Vertical Divider

|

Chinese Panel Makers to More Than Double 2019 OLED Production

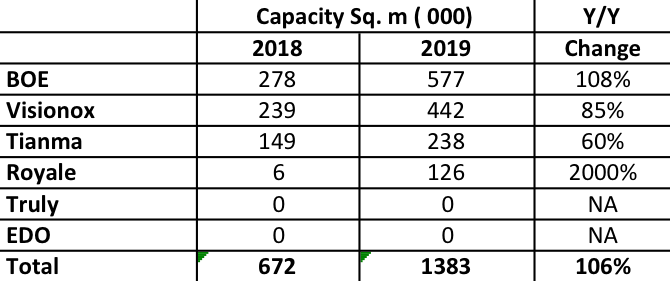

January 06, 2019 There are currently six Chinese panel makers producing small panel OLED displays, Visionox, EDO, BOE, Tianma, Royale and Trulywith each having different fab sizes, experience, build-out plans, and actual production capabilities. The next table shows the six Chinese small panel OLED producers based on their total raw OLED capacity and the increase we expect for the 2019-year. Table 1: China Smartphone Panel Producers - Raw OLED Capacity Source: SCMR LLC, OLED-A

|

|

The expected growth rate in capacity is substantial at 78% Y/Y. Looking only at flexible display capacity, in the next table, growth increases to 100%.

Table 2: China Smartphone Raw Small Panel Flexible OLED Capacity

Table 2: China Smartphone Raw Small Panel Flexible OLED Capacity

Source: SCMR LLC, OLED-A

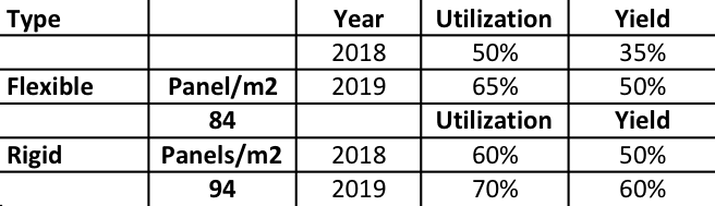

Converting panel capacity in sq. m to panel capacity, we use the following assumptions:

Table 3: Panel Yield and Utilization Assumptions

Table 3: Panel Yield and Utilization Assumptions

Source: OLED-A

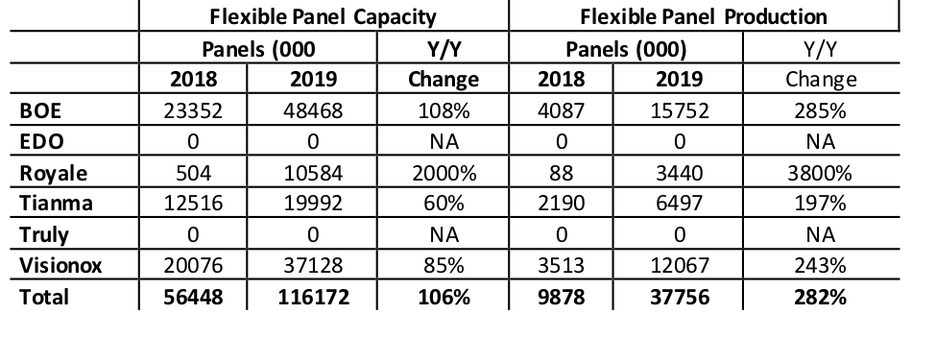

Table 4: Chinese Smartphone Panel Producers - Flexible Raw vs. Available Unit Comparison

Source: SCMR LLC, OLED-A

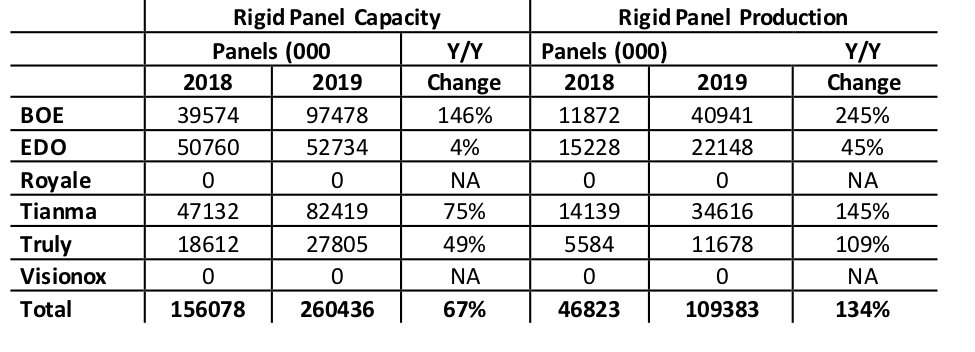

Table 5: Chinese Smartphone Panel Producers - Rigid Raw vs. Available Unit Comparison

Source: SCMR LLC, OLED-A

Industry expectations for OLED smartphone shipment in China range from 100m to 125m units in 2018, which implies an 11.7% penetration rate for flexible OLED displays produced by Chinese panel producers, with the rest coming from Samsung Display (pvt) or LG display (LPL), who we estimate have a combined 2018 small panel flexible OLED capacity share of 91.6% and 87.5% in 2019. We would have to expect both a substantial increase in small panel flexible OLED display penetration in China and an also substantial increase in small panel flexible OLED product yields among Chinese panel producers in 2019 to see how one might say that the Chinese have taken over small panel OLED production. However, we expect the actual share gain that Chinese small panel flexible OLED producers will be able to garner in 2019 will be more muted, and while small panel flexible demand in China will increase in 2019, we expect a more realistic expectation for Chinese small panel flexible OLED producers would be for 38.3m units (implied yield of 54.8%), which would represent roughly 27% of the total expected Chinese OLED smartphone market in 2019 on a unit volume basis.

Such an increase in 2019 is not to be ignored, although there will have to be a vast number of goals that need to be met by Chinese small panel flexible OLED producers, along with a number of expectations for the overall Chinese smartphone market, the flexible portion of that market, and the flexible OLED penetration rates associated with brands offered in that market. This makes the notion of China displacing other flexible OLED panel producers a bit less ‘glorious’ and likely to take more time than panel producers expect, especially given the somewhat ‘controlled’ pricing levels of small panel flexible OLED panels that Samsung Display has been able to exert in past years, but we certainly do not count out Chinese small panel flexible OLED panel producers and do expect them to have an increasing influence over panel pricing as they begin to take a more substantial place in that market in 2020 and beyond. While they might not ‘dominate’, they will pressure Samsung Display’s small panel flexible OLED pricing, and as such, could be considered starting a ‘new era’ for the small panel flexible OLED market.

Such an increase in 2019 is not to be ignored, although there will have to be a vast number of goals that need to be met by Chinese small panel flexible OLED producers, along with a number of expectations for the overall Chinese smartphone market, the flexible portion of that market, and the flexible OLED penetration rates associated with brands offered in that market. This makes the notion of China displacing other flexible OLED panel producers a bit less ‘glorious’ and likely to take more time than panel producers expect, especially given the somewhat ‘controlled’ pricing levels of small panel flexible OLED panels that Samsung Display has been able to exert in past years, but we certainly do not count out Chinese small panel flexible OLED panel producers and do expect them to have an increasing influence over panel pricing as they begin to take a more substantial place in that market in 2020 and beyond. While they might not ‘dominate’, they will pressure Samsung Display’s small panel flexible OLED pricing, and as such, could be considered starting a ‘new era’ for the small panel flexible OLED market.

|

Contact Us

|

Barry Young

|