Vertical Divider

Apple to Build and Ship 221 iPhones in 2021

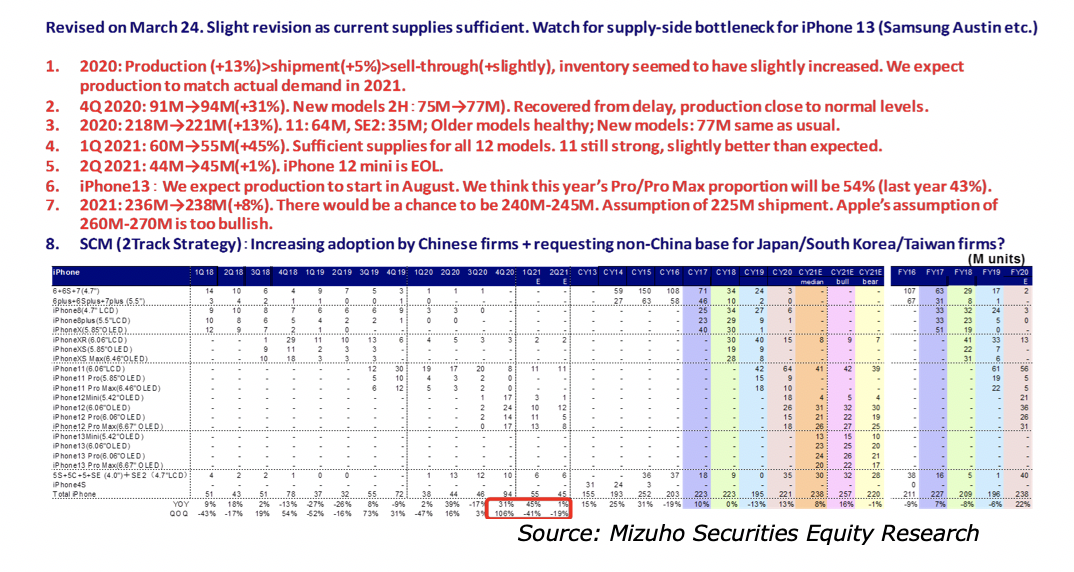

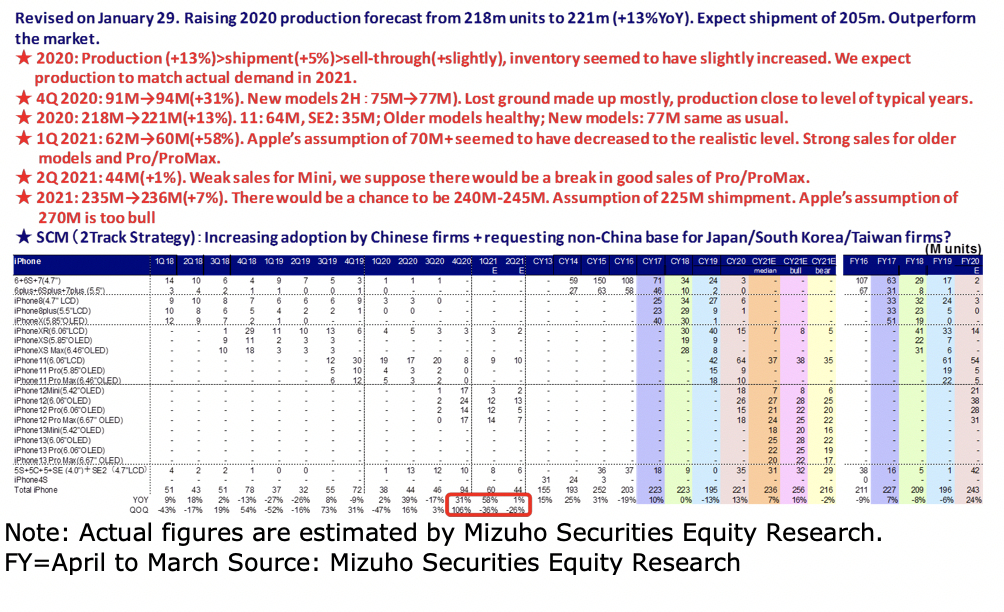

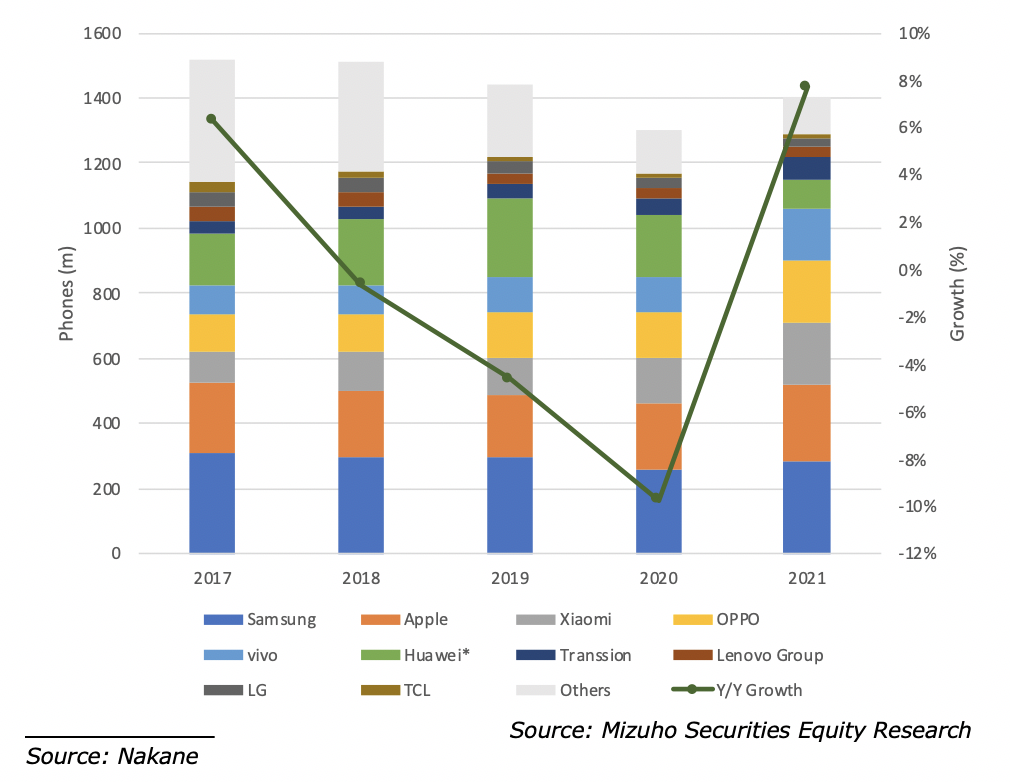

iPhone production is expected to reach 221m units (+13% Y/Y) and should outpace shipments at 205m units (+5%) and sell-through volume of about 195m units (+5% or less), with a full-year estimate to 238m units that roughly matches the overall market growth (+8%). By quarter

