Vertical Divider

China Smartphone Shipped Q2'20 100.1M Units

July 19, 2020

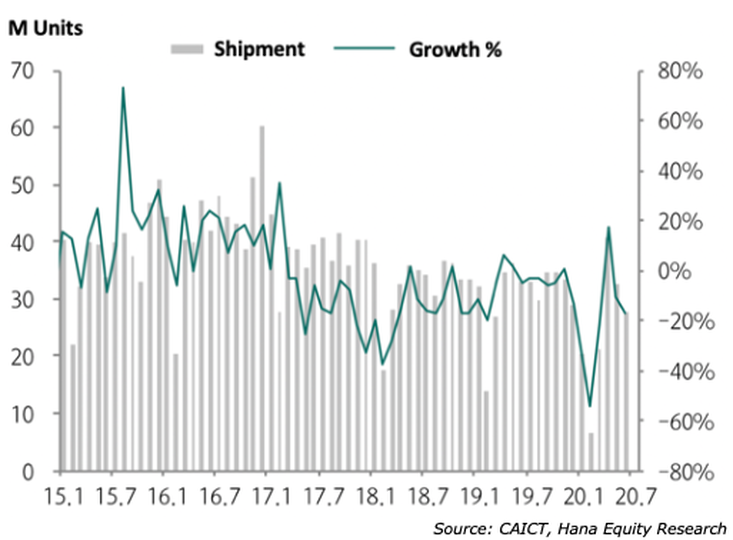

The China Academy of Information and Communication Technology (CAICT), a Chinese government funded scientific research group, reported that China’s June 2020 smartphone shipment was 27.7M units, down 17% YoY, 15% MoM, from 32.7M in May 2020. The smartphone shipment hit bottom with the start of the pandemic in January 2020; however, the shipment rebounded in April 2020 reaching 40.8M units, up 17% YoY, 94% MoM. According to CAICT research, the Q2’20 shipment is 100M units, down 3% sequentially. As a result, the performance in July shipment is expected to an important indicator for the rest of year smartphone market growth.

Figure 1: Monthly China Smartphone Shipment Trend

July 19, 2020

The China Academy of Information and Communication Technology (CAICT), a Chinese government funded scientific research group, reported that China’s June 2020 smartphone shipment was 27.7M units, down 17% YoY, 15% MoM, from 32.7M in May 2020. The smartphone shipment hit bottom with the start of the pandemic in January 2020; however, the shipment rebounded in April 2020 reaching 40.8M units, up 17% YoY, 94% MoM. According to CAICT research, the Q2’20 shipment is 100M units, down 3% sequentially. As a result, the performance in July shipment is expected to an important indicator for the rest of year smartphone market growth.

Figure 1: Monthly China Smartphone Shipment Trend

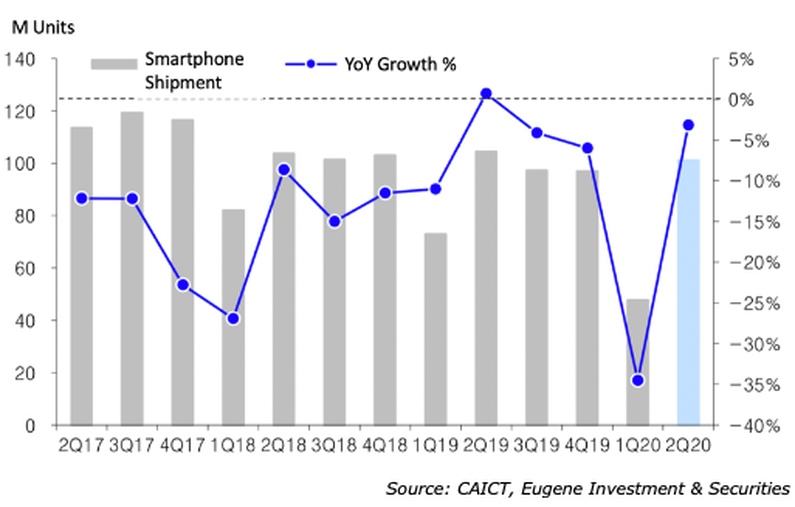

Figure 2: Quarterly China Smartphone Shipment

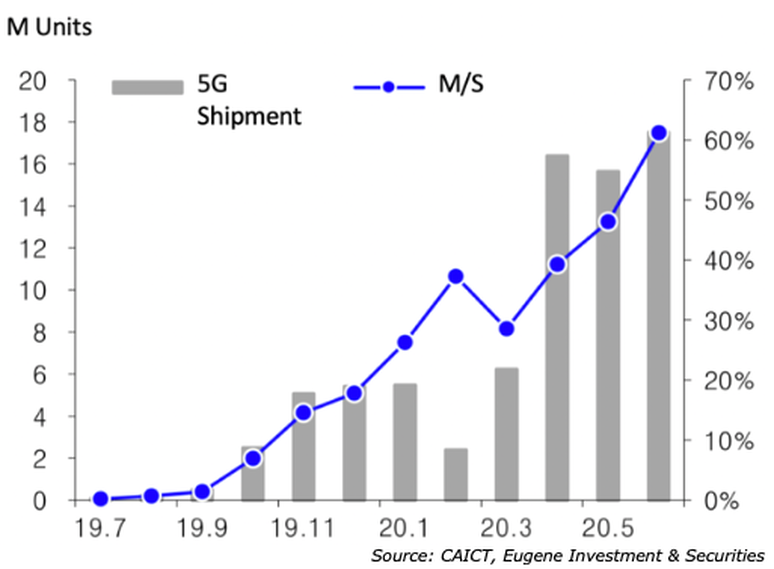

Chinese brands released total of 36 new smartphones in June 2020. Especially 5G types are a 12% increase to 17.5M, taking 61% of 27.7M units in June. CAICT forecasted that the China brands’ 5G movement will be continuing in later half of 2020 and hope to work as a new value-added functionality to revive the smartphone shares. Xiaomi, Huawei and OPPO released entry level smartphones with the 5G network capability. According to Eugene Investment & Securities (Eugene), a Korean securities brokerage company, reported that these low-range 5G smartphones from Chinese brands are targeting European markets. The U.S. economic sanctions on Huawei resulted a declining market shares of Huawei in European market; however, with an absence of Huawei is well consumed by its local competitors Xiaomi and OPPO, according to Eugene.

Figure 3: 5G Smartphone Shipment Trend in Chinese Brands

Figure 3: 5G Smartphone Shipment Trend in Chinese Brands

|

Contact Us

|

Barry Young

|