Vertical Divider

Smartphones

Apple Developing Larger Smartphone Panel Capability without Folding

March 15, 2020

Apple is working on technology for two or more devices to act in concert when close together, with the technology able to make a foldable iPhone that doesn't suffer from a bending screen.

Figure 1: Multiple Smartphones Linked to One Display Image

Apple Developing Larger Smartphone Panel Capability without Folding

March 15, 2020

Apple is working on technology for two or more devices to act in concert when close together, with the technology able to make a foldable iPhone that doesn't suffer from a bending screen.

Figure 1: Multiple Smartphones Linked to One Display Image

Source: USPTO

Future iPhones, or other Apple devices, could automatically detect when they're in close proximity, and then share a common display image across all of them. Based on previous patent applications regarding "wraparound" multiple displays for iPhones, this one details possible future devices that share screens. They may automatically register each other's presence, and immediately begin to work together.

Using the technology, a series of iPhones or iPads can be used to display a single video wall across all their screen. However, Apple also describes how two iPhones could be connected in this way to effectively produce one bendable device in "System with multiple electronic devices", US Patent No 10,585,708, also show a familiar iPad-style Smart Cover being used to house such a device. Apple described how devices could be made that contain sensors to register when they are in close proximity. Placing two, or more, next to each other could be enough to trigger them working in concert. Simply picking up one device could be enough to make them all revert to working independently. "The electronic devices may use sensor measurements and other information to detect when an edge of a first electronic device is adjacent to an edge of a second electronic device."

Figure 2: Folding Smartphone

Source: USPTO

Detail from the patent applications drawings. Notice the Smart Cover-like image in the right hand drawing.

"In the joint operating mode," it continues, "images may extend across displays in the devices, speakers in the devices may be used to play different channels of an audio track, cameras and other sensors may be used in cooperation with each other, and other resources may be shared." Apple suggests that "magnetic components may hold devices together in a variety of orientations," and certain of the orientations it describes fit with the idea of a bendable device. Such a device could comprise two completely independent iPhones which act in concert only because they are housed close together in a foldable or bendable cover. Alternatively, one device might contain a touch display while the other contains storage or further processing capabilities. "[Both may] be cellular telephones, may both be wristwatch devices, may both be tablet computers, may both be laptop computers, may both be desktop computers, etc.," continues the patent, "[or they] may be different types of devices. For example, a tablet computer and... a cellular telephone. The technology is not dissimilar to that of the Surface Duo, expected to ship at some point in 2020. For that device, the "hinge" area is a bezel, and is used to implement user interface gestures.

Figure 3: Microsoft’s Surface Duo

Source: Microsoft

The patent application is credited to two inventors, James R. Wilson, and David A. Pakula. Between them, they hold over 120 patents, many to do with displays on electronic devices. Wilson was recently credited on a patent regarding how Apple glasses could have hidden cameras and removable headphones.

The smartphone parts sector is a viable forecaster of upcoming smartphone sales and technology changes. Hyundai Securities has conducted a run at the sector.

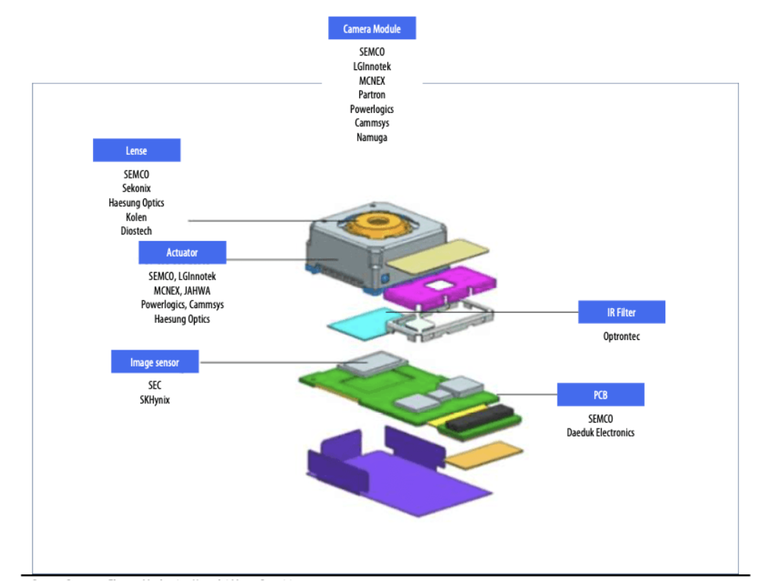

- Camera modules, the multi-camera trend in smartphones will continue in 2020. If double- or triple-camera modules were the norm in 2019, 2020 will see a surge of triple- and quadruple- camera modules in smartphones, which means much higher demand for camera modules.

