Vertical Divider

|

Apple Warns Supply Chain of a 20% Drop in New Orders

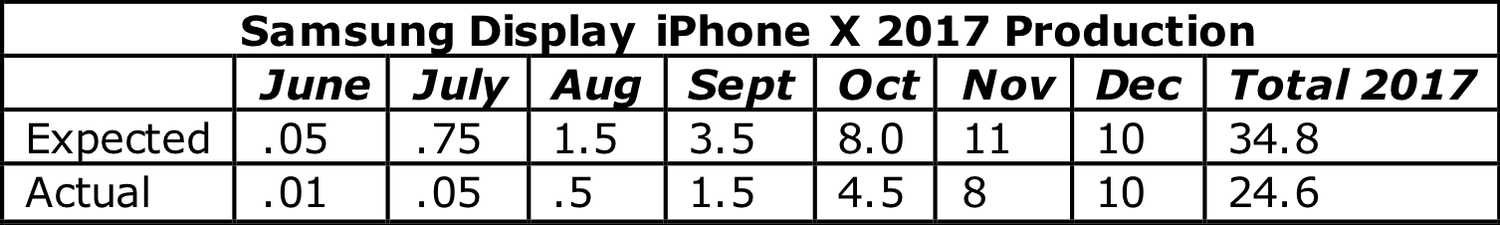

June 18, 2018 According to Nikkei Asian Review sources, "Apple is quite conservative in terms of placing new orders for upcoming iPhones this year. For the three new models specifically, the total planned capacity could be up to 20% fewer than last year's orders." Last year, Apple placed orders to prepare 100M production units of the iPhone 8 models and the iPhone X. Sources say Apple expects 80M total shipments of the new iPhones. Total iPhone shipments dropped 1% Y/Y in the December quarter to 77.31M. Global smartphone shipments declined 0.3% to 1.46B units last year for the first-ever industry decline, according to IDC data. The three iPhone modelscurrently speculated to arrive this fall include two models with OLED screens measuring 6.5 inches and 5.8 inches, while a third is equipped with a 6.1-inch TFT LCD. Nikkei claims all three will have the TrueDepth camera array and use Face ID, but the LCD model will be singled out, as a cost-effective model while the OLED versions will have more premium pricing and specifications. Two sources claim that, in order to avoid any manufacturing delays that allegedly occurred during the initial production of the iPhone X, suppliers were informed by Apple to prepare for the two OLED models earlier than normal. Increased preparation ahead of production could fend off component shortages and quality control issues that were said to have caused last year's manufacturing problems. "The scheduled time frame for components for the OLED models to go into iPhone assemblers like Foxconn and Pegatron for final assembly falls in July, while the schedule for components for the LCD model would be in August," one source states. "Two OLED models are likely to be ready roughly one month earlier than the more cost-effective LCD model, according to the current plan." It is currently expected that all three of this fall's iPhones will start shipping in September, rather than being released at a later time. There has been speculation that the LCD model will be delayed, due to production yield issues surrounding its touchscreen functionality, but the situation has apparently improving. Bottlenecks in integrating the TrueDepth camera array into the LCD screen are also said to be easing, removing another hurdle that could cause manufacturing delays. Suppliers are currently undergoing an Apple verification process ahead of mass production, one source claimed, with assembly partners Foxconn, Pegatron, and Wistron also communicating with Apple over scheduling. Finalizing the schedule will apparently influence how each assembly partner recruits its workforce. Foxconn will continue to be the main iPhone assembler this year, handling all 5.8-inch OLED units and 80 to 90 percent of the 6.5-inch OLED version, as well as 30 percent of LCD model orders. Pegatron is identified as taking 60 percent of the LCD orders and between 10 and 15 percent of the 6.5-inch OLED model orders, while Wistron makes up the remainder. Reports stemming from unidentified supply chain sources are not always completely truthful, and can be fabricated from hearsay and speculation without any concrete evidence. While the report's details do seem to correlate with earlier reports, there is still no proof that can confirm the reduced order claims are genuine. Apple CEO Tim Cook has previously spoken outabout such reporting and supply chain analysis, advising for industry observers to avoid relying too heavily on these types of rumors. "The supply chain is very complex, and we obviously have multiple sources for things," Cook advised in 2013, adding that some reports could be based on a "single data point," and basing assumptions on limited quantities of data is not recommended. For example, reports in January claimed Apple had cut its iPhone X production, citing slower-than-expectedholiday sales" among other claims. On February 1, Apple revealed it had continued to improve its holiday quarter revenueyear-on-year, and though overall iPhone sales had dropped, it had reduced by only 1.2 percent year-on-year while simultaneously achieving the highest average selling price of $796.42. First, while Apple’s expectations for the iPhone X would have been at a high point around mid-year 2017, we believe Apple’s front panel and display modules were more complicated than originally expected. As the final design prototypes were being locked down, suppliers realized that component yields were lower than projected, which was going to lead to a delay in the product manufacturing schedule and release. Whether this was entirely due to a particular component, or a combinations of factors is unimportant at this point, yet we believe these issues added between 4 and 6 weeks to the expected iPhone X production schedule beyond what would have been typical from Samsung Display. We model what we believe the production schedule originally looked like and what it actually became in 2017 in the Table below: Table 1: Samsung Display iPhone X 2017 Production Source: SCMR LLC