has been targeting an earlier schedule in July, versus August normally and

last year’s (iPhone 12) September, but suspended operations at Samsung

Electronics’ Austin plant (OLED driver ICs) and other factors are likely to

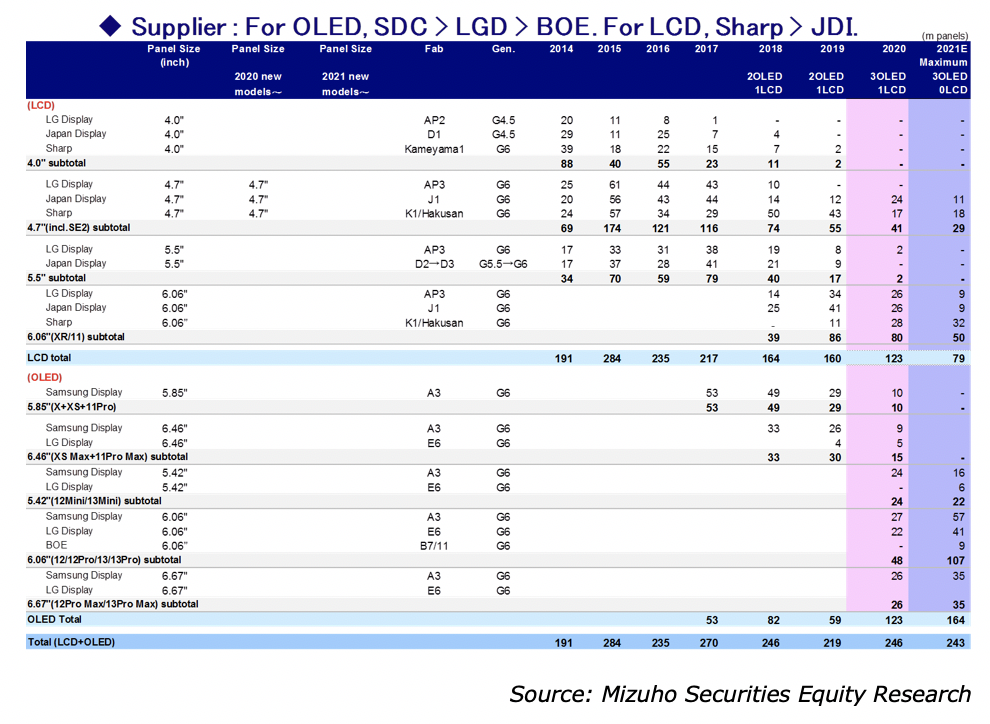

push the timing into August, on track with a typical year, and 5) in displays,

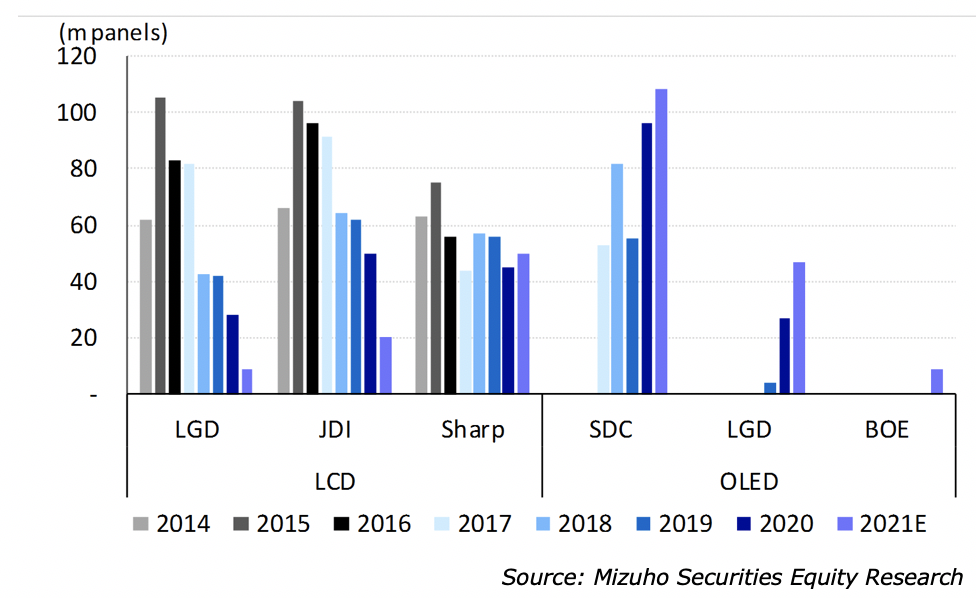

OLED volume should surpass LCD volume for the first time in 2021, a positive

development for the OLED value chain, and we expect concentration of LCD

share at Sharp following the JDI plant purchase.

Table 1: iPhone End Product Assembly Volume Forecasts

iPhone production is expected to reach 221m units (+13% Y/Y) and should outpace shipments at 205m units (+5%) and sell-through volume of about 195m units (+5% or less), with a full-year estimate to 238m units that roughly matches the overall market growth (+8%). By quarter

- Q121 -- 55m units (+45% Y/Y, -41% sequentially

- Q221 -- 45m units (+1%, -19% Y/Y), taking into account Apple’s based on the anticipated procurement strategy (obtaining necessary inventory for products in the iPhone 12 series), current conditions in the end-user market (demand lulls in China and Asia), and value-chain (Samsung semiconductor and OLED) conditions.

has been targeting an earlier schedule in July, versus August normally and

last year’s (iPhone 12) September, but suspended operations at Samsung

Electronics’ Austin plant (OLED driver ICs) and other factors are likely to

push the timing into August, on track with a typical year, and 5) in displays,

OLED volume should surpass LCD volume for the first time in 2021, a positive

development for the OLED value chain, and we expect concentration of LCD

share at Sharp following the JDI plant purchase.

- Median full-year outlook (2021): We slightly adjust this value from 236m units to 238m units (+8%). This retains the outlook of production roughly on par with real demand in 2021 after output exceeded demand in 2020. While some industry sources are talking about a bullish level of 260m–270m units as Apple’s plan target, we think the feasibility of this scenario is low and set our bull case at 257m units and bear case at 220m units. The four new models coming in 2H use the same display sizes as current ones and are likely to lack notable performance appeal other than further improvement in camera functionality (app benefits from using a ToF camera). Our 2H volume estimate is 139m units (vs. 132m units previously), on par with 139m units in 2020.

