Vertical Divider

|

Chinese Press Push BOE

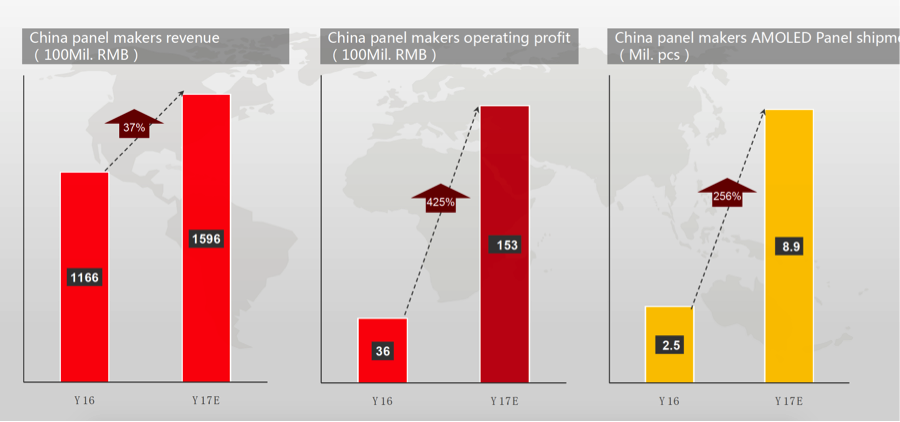

October 23, 2017 Chinese media reports that BOE’s stock has risen over 78% this year, with the last 20% attributed to the idea that BOE’s Chengdu B7 fab will be providing flexible OLED displays to Huawei but they claim the new fab will be able to produce 500,000 to 600,000 5.5” flexible smartphones by November assuming 100% factory utilization and 100% product yield. The note extoled the virtues of a rapid increase in factory yield as the company has copied the ‘Samsung configuration’ on the production line and is using personnel with a wealth of field experience. However, much of the B7 line staff is Korean nationals, essentially stolen from Samsung. This was reported proudly, as a goal that was directly accomplished. As the note continued, the same positive rhetoric was applied to the Gen 6 OLED Fab in Mianyang, which is also under construction, with only the hope that the supply chain can keep up with the speed at which the construction and debugging will take place, likely at a “faster pace than ever seen before”. The reality is that the Chinese panel makers, while investing heavily in OLED capacity have yet to realize any significant product ion as reported last week by Sigmaintell, 2016 OLED shipments being 2.5m and 2017 shipments reaching only 8.9m panels despite the OLED capacity of ~500K m2 in 2016 and 2700K m2 in 2017. Figure 1: China’s Panel Makers – Revenue, Operating Profit and AMOLED Units Source: Sigmaintell

The note criticized LGD’s flexible OLED displays with uneven quality and similar problems Chinese smartphone brands had experienced, forcing LGD to replace some of their OLED equipment with the same equipment that Samsung uses. We have learned that LG’s TFE process sometimes causes mura and RFI is being replaced by Kateeva equipment. However, the notion BOE could supply flexible panels to Huawei seems pre-mature given that BOE cannot yet supply volume rigid OLED displays. The note makes reference to how the Chinese LCD panel manufacturers moved from a defensive position in 2014 to an offensive position in 2015 and beyond, and how the country has been reducing its TV trade deficit with South Korea since then and will use their soon-to-be-online Gen 10+ Chinese fabs to further that battle with the rest of the industry. However, there is a 20+-year history of making TFT LCDs and the panels are virtually a commodity, while OLEDs are still in the development stage requiring quite a bit of proprietary knowhow. Meaning it is likely to take the Chinese much longer to learn how to make OLED panels than it did to learn LCD panels. |

|

|

Contact Us

|

Barry Young

|