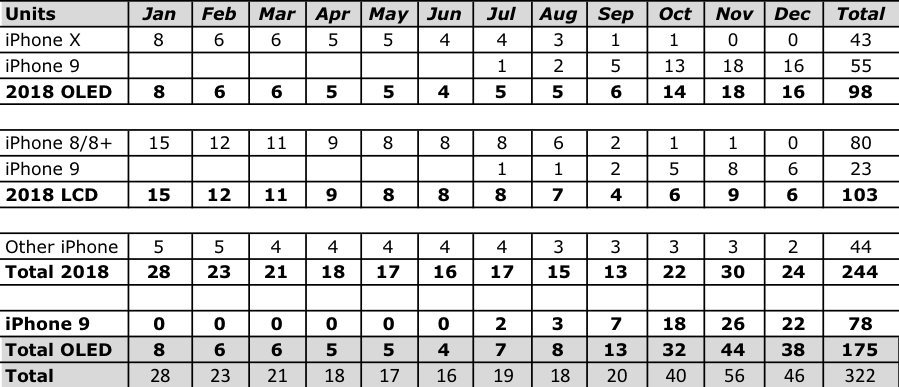

Second, price, and this applies primarily to the iPhone X. As can be seen in Figure 1, the cost of iPhones has remained essentially the same since the iPhone 6 family, at between ~$65 and $85 per square inch of display area, while the average absolute price also remained range bound until the iPhone X As the iPhone X had the requisite number of incremental improvements and features but seems to have been poorly received by consumers, we conclude that the average price point was responsible for the weak initial sales and we expect Apple will be careful not to repeat that mistake in future models. As such, we would assume that Apple will try to reduce the price and cost of upcoming iPhone families at least enough to fall back into the $65 to $85 per square inch of display space, but if they are going to increase the size of the devices for the next iPhone family, they will need to reduce the cost of the units in proportion to the size (and therefore cost) of the new displays. In order to accomplish this, they would need to reduce the cost of the display by 10.6% for the 6.1” model and 23.8% for the 6.45” model.1 Unless Apple presents Samsung Display with radically different specifications for the iPhone 9 family, Samsung Display’s product yield should be higher and increase more rapidly for such new models than for the iPhone X, reducing the overall cost of the module over the production period. Samsung Display needs to fill capacity that it built out under the assumption that it would be producing larger quantities of the iPhone X. While the question remains as to whether Samsung Display will pass along the ‘experience based’ cost reduction to Apple, or whether SDC will accept a lower margin to fill the fabs is unclear but in most cases, the impact of lower factory utilization is a more important factor in maintaining gross margins than a price reduction on a single product, especially when other products for other customers are still in production. Apple should secure lower prices for the iPhone 9 OLED displays that will keep them in the ‘below $1,000’ bracket. Third, and the least specific to Apple and the iPhone but still a factor, was that according to IDC, smartphone shipments dropped 0.3% Y/Y in 2017, the first year of negative smartphone shipment growth ever, which indicated that the industry had reached a point of maturity, and that consumers were no longer upgrading every cycle, which leads us to 2018, where despite the iPhone X, lower than anticipated sales, production will continue through much of 2018. Apple is expected to ship an additional 42.2m-iPhone X units. OLED unit volume shipments in 2018 are shown in the next table. Table 2: Projected 2018 iPhone Shipment Source: SCMR LLC

Apple is projected to order between 20m and 22.5m LCD based units for the iPhone 9 family, which puts iPhone 9 orders at 77.5m, ~3.3% below Nikkei’s estimate. However, it should be noted that Apple continues to sell iPhone 8/8+ and older iPhone smartphones, Apple’s total smartphone orders will be 244.26m units, including both OLED and LCD devices and residual iPhone models. |

|

|

Contact Us

|

Barry Young

|