- Smartphone PCBs are expected to experience increasing demand for camera while growing numbers of OLED smartphones work to buoy display PCB demand, which bodes well for Korean PCB manufacturers.

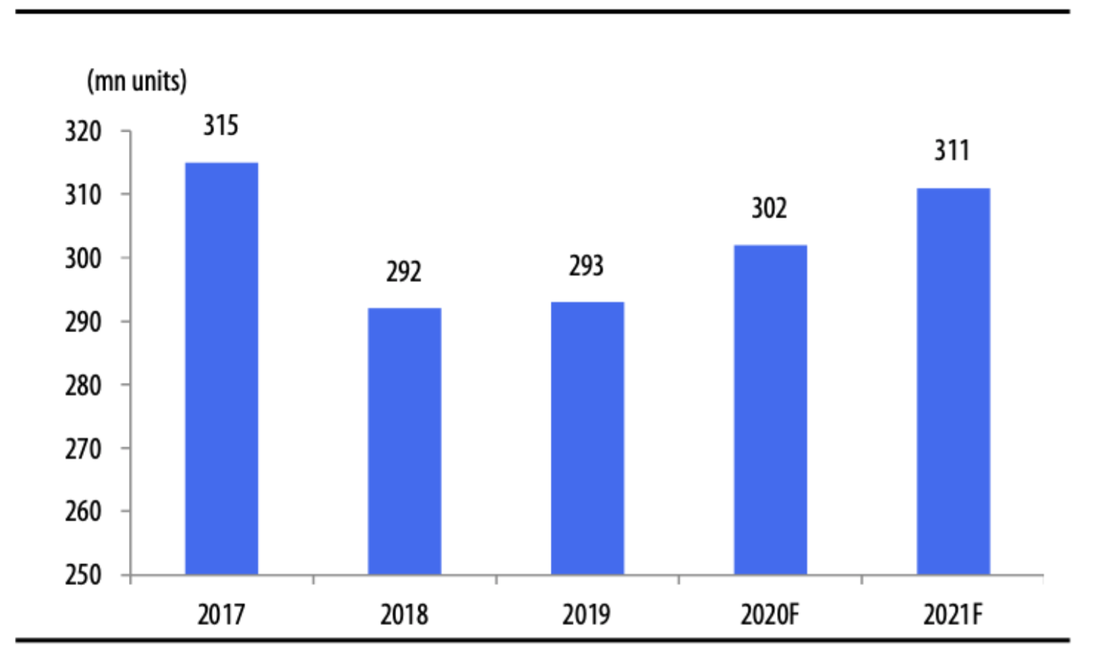

- Hyundai estimates global smartphone shipments in 2020 at 1,444m units, up 1.2% Y/Y from 2019's 1,427mn units. The biggest factors that will drive global shipments of smartphones are:

- the arrival of the 5G era;

- blooming of the foldable smartphone market.

5G smartphones are expected to gain presence faster than 4G smartphones given aggressive investments in the countries where the 5G service is available as well as the launch of affordable 5G phones by smartphone makers. Additionally, the release of various types of foldable smartphones is expected to boost demand while cutting prices.

