Vertical Divider

|

Apple’s iPhone Sales Spur $1 Trillion Valuation, but Shipments in China Down 12.5% Y/Y

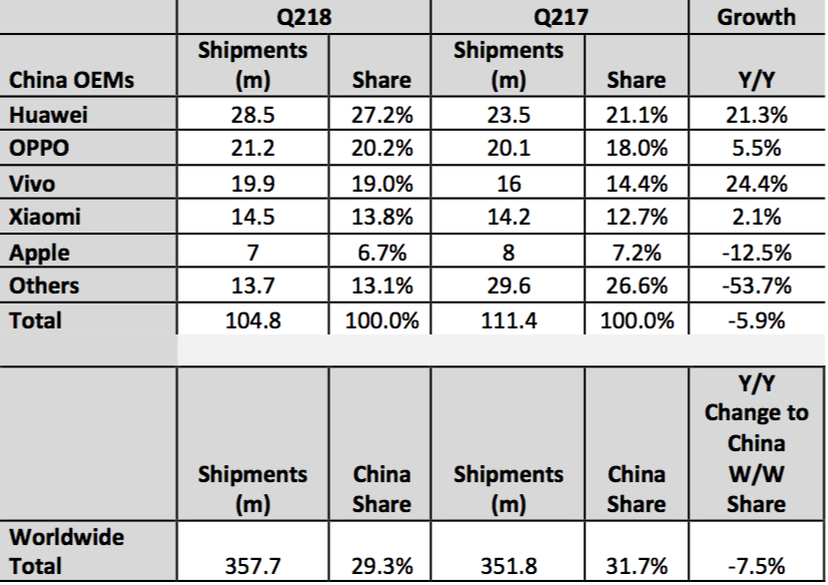

August 13, 2018 Apple, after reporting a robust fiscal third-quarter performance driven by strong sales of iPhone X, faces now increasing risk of seeing iPhone shipments start retreating in China as local brands have continued to roll out high-end models trying to wrest back control of the domestic market, according to industry sources. Apple sold 41.3 million iPhones in Q218, generating revenues of US$29.9 billion driven by a higher average selling price (ASP) of US$724. However, the quarterly shipments were lower than 52.2 million units shipped in the previous quarter, which is unusual because the Q1 calendar quarter is typically the lowest and overall shipments in China by Chinese OEMs were 94.2m, up 15.1% vs. Q118 shipments of 81.87, according to the Ministry of Industry and Information Technology (MIIT). In terms of unit shipments, Apple ranked third in China in the first half, trailing Oppo's 38 million units and Vivo's 35.5 million units. But Apple was the top vendor in terms of sales value with iPhone revenues totaling CNY172.7 billion (US$25.238 billion), Sigmaintell reported. Huawei shipped a total of 58.96 million units in first-half 2018 but the figures were divided and assigned to Huawei- and Honor-brand, respectively. A media report from China also indicated that the iPhone X accounted for about half of the iPhones that Apple sold in China in the fiscal third quarter. But some sources pointed out that sales of the iPhone 6 devices currently account for a higher portion of total iPhone shipments in China, pushing up overall shipment volume for the first half of 2018. While Apple is continuing to promote iPhone 6 devices with local telecom and channel operators in China, it remains to be seen whether the sales momentum of the iPhone 6 will continue into 2019, judging from factors including product life cycle and specification upgrades, said the sources. Meanwhile, following the steps of Huawei, China's vendors including Oppo and Vivo have recently launched new high-end models targeting the over US$650 segment. In addition to incorporating new innovative features such as pop-up cameras into their new devices, China's vendors are also adopting a dual-brand strategy to promote their new flagship models through cross-industry cooperation, which may affect sales of high-priced offerings from Apple, commented the sources. Table 1: China OEM Smartphones, Shipments, Share, and Growth Source: IHS

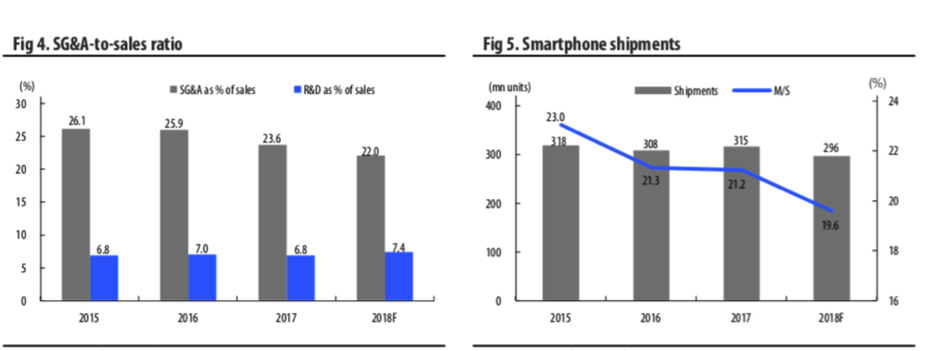

Figure 1: Apple -- Selected Financial Data |

|

Source: Company Data

|

Contact Us

|

Barry Young

|