with Chinese TV brands such as TCL, who would be producing 60% to 70% of their own needs, or Sharp, who would be producing at least a similar amount in-house, giving them a pricing advantage that Samsung will no longer have. That said, right now things are working in the right direction for SDC, but things have been moving rapidly in the CE space this year and forecasting where things will be in 60 or 90 days has become infinitely harder with the spread of COVID-19.

Samsung Display's decision to terminate production of LCD panels at its plants in Korea and China before year-end 2020 is positive for demand and supply of large-size panels in 2021, and the move will also benefit rivals including China Star Optoelectronics Technology (CSOT), BOE Technology, Sakai Display Products (SDP) and AU Optronics (AUO), according to DigiTimes Research. It is no surprise to the display industry that Samsung Display will opt to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors' aggressive capacity ramp.

LCD panel prices did stage a rally in early 2020 but the upswing was capped in March by the coronavirus pandemic, which has also undermined consumer demand for TVs, pushing Samsung Display to accelerate its exit from the LCD panel sector.

Samsung Display had 14.4% of the world's large-size LCD panel production capacity in 2019, including 11.1% in Korea and 3.3% in China. The Korean panel maker is currently operating an 8.5G line in Suzhou, China, and the company is likely to sell it to China-based companies, such as CSOT, which would narrow its capacity gap to rival company BOE if it acquired the plant.

DigiTimes Research believes that CSOT, BOE and SDP (including Sakai SIO International Guangzhou) will benefit from Samsung Display's exit as these three firms all boast 10G or above LCD lines.

AUO has maintained long-term business relationships with Samsung Display in TV panel segment though the two firms are competing each other for panel orders from the gaming monitor segment. AUO stands a good chance of ramping up gaming monitor panel shipments once Samsung Display stops producing LCD panels. LCD panel makers in China and Taiwan are expected to gear up efforts to grab TV panel orders to be released by Samsung Electronics after its associate company Samsung Displays stops producing LCD panels, according to industry sources. Samsung Display has decided to terminate production of LCD panels at its plants in Korea and China by year-end 2020, as it moves to accelerate developing high-margin QLED panels, said the sources.

However, Samsung Display will remain the largest supplier of LCD TV panels to Samsung Electronics in 2020, with its shipments likely to reach 10 million units, supporting the vendor's goal of delivering up to 46 million TVs worldwide in the year, the sources indicated.

To mitigate its production risks, Samsung Electronics is likely to buy TV panels from multiple sources after 2020, mainly panel makers in China and Taiwan, the sources added.

China Star Optoelectronics Technology (CSOT), a subsidiary of TCL, has a good chance to grab more windfall orders from the Korean TV vendor as it holds a 10% stake in an 8.5G joint venture currently operated by Samsung Display in Suzhou, China, noted the sources.

Samsung Display holds a majority 60% share in the joint venture and the city government of Suzhou has 30%. Samsung Display has recently resumed talks for selling its stake to CSOT after previous discussions for such a deal were suspended due to unspecified reasons, the sources said.

Meanwhile, Taiwan-based AU Optronics (AUO) is expected to be able enhancing its business relationships with Samsung Electronics, having supplied high-end TV panels such as 4K, curved and bezel-less 8K models to the Korean TV vendor for years, commented the sources. Cooperation between AUO and Samsung will continue to focus on high-end and slim-type models due to capacity constraints at AUO, said the sources.

Samsung owns 60% of a Gen 8.5 LCD fab in China, along with the Suzhou government (30%) and TCL, the parent of CSoT. SDC has been in on and off negotiations to sell this fab, likely to TCL/CSoT and also has a ~10% stake in CSoT’s Gen 11 LCD fab, which gives CSoT at least a working relationship with SDC, with ~5% - 6% of SDC’s needs being supplied by other CSoT facilities. China’s BOE has also been a supplier to SDC, likely between 6% and 7% of Samsung’s LCD panel needs, but it is likely that AUO and Innolux will capture at least a combined 12% to 15% of SDC’s business going forward, with both having been SDC’s ‘fill-in-the-gap’ suppliers for years during periods when panels were in short supply. As reported previously, Sharp, which had arbitrarily cancelled a supply agreement with SDC is back in the mix.