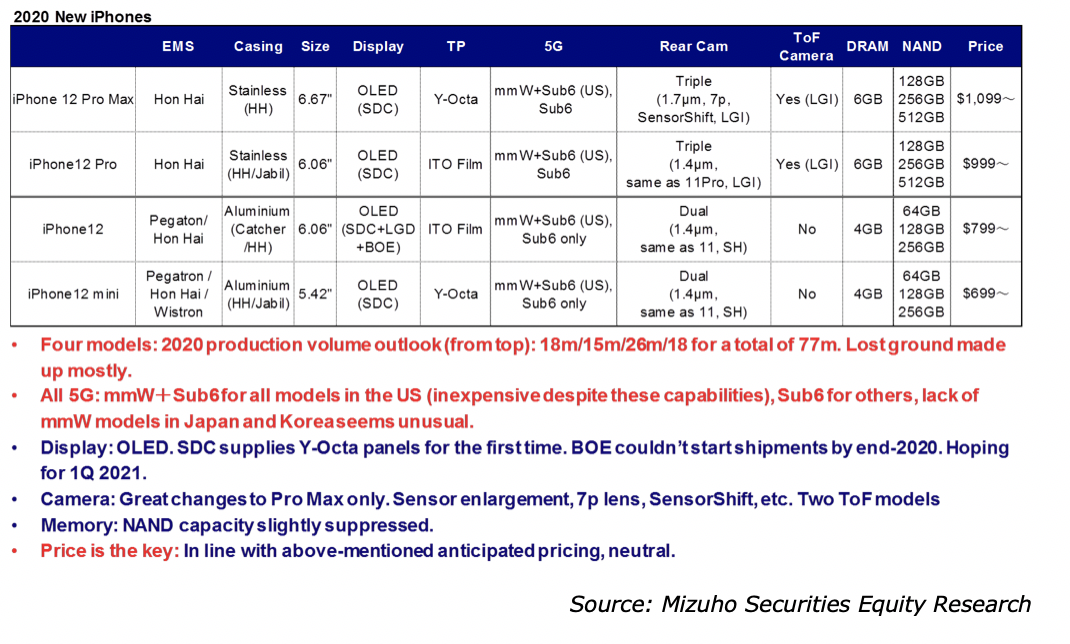

- 4) Focus points for iPhone 13: We expect increase in the Pro/Pro Max output share in iPhone 13 (projecting 54% in 2021 versus iPhone 12 Pro/Pro Max’s 43% a year earlier) due to healthier high-end demand and weaker mainstream demand than anticipated in iPhone 12. Though it depends on pricing, further improvements in camera functionality, including the main camera (increase in pixel size from 1.7 μm to 1.9 μm) and front camera (adopting autofocus), should capture a certain amount of demand. However, we project a return to the normal pattern of producing large volume during the year and making adjustments at the start of the following year, rather than the rising volume trend seen last year. We intend to closely monitor iPhone 13 mini trends. In the iPhone 12 mini, Apple utilized the same camera format as iPhone 11 and offered differences in the external, 5G support, and size (5.42”; smaller than iPhone 11’s 6.06”). Based on sales conditions, the market ultimately did not accept the $100 price disparity with iPhone 11, and this model had the weakest sales in the iPhone 12 series (we expect Apple to halt production at the end of 2Q). in this year’s iPhone 13 mini, considering the outcome described above, we anticipate substantial upgrade to use of the 1.7 μm sensor contained in iPhone 12 Pro Max in the main camera, while retaining a dual-camera system. While absolute and relative pricing are obviously most important, we think the camera should continue to be the major appeal and are focusing on iPhone 13 mini as an indicator. However, at the current juncture we think it is likely that Apple could discontinue the Mini (5.42”) model when it releases its 2022 phones.

