Vertical Divider

As Samsung Loses Share, It Vows To Make Foldable Smartphones 'Mainstream'

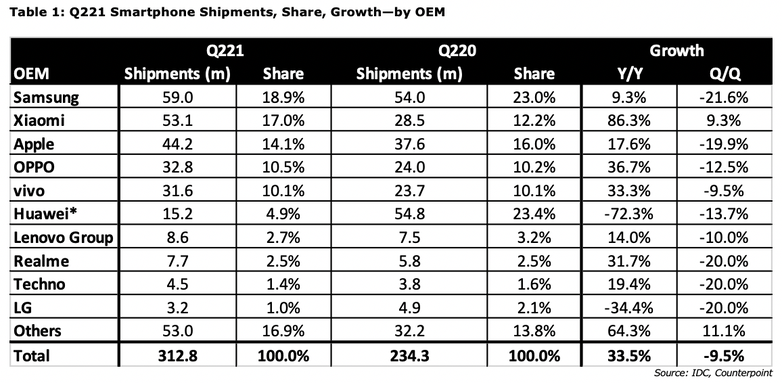

Samsung’s mobile business suffered in Q221 due to component shortages, down 21.6% sequentially. Shipments were up 9.3% Y/Y but down 21.2% vs. 2019, a much truer comparison. Samsung’s share dropped from 32.0% to 18.9% Y/Y. The much heralded news in Q321 was Xiaomi passing Apple to become the #3 supplier, an event likely to be repeated in Q321, before Apple releases the iPhone 13.

Samsung’s mobile business suffered in Q221 due to component shortages, down 21.6% sequentially. Shipments were up 9.3% Y/Y but down 21.2% vs. 2019, a much truer comparison. Samsung’s share dropped from 32.0% to 18.9% Y/Y. The much heralded news in Q321 was Xiaomi passing Apple to become the #3 supplier, an event likely to be repeated in Q321, before Apple releases the iPhone 13.

In its latest earnings release, Samsung showed that it doesn't need mobile to make money, as it boosted earnings by 20% to 63.67 trillion won ($55.56 billion) and saw an operating profit of 12.57 trillion won ($11 billion) as its mobile division saw revenue fall over the previous quarters.

The mobile division fell off due to weaker seasonal demand and a component shortage at its Vietnam factories, the company said it would "solidify its leadership in the premium [mobile] statement by mainstreaming the foldable category."

Samsung confirmed that it would introduce new foldable products soon, likely referring to its August 11th event in which its expected to announce The Z Flip 3 and the Z Fold 3, with an under panel camera.

The mobile division fell off due to weaker seasonal demand and a component shortage at its Vietnam factories, the company said it would "solidify its leadership in the premium [mobile] statement by mainstreaming the foldable category."

Samsung confirmed that it would introduce new foldable products soon, likely referring to its August 11th event in which its expected to announce The Z Flip 3 and the Z Fold 3, with an under panel camera.

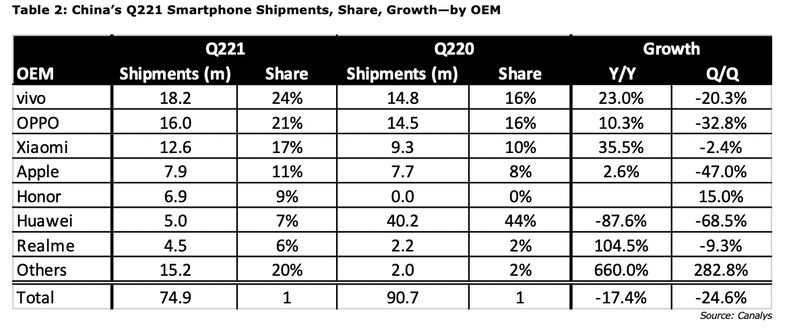

Canalys, reported smartphone shipments in China totaled 74.9 million units in Q221, a 17% decline Y/Y. vivo which managed 18.2 million shipments and a 24% market share was the market leader in China followed by Oppo with 16 million shipments and 21% of the market while Xiaomi with its 12.6 million shipments and 17% market share rounds out the top three. Apple stands at the number four spot with 7.9 million shipments for the period which corresponds to a 10% market share. Honor is the fifth leading brand with 6.9 million shipments and a 9% market share. Xiaomi is the largest grower out of the bunch with an annual growth of 35% while Honor was on the opposite end as its shipments decreased by 46%.

