Vertical Divider

BOE and CSoT Vie for Leadership in the LCD Market

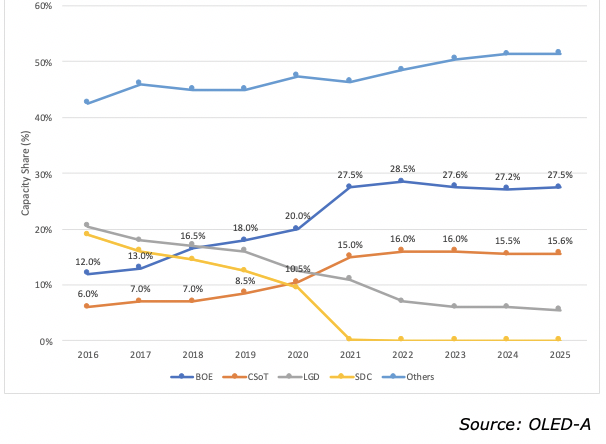

In 2016, together LGD and SDC controlled ~40% of LCD capacity and then the world changed such that by 2021 after CSoT purchase of Samsung Sichuan Gen 8.5 fab and BOE’s purchase of CEC Pandas fabs, the two Chinese stalwarts will control ~42.5% of LCD capacity as LGD drops to 11% and Samsung falls to 0%. BOE is the largest fab in terms of capacity with a 27.5% share with CSoT #2 at 15.0%.

Figure 1:LCD Capacity by Panel Maker

In 2016, together LGD and SDC controlled ~40% of LCD capacity and then the world changed such that by 2021 after CSoT purchase of Samsung Sichuan Gen 8.5 fab and BOE’s purchase of CEC Pandas fabs, the two Chinese stalwarts will control ~42.5% of LCD capacity as LGD drops to 11% and Samsung falls to 0%. BOE is the largest fab in terms of capacity with a 27.5% share with CSoT #2 at 15.0%.

Figure 1:LCD Capacity by Panel Maker

Google also launched a new Chromecast with Google TV, and new Nest Audio

Total capacity share for all the other panel makers is rising from 47.5% in 2020 to 51.4% by 2025 driven primarily by the growth from newcomer HKC whose share is growing from ~5% in 2020 to 10% in 2025. There are reports that CSoT is discussing a possible takeover of HKC, which would virtually eliminate the capacity gap with BOE.

Total capacity share for all the other panel makers is rising from 47.5% in 2020 to 51.4% by 2025 driven primarily by the growth from newcomer HKC whose share is growing from ~5% in 2020 to 10% in 2025. There are reports that CSoT is discussing a possible takeover of HKC, which would virtually eliminate the capacity gap with BOE.

|

Contact Us

|

Barry Young

|