While SDC is currently has a strong negotiating position, reducing the company’s LCD production to a small amount while parent Samsung Electronics is still expecting to sell 40m – 50m LCD based TV sets/year, can have the opposite effect if panel prices rise. Fortunately, for Samsung large panel pricing is expected to fall over the next 6 months as demand SDC has reduced and likely will eliminate its exposure to the LCD TV panel space as a primary supplier, but will bear the burden of paying up for panels when demand exceeds supply. Those costs would have to be passed on to Samsung Electronics who would be competing with Chinese TV brands such as TCL, who would be producing 60% to 70% of their own needs, or Sharp, who would be producing at least a similar amount in-house, giving them a pricing advantage that Samsung will no longer have. That said, right now things are working in the right direction for SDC, but things have been moving rapidly in the CE space this year and forecasting where things will be in 60 or 90 days has become infinitely harder with the spread of COVID-19.

Samsung Display's decision to terminate production of LCD panels at its plants in Korea and China before year-end 2020 is positive for demand and supply of large-size panels in 2021, and the move will also benefit rivals including China Star Optoelectronics Technology (CSOT), BOE Technology, Sakai Display Products (SDP) and AU Optronics (AUO), according to DigiTimes Research. It is no surprise to the display industry that Samsung Display will opt to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors' aggressive capacity ramp.

LCD panel prices did stage a rally in early 2020 but the upswing was capped in March by the coronavirus pandemic, which has also undermined consumer demand for TVs, pushing Samsung Display to accelerate its exit from the LCD panel sector.

Samsung Display had 14.4% of the world's large-size LCD panel production capacity in 2019, including 11.1% in Korea and 3.3% in China. The Korean panel maker is currently operating an 8.5G line in Suzhou, China, and the company is likely to sell it to China-based companies, such as CSOT, which would narrow its capacity gap to rival company BOE if it acquired the plant.

DigiTimes Research believes that CSOT, BOE and SDP (including Sakai SIO International Guangzhou) will benefit from Samsung Display's exit as these three firms all boast 10G or above LCD lines.

AUO has maintained long-term business relationships with Samsung Display in TV panel segment though the two firms are competing each other for panel orders from the gaming monitor segment. AUO stands a good chance of ramping up gaming monitor panel shipments once Samsung Display stops producing LCD panels. LCD panel makers in China and Taiwan are expected to gear up efforts to grab TV panel orders to be released by Samsung Electronics after its associate company Samsung Displays stops producing LCD panels, according to industry sources. Samsung Display has decided to terminate production of LCD panels at its plants in Korea and China by year-end 2020, as it moves to accelerate developing high-margin QLED panels, said the sources.

However, Samsung Display will remain the largest supplier of LCD TV panels to Samsung Electronics in 2020, with its shipments likely to reach 10 million units, supporting the vendor's goal of delivering up to 46 million TVs worldwide in the year, the sources indicated.

To mitigate its production risks, Samsung Electronics is likely to buy TV panels from multiple sources after 2020, mainly panel makers in China and Taiwan, the sources added.

China Star Optoelectronics Technology (CSOT), a subsidiary of TCL, has a good chance to grab more windfall orders from the Korean TV vendor as it holds a 10% stake in an 8.5G joint venture currently operated by Samsung Display in Suzhou, China, noted the sources.

Samsung Display holds a majority 60% share in the joint venture and the city government of Suzhou has 30%. Samsung Display has recently resumed talks for selling its stake to CSOT after previous discussions for such a deal were suspended due to unspecified reasons, the sources said.

Meanwhile, Taiwan-based AU Optronics (AUO) is expected to be able enhancing its business relationships with Samsung Electronics, having supplied high-end TV panels such as 4K, curved and bezel-less 8K models to the Korean TV vendor for years, commented the sources. Cooperation between AUO and Samsung will continue to focus on high-end and slim-type models due to capacity constraints at AUO, said the sources.

|

Contact Us

|

Barry Young

|