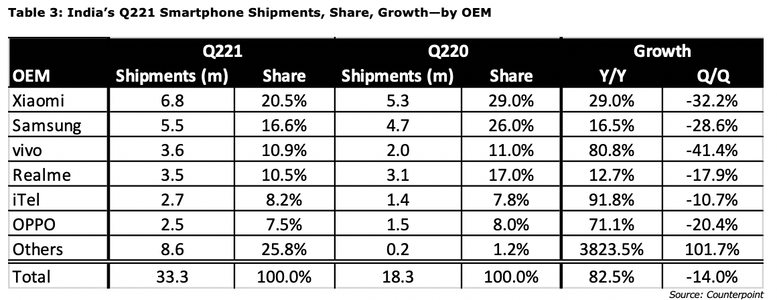

Counterpoint Research has released its quarterly analysis of the mobile market in India, one of the biggest markets in the world. The report revealed an 82% yearly increase in shipments and a 14% sequential decline due to the second COVID-19 wave. Xiaomi retained its leadership with a 28.4% market share, while second placed Samsung lost a lot of ground and accounted for just 17.7% of the sales. Third placed vivo also lost some market share as Realme and Oppo as well as the makers in the "others" group gained significantly. India is also a huge market for feature phones, and that segment affected the overall sales numbers a lot. The handset business (smartphones + feature phones) grew 74% YoY but declined 28% on a quarterly basis, mostly because the feature phone side saw half the sales, compared with Q1 2021.

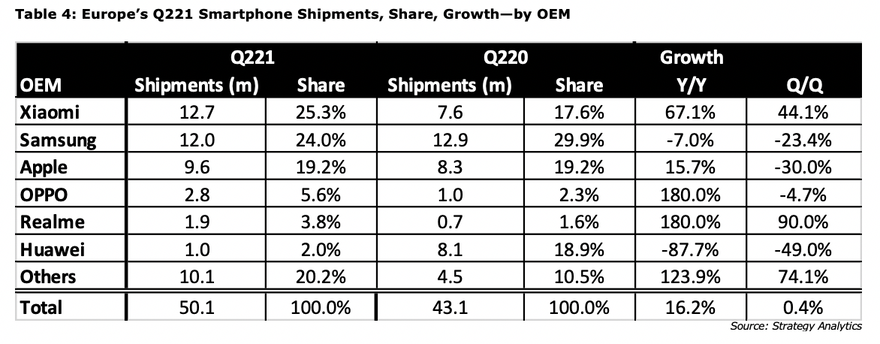

Strategy Analytics reported that Q221 European smartphone shipments were up 16.2% Y/Y to 50 million units. Xiaomi topped all vendors with 25% market share. The smartphone market rebound was driven by the continued economic recovery, a healthy demand from consumers with aging devices and appealing value priced 5G devices.

- Xiaomi (includes POCO) retained the top position in the Indian smartphone market with a 28% share driven by the Redmi 9 series and Redmi Note 10 series. Xiaomi captured the top four positions in the Top 5 models list with the Redmi 9A, Redmi 9 Power, Redmi Note 10 and Redmi 9, out of which the top three models clocked more than a million shipments. The Redmi 9A has been the best-selling model for the last three quarters. Xiaomi re-entered the ultra-premium segment with the Mi 11 Ultra powered by Snapdragon 888 chipset. In the premium segment, Xiaomi shipped its highest-ever volumes in Q2 2021, capturing more than 7% of the segment. POCO, Xiaomi’s sub-brand, registered 480% YoY growth driven by its strong demand in the budget segment. The POCO M3, C3 and X3 Pro were the top models for POCO in Q2 2021.

- Samsung is the second-largest brand in India’s smartphone shipments, registering 25% Y/Y growth. It remained aggressive in online channels during the quarter. Its online-centric Galaxy M-series and F-series contributed to 66% shipments of the brand in Q221. Samsung reached its highest-ever online share, an indication that the brand’s online channel strategy is working well along with its e-store. Samsung led the upper mid-tier (INR 20,000-INR 30,000) segment driven by the strong performance of the Galaxy A32, A52 and F62.

- vivo grew 61% YoY and held the third position in Q2 2021. The brand’s share in the premium segment (>INR 30,000) increased to 12%, its highest ever in a single quarter. The newly launched V21 series along with the X60 and IQOO 7 series drove the shipments for the brand. vivo also led the INR 15,000-INR 20,000 price band.

- realme grew 140% YoY in Q2 2021 and captured the fourth position in the Indian smartphone market. realme is quite aggressive with its 5G push. The brand led the market in 5G smartphone shipments, capturing more than 22% share. It also became the fastest brand to reach 50 million cumulative smartphone shipments in India.

