Vertical Divider

BOE Planning A 3rd Gen 10.5 Fab with A 150,000 Substrate/Month Capacity

As reported last week, BOE has begun planning a 3rd Gen 10.5 LCD fab. While the company will not confirm anything officially, the addition of a 3rd Gen 10.5 LCD fab would move them further ahead of their closest rival, China Star with a ~13.5% share of the global LCD market (capacity basis). BOE has a 26.8% share.

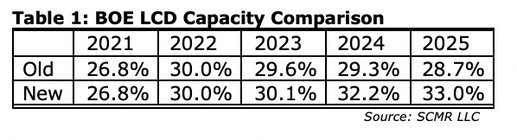

Each of BOE’s two Gen 10.5 fabs have a capacity of 120,000 sheets/month, and speculation about the new fab is calling for 150,000 sheet/month capacity. Timing is open, as no announcements have been made, but Phase 1 is most probable in June 2023 and a phase 2 opening in March 2024, with both ramping to full production over roughly 10 to 12 months. The ramp will begin to increase BOE’s global capacity share in 2023, and more so in 2024 and 2025. The table below shows expectations for BOE’s gross LCD capacity share under current circumstances and with the inclusion of this new Gen 10.5 fb.

As reported last week, BOE has begun planning a 3rd Gen 10.5 LCD fab. While the company will not confirm anything officially, the addition of a 3rd Gen 10.5 LCD fab would move them further ahead of their closest rival, China Star with a ~13.5% share of the global LCD market (capacity basis). BOE has a 26.8% share.

Each of BOE’s two Gen 10.5 fabs have a capacity of 120,000 sheets/month, and speculation about the new fab is calling for 150,000 sheet/month capacity. Timing is open, as no announcements have been made, but Phase 1 is most probable in June 2023 and a phase 2 opening in March 2024, with both ramping to full production over roughly 10 to 12 months. The ramp will begin to increase BOE’s global capacity share in 2023, and more so in 2024 and 2025. The table below shows expectations for BOE’s gross LCD capacity share under current circumstances and with the inclusion of this new Gen 10.5 fb.

BOE’s plans for its earlier Gen 10.5 LCD fabs were delayed from their original timeline, in part because of COVID-19, but also as a reflection of declining large panel LCD prices. As t prices have increased, the expected profitability of new fabs, , is very attractive and makes a strong case for government subsidies, which expect a cash return, in addition to job creation. BOE’s management has stated that it believes the LCD display industry is exiting an era of cyclicality and becoming a more mature and more predictable industry.

|

Contact Us

|

Barry Young

|