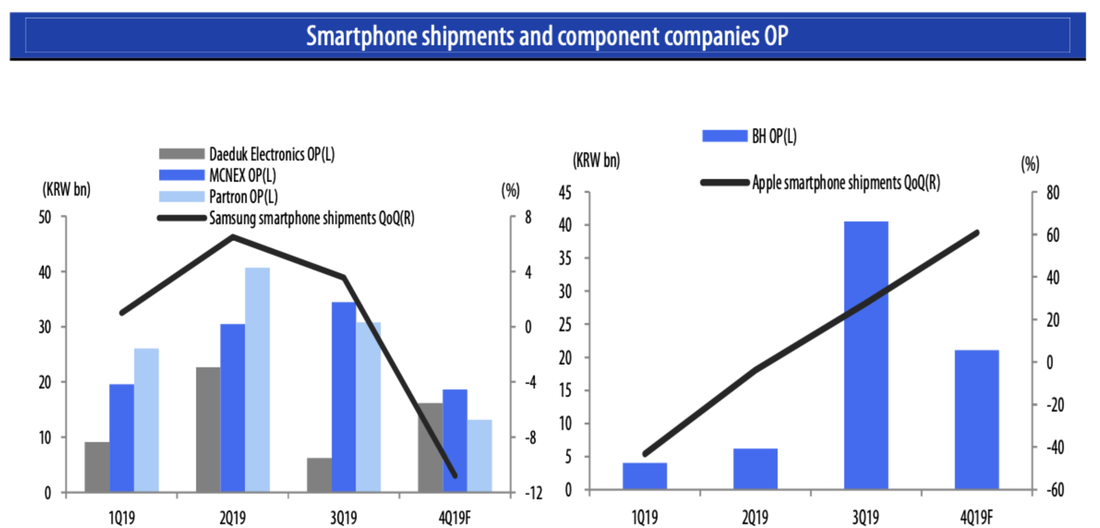

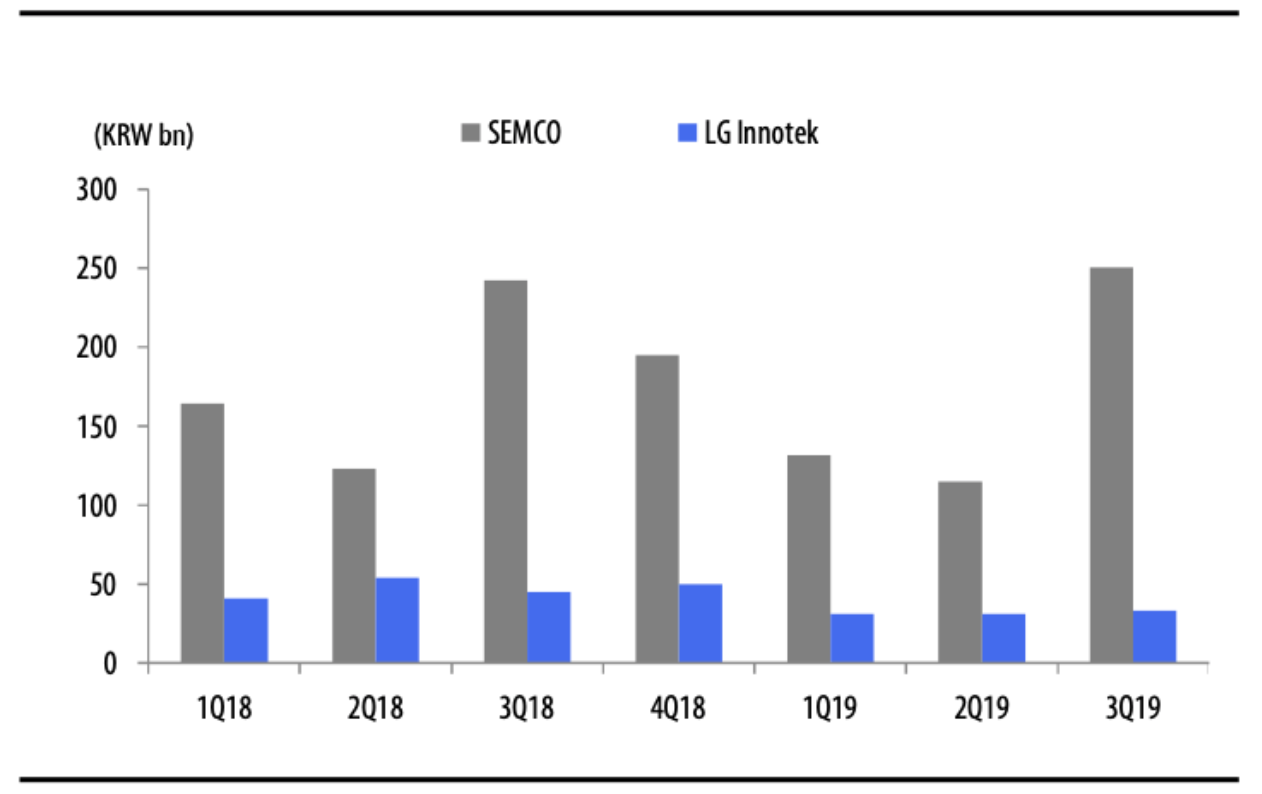

Figure 4: 2019 Smartphone Shipments and Component Companies OP

Source: Hyundai Motor Securities

BH is their top pick for the smartphone parts sector as they expect BH's major US-based models released in 2020 should come with OLED display. BH, as a key supplier of OLED display PCBs for its Apple, stands to benefit materially. Apple is expected to make two out of its four models in Y-Octa OLED, which means higher ASPs and wider margins. BH should enjoy the momentum from the growing foldable smartphone market as it exclusively supplies Korean smartphone makers with display FPCBs for foldable smartphones.

The 5G era began in 2018 when the first 5G network transmission started between Korea and the US. The replacement of the network, taking place every 10 years, is expected to bloom in 2020 with the launch of commercial services in major countries such as Japan and Russia. 5G is a communications technology that is indispensable for the future as the transmission speed is dramatically faster than 4G. The common qualities of future technologies such as big data, AI, and autonomous driving are that when a large amount of data moves, it moves at high speeds and low latency, and the network connection must be stable. The maximum transmission speed of 5G is 20Gbps and the transmission delay is only 1ms. Additionally, since the 5G network structure uses a high band frequency, small cells are used to ensure stable 5G connections.

The 5G era began in 2018 when the first 5G network transmission started between Korea and the US. The replacement of the network, taking place every 10 years, is expected to bloom in 2020 with the launch of commercial services in major countries such as Japan and Russia. 5G is a communications technology that is indispensable for the future as the transmission speed is dramatically faster than 4G. The common qualities of future technologies such as big data, AI, and autonomous driving are that when a large amount of data moves, it moves at high speeds and low latency, and the network connection must be stable. The maximum transmission speed of 5G is 20Gbps and the transmission delay is only 1ms. Additionally, since the 5G network structure uses a high band frequency, small cells are used to ensure stable 5G connections.

