Vertical Divider

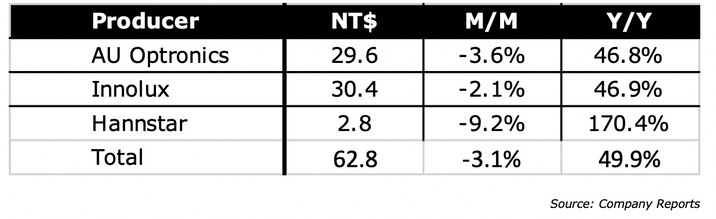

April Panel Sales in Taiwan were 41.9 NT4, up 49.9% Y/Y

AUO, Innolux and HannStar large panel production sequentially with AUO’s shipment area down 6.3% sequentially, Innolux’s large panel shipments declined 10.6% sequentially and HannStar’s, large panel shipments were down66.7% sequentially is a small player in the large panel

Table 1: Taiwan’s Panel Revenue

AUO, Innolux and HannStar large panel production sequentially with AUO’s shipment area down 6.3% sequentially, Innolux’s large panel shipments declined 10.6% sequentially and HannStar’s, large panel shipments were down66.7% sequentially is a small player in the large panel

Table 1: Taiwan’s Panel Revenue

Panel prices rose across the board again in April, but lower sales indicate an overall slowdown in production after a strong March. Panel makers apparently pushed out as much product as possible in March before they faced depleted component or materials inventory, which began to limit production further in April. Panel sales remain substantially above historic levels as panel pricing has risen sharply since the beginning of last year, and even if sales level continue to fall, Y/Y comparisons will remain positive at least until August/September when pricing stabilized somewhat.

After an unusually strong January and March, smartphone shipments in China settled back to a more ‘normalized’ pace, similar to rates seen through much of last year’s 2nd half but returned to negative m/m and y/y comparisons of -23.8% and -34.1% respectively. While 5G smartphone shipments also declined 22.2% m/m they were still up 31.1% y/y and represented 77.8% of shipments for the month, the highest share rate seen since last June. We note that while 1Q shipments in China were strong in both absolute and relative terms, last year’s 1Q was unnatural to say the least, so we look more at the average y/y decline in 2H last year, which was -23.0%, very similar to the y/y decline in April of this year.

While the smartphone industry in China had high hopes for 2021 in terms of a return to growth, it seems that while certainly better than last year thus far, the industry is still facing growth issues this year. While it won’t be seen in Chinese shipment numbers, Chinese smartphone brands will be feeling the effects of both component shortages and the massive COVID-19 outbreak in India, where Chinese brands hold considerable sway.

Tyntek produces both LEDs and Silicon sensors and through a subsidiary, produces high brightness LED products and drivers for the automotive space and has been seeing progressively higher sales since the pandemic began last year. The company will raise prices between 10% and 15% for orders that it is carrying on its books this quarter. The company is running its 5” production line at full utilization and expects to start production on its new 6” line in July. While such a price hike is not unusual given the inventory building that IT display backlight producers have been doing to insure supply. What makes this price hike a bit unusual is that it is the 2nd increase that Tyntek has put in place this year, having instituted a 5% to 10% hike in the 1st quarter.

Pegatron an OEM/ODM for a number of highly visible CE producers reduced its forecast for shipment growth in 2nd quarter from 25% to 30% to 5% to 10% due to a worsening shortage of components and semiconductors. Asustek cited a positive view on order visibility for PCs through the end of this year with sales growth of 5% to 10% in Q221, but also sees the shortage worsening. Asustek cited audio codec chips as a new problem for supply and indicated that it has accepted recent price increases for components and will make price adjustments itself to compensate., The company raised concerns that overbooking was an issue behind the rising shortages and was making it difficult to understand real demand, but while the intellectualizing over price increases continues, there is still considerable competition among semiconductor fab customers, particularly automotive customers, that are pushing prices progressively higher.

Notebook prices have been rising quickly, with high-end Huawei models up 9.4% in 1Q, both ACER and Asustek up between 5% and 10% for most models, and Lenovo increasing prices on some models by as much as 20%. With Q221, the peak season for educational bidding, notebook demand is expected to be up 10% sequentially, assuming component availability.

After an unusually strong January and March, smartphone shipments in China settled back to a more ‘normalized’ pace, similar to rates seen through much of last year’s 2nd half but returned to negative m/m and y/y comparisons of -23.8% and -34.1% respectively. While 5G smartphone shipments also declined 22.2% m/m they were still up 31.1% y/y and represented 77.8% of shipments for the month, the highest share rate seen since last June. We note that while 1Q shipments in China were strong in both absolute and relative terms, last year’s 1Q was unnatural to say the least, so we look more at the average y/y decline in 2H last year, which was -23.0%, very similar to the y/y decline in April of this year.

While the smartphone industry in China had high hopes for 2021 in terms of a return to growth, it seems that while certainly better than last year thus far, the industry is still facing growth issues this year. While it won’t be seen in Chinese shipment numbers, Chinese smartphone brands will be feeling the effects of both component shortages and the massive COVID-19 outbreak in India, where Chinese brands hold considerable sway.

Tyntek produces both LEDs and Silicon sensors and through a subsidiary, produces high brightness LED products and drivers for the automotive space and has been seeing progressively higher sales since the pandemic began last year. The company will raise prices between 10% and 15% for orders that it is carrying on its books this quarter. The company is running its 5” production line at full utilization and expects to start production on its new 6” line in July. While such a price hike is not unusual given the inventory building that IT display backlight producers have been doing to insure supply. What makes this price hike a bit unusual is that it is the 2nd increase that Tyntek has put in place this year, having instituted a 5% to 10% hike in the 1st quarter.

Pegatron an OEM/ODM for a number of highly visible CE producers reduced its forecast for shipment growth in 2nd quarter from 25% to 30% to 5% to 10% due to a worsening shortage of components and semiconductors. Asustek cited a positive view on order visibility for PCs through the end of this year with sales growth of 5% to 10% in Q221, but also sees the shortage worsening. Asustek cited audio codec chips as a new problem for supply and indicated that it has accepted recent price increases for components and will make price adjustments itself to compensate., The company raised concerns that overbooking was an issue behind the rising shortages and was making it difficult to understand real demand, but while the intellectualizing over price increases continues, there is still considerable competition among semiconductor fab customers, particularly automotive customers, that are pushing prices progressively higher.

Notebook prices have been rising quickly, with high-end Huawei models up 9.4% in 1Q, both ACER and Asustek up between 5% and 10% for most models, and Lenovo increasing prices on some models by as much as 20%. With Q221, the peak season for educational bidding, notebook demand is expected to be up 10% sequentially, assuming component availability.

|

Contact Us

|

Barry Young

|