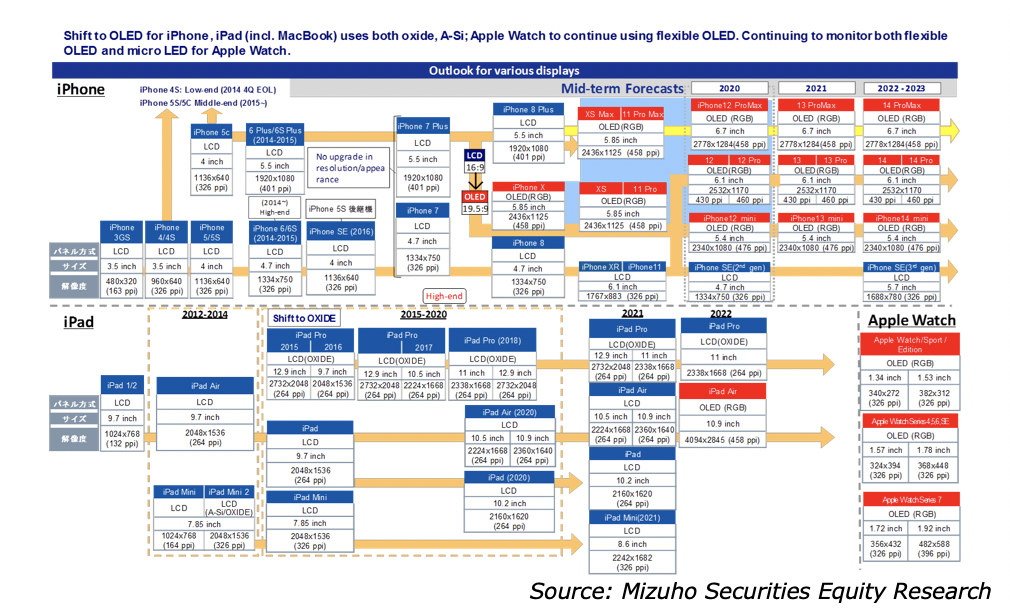

- Display (iPhone): iPhone 13 to use OLEDs in all four models and retain the same sizes as the iPhone 12 series. Pro and Pro Max models should utilize an LTPO backplane primarily for power savings, and Samsung Display will be the exclusive supplier. LG Display (LGD) should supply iPhone 13 and iPhone 13 mini panels, and BOE to supply iPhone 13. Since all four models are using Y-OCTA, which embeds the touch panel (TP) circuit in the display, this year and the format results in a four-layer increase in TFT-side masks (lowering yield), yield improvement is a key point at LGD and BOE, which have limited volume- output experience. Apple working reduce dependence on Samsung Display as much as possible and expect steep increases in supply volume at LGD and BOE if they achieve stable supply of quality products. Furthermore, LGD plans to expand production capacity at its back-end process plant in Vietnam from 4.0m-4.5m units/month to roughly 7.5m units per month (3Q 2021), suggesting the possibility of bolstering front-end (TFT + OLED) output capacity (+15,000 sheets at E6-3 and +15,000 sheets at E6-4) from 2022.

- Major structural changes in iPhone OLEDs are not anticipated from 2022 resulting in an excellent opportunity for LGD and BOE to catch up. For LCDs, iPhone 11 and iPhone SE2 output, a 5G-version SE2 output in 2022, and a new 5.7”-class model (SE3?) is expected in 2023. Sharp, which jointly purchased JDI’s Hakusan plant with Apple, should be the main supplier. In 2021, however, the Sharp and LGD will share the volume 6) Displays (iPad/MacBook): Similar to iPhone, Apple’s strategy calls for a co-existence of LCDs and OLEDs. The iPad Air (10.9”) to be the first OLED model with release in the latter half of 2022 at the earliest and during 2023 at the latest, Samsung Display is the supplier, and a hybrid structure of rigid on the bottom side and flex on the upper side. There is a possibility that the iPad Pro and MacBook will use OLEDs in 2023. Apple is likely to make a decision on whether to shift course to OLEDs after observing market assessment of products that use the Mini LED backlight because of differentiation from other firms with control technology and substantial investment of R&D resources in the development period (roadmap) of roughly five years.

Table 1: iPhone End Product Assembly Volume Forecasts

Table 2: iPhone End Product Assembly Volume Forecasts

Table 3: 2020 iPhone: Current Outlook

Table 4: 2021 iPhone: Current Outlook

Table 5: 2020 iPhone Panel Supply Forecasts (LCD/OLED By Model)

Figure 1: LCD/OLED Panel Production by Supplier

Figure 2: Smartphone Shipment Forecasts By Brand (M unit)

Figure 3: Smartphone Shipments by OEM

|

Contact Us

|

Barry Young

|