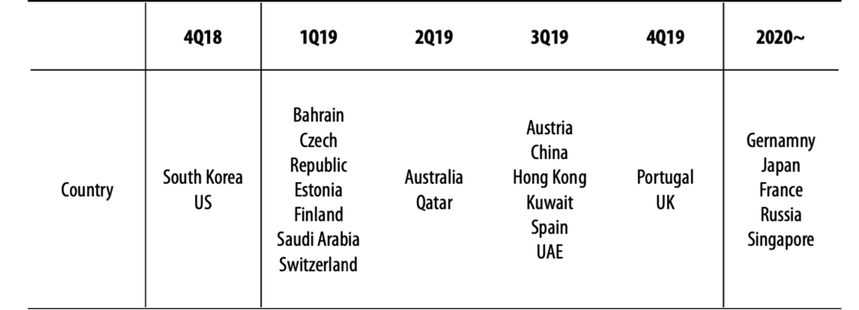

Table 1: Global 5G Launching Schedule

Source: GSMA Intelligence, Hyundai Motor Securities

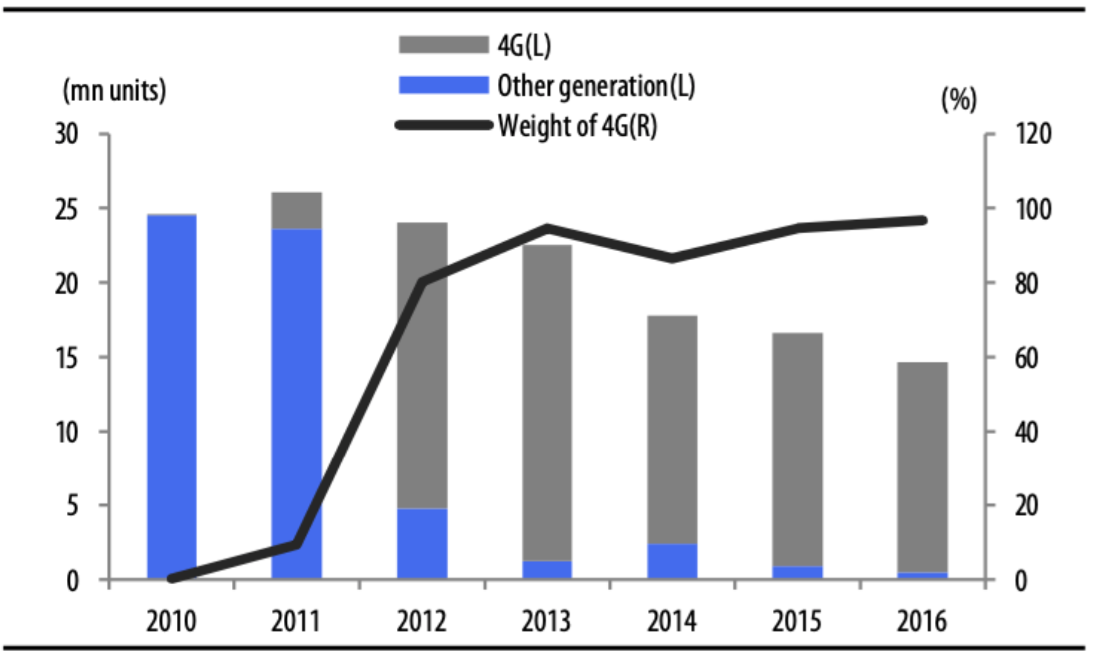

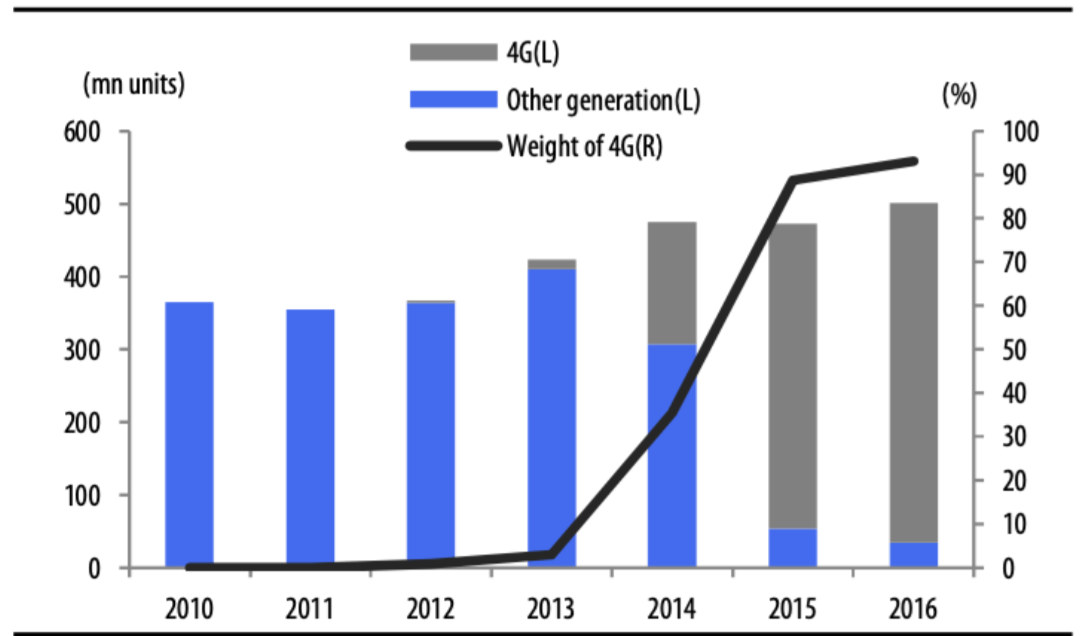