- OPPO grew 103% YoY and had a 10% market share in Q2 2021. The OPPO F19 Pro Plus was the top 5G smartphone model in the INR 20,000-INR 30,000 price band. OPPO launched an e-store in Q2 2021 to expand its online reach and consumer base. The brand also helped its offline consumer base and channel partners by offering free smartphone deliveries during lockdowns by leveraging digital platforms like WhatsApp.

- Transsion Group brands (itel, Infinix and TECNO) registered 296% YoY growth, capturing a 7% share collectively in India’s smartphone market. itel remained the top smartphone brand in the sub-INR 6,000 price band. Also, in the sub-INR 8,000 price band, Transsion brands collectively led the market with a 29% share. itel has been leading the feature phone market for the last seven consecutive quarters.

- Apple was up 144% Y/Y. The brand maintained its leading position in the ultra-premium segment (>INR 45,000 or ~$650) with more than 49% share. Continued strong demand for the iPhone 11 coupled with aggressive offers on the iPhone 12 series were the driving factors for this growth.

- OnePlus grew more than 200% Y/Y driven by the OnePlus 9 Series. The brand led the premium market with a 34% share. OnePlus captured three spots in the top five smartphone models in India’s premium market. It was also the top 5G smartphone brand in the premium segment in Q2 2021, capturing a 48% share.

Strategy Analytics reported that Q221 European smartphone shipments were up 16.2% Y/Y to 50 million units. Xiaomi topped all vendors with 25% market share. The smartphone market rebound was driven by the continued economic recovery, a healthy demand from consumers with aging devices and appealing value priced 5G devices.

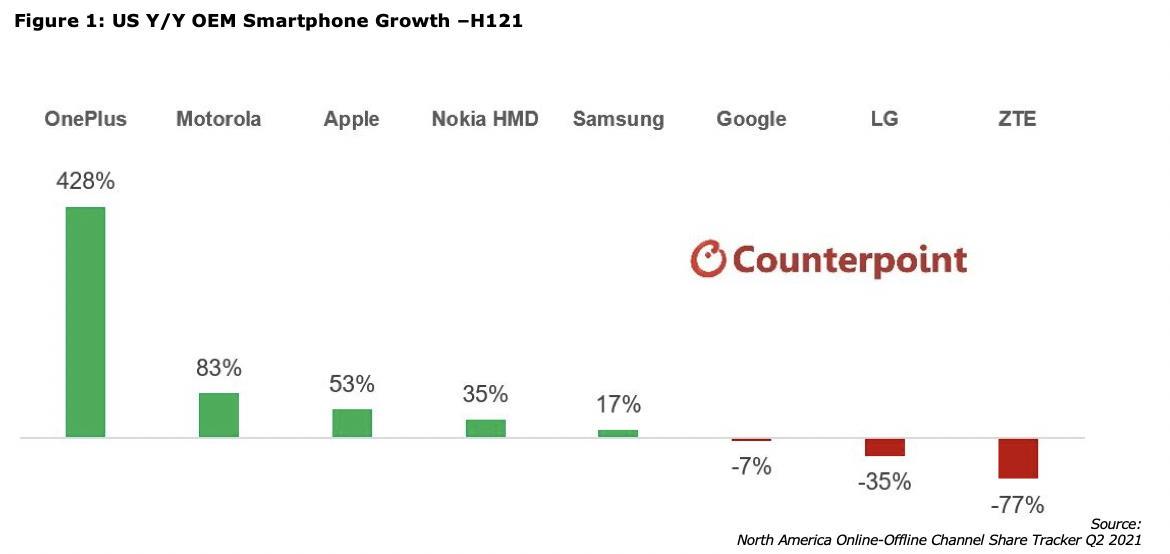

The US smartphone market saw a 27% Y/Y increase in H1 2021 sales as carriers continued pushing 5G upgrades and heavily discounted 5G smartphones. Both Apple and Samsung devices were the top-sellers in the premium segment with 53% and 17% YoY growth, respectively. OnePlus, Motorola and Nokia HMD saw strong growth in the market by capturing the void left by LG’s exit from the smartphone business.

There was a consolidation of the market with LG and VinSmart’s exit, increased demand from carriers for more affordable 5G smartphones, and manufacturing constraints due to the global component shortage. OnePlus, Lenovo (Motorola) and Nokia HMD stepped in the vacuum. Supply for many Android OEMs has been tight, especially for the sub-$600 devices.

|

Contact Us

|

Barry Young

|