Vertical Divider

Corning’s Display Businesses Down 6.2% for the Year, But Gorilla Glass Up 18.2% Y/Y

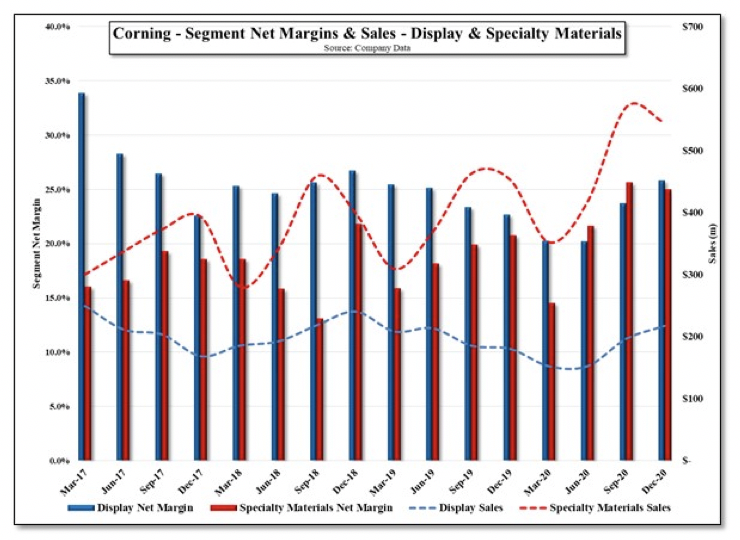

Corning reported Q420 results above expectations and gave 1Q guidance that was also above expectations. Display Sales in 4Q were $841m (core), up 1.7% sequentially and 5.8% Y/Y, while Specialty Materials (primarily Gorilla Glass) saw Q420 sales decline 13.5% sequentially but increase 20.8% Y/Y with full year display sales down 0.6%, while specialty materials sales were up 18.2%.

Corning puts large panel display industry sales growth up ~15.6% for 2020, with much of that growth coming from higher panel prices in the 2nd half of the year. Corning’s display margins increased from 20.2% in 1Q to 25.8% in 4Q and display net income increased 42.8% over the same period.

While the display industry’s growth has been a driver for Corning’s glass business during much of the last decade, the company’s Specialty Material’s (Gorilla Glass™) and similar products, is a new source of growth, while display maintains more ‘steady’ growth prospects. As strengthened glass becomes a more common product and specifications continues to be improved, the competitive nature of the smartphone business will follow that trend. Last year the specialty materials division introduced Victus™, a further improved Gorilla Glass, (Apple’s Ceramic Shield) a glass composite with ceramic nano-crystals, that improve strength without reducing clarity.

While the use of strengthened glass as an external automotive product is limited to premium vehicles, its use in digital dashboards, able to be molded to whatever shape such a display might require are gaining traction and is a key to some of the promises made to automotive customers about interior vehicle safety. Based on the Specialty Materials division’s ability to continually improve and expand applications for its products, there is far less reliance on absolute mobile device growth and more on expanding content on a per device basis, which allows for segment growth despite weakness in end markets, although we still expect that the specialty materials segment is still primarily dependent on mobile devices.

After the early part of 2020, glass availability continued to tighten and a power outage at a competitor pushed the glass market into shortage, while there was little glass price impact given the occurrence happening during the last few days of the year, it does set the tone for glass pricing in Q121, which is expected to be flat on a sequential basis, compared to what is usually a relatively weak glass pricing quarter.

These two segments of Corning’s business represented ~52% in Q420,. Corning’s ability to expand device content in the Specialty Materials space has been unusually aggressive during a time when demand and device pricing remain under pressure. This is a hard act to follow, so even the 8% mobile device (smartphone) growth this year should help to keep that momentum intact, otherwise that aggressive content and application development cycle will be the sole driver and not every year can Corning be developing a new product with a major customer.

Figure 1: Corning - Segment Net Margins Sales - Display & Specialty

Corning reported Q420 results above expectations and gave 1Q guidance that was also above expectations. Display Sales in 4Q were $841m (core), up 1.7% sequentially and 5.8% Y/Y, while Specialty Materials (primarily Gorilla Glass) saw Q420 sales decline 13.5% sequentially but increase 20.8% Y/Y with full year display sales down 0.6%, while specialty materials sales were up 18.2%.

Corning puts large panel display industry sales growth up ~15.6% for 2020, with much of that growth coming from higher panel prices in the 2nd half of the year. Corning’s display margins increased from 20.2% in 1Q to 25.8% in 4Q and display net income increased 42.8% over the same period.

While the display industry’s growth has been a driver for Corning’s glass business during much of the last decade, the company’s Specialty Material’s (Gorilla Glass™) and similar products, is a new source of growth, while display maintains more ‘steady’ growth prospects. As strengthened glass becomes a more common product and specifications continues to be improved, the competitive nature of the smartphone business will follow that trend. Last year the specialty materials division introduced Victus™, a further improved Gorilla Glass, (Apple’s Ceramic Shield) a glass composite with ceramic nano-crystals, that improve strength without reducing clarity.

While the use of strengthened glass as an external automotive product is limited to premium vehicles, its use in digital dashboards, able to be molded to whatever shape such a display might require are gaining traction and is a key to some of the promises made to automotive customers about interior vehicle safety. Based on the Specialty Materials division’s ability to continually improve and expand applications for its products, there is far less reliance on absolute mobile device growth and more on expanding content on a per device basis, which allows for segment growth despite weakness in end markets, although we still expect that the specialty materials segment is still primarily dependent on mobile devices.

After the early part of 2020, glass availability continued to tighten and a power outage at a competitor pushed the glass market into shortage, while there was little glass price impact given the occurrence happening during the last few days of the year, it does set the tone for glass pricing in Q121, which is expected to be flat on a sequential basis, compared to what is usually a relatively weak glass pricing quarter.

These two segments of Corning’s business represented ~52% in Q420,. Corning’s ability to expand device content in the Specialty Materials space has been unusually aggressive during a time when demand and device pricing remain under pressure. This is a hard act to follow, so even the 8% mobile device (smartphone) growth this year should help to keep that momentum intact, otherwise that aggressive content and application development cycle will be the sole driver and not every year can Corning be developing a new product with a major customer.

Figure 1: Corning - Segment Net Margins Sales - Display & Specialty

Source: Company Data

|

Contact Us

|

Barry Young

|