Vertical Divider

BOE Stops LCD Investing as it Shifts to OLEDS

January 27, 2020

BOE has become the largest LCD panel supplier in the world will cease further investments in the area and is shifting its investment emphasis to OLEDs.

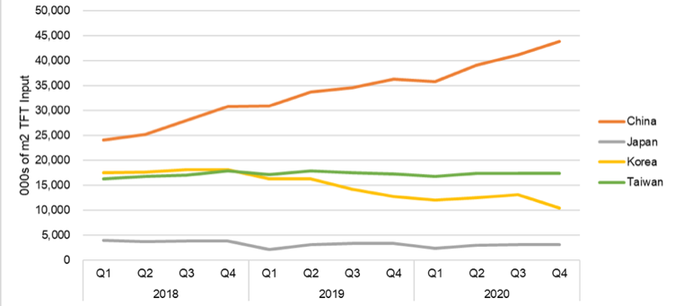

LCD panels prices have been plummeting as even more smartphone manufacturers adopt the OLED panel. Currently, smartphones with OLED displays are more popular in mid to premium grade handsets, with even entry level devices expected to soon adopt the technology as well. DSCC recently reported on the growth on TFT input capacity by country, which is indicative of:

Figure 1: TFT Area Input By Country

January 27, 2020

BOE has become the largest LCD panel supplier in the world will cease further investments in the area and is shifting its investment emphasis to OLEDs.

LCD panels prices have been plummeting as even more smartphone manufacturers adopt the OLED panel. Currently, smartphones with OLED displays are more popular in mid to premium grade handsets, with even entry level devices expected to soon adopt the technology as well. DSCC recently reported on the growth on TFT input capacity by country, which is indicative of:

- The mass excess capacity from China due to the growth of Gen 8 and Gen 10 fabs

- The pull back of LCD production by LG and Samsung simultaneously growing OLED capacity and dropping LCD capacity

- The maintenance of the status quo in Taiwan, where they continue to lose money yet maintain their LCD capacity

- The almost total abandonment of the display industry in Japan, where JDI has hot been able to find a white knight and Foxconn equivocates regarding a long term strategy for Sharp.

Figure 1: TFT Area Input By Country

Source: DSCC

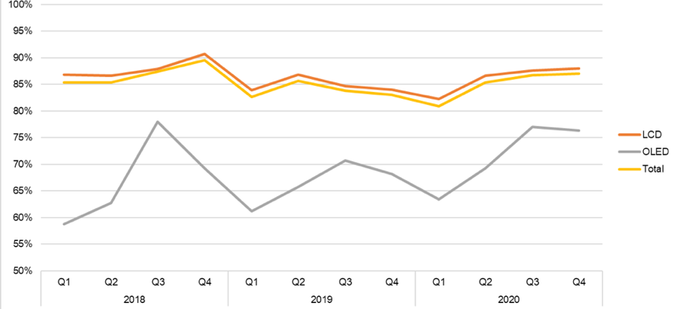

Despite the strength of OLEDs, DSCC points to the relatively weak fab utilization, which is a function of Chinese panel makers not fully using their capacity due to the low yields and Samsung’s underutilization of it’s A3 fabs due to the over estimates of iPhone demand. However, the trend is positive as more Chinese OEMs adopt OLEDs for their prime and mid-range phones.

Figure 2: TFT Fab Utilization By Technology

Source: DSCC

BOE will launch additional OLED production lines this year to boost its manufacturing capacity by more than 200 percent, with three OLED production lines in China. The first is in Chengdu which is a flexible AMOLED production line within China and has a capacity of 48,000 substrates/month. The second is in Sichuan and will start shipping AMOLED display units by July 2020 and is currently raising production capacity. The third facility is in Chongqing, which had a 46.5 billion Yuan investment and will be completed later this year. The production capacity is also expected to reach 48,000 substrates/month.

BOE expects to produce 70 million OLED displays in 2020, of which 20 million will be flexible displays and increase its market share to 10%. BOE OLED clients include Huawei, OPPO, Vivo and Apple is reportedly considering the supply of OLED displays for its 2021 lineup of iPhones.

|

Contact Us

|

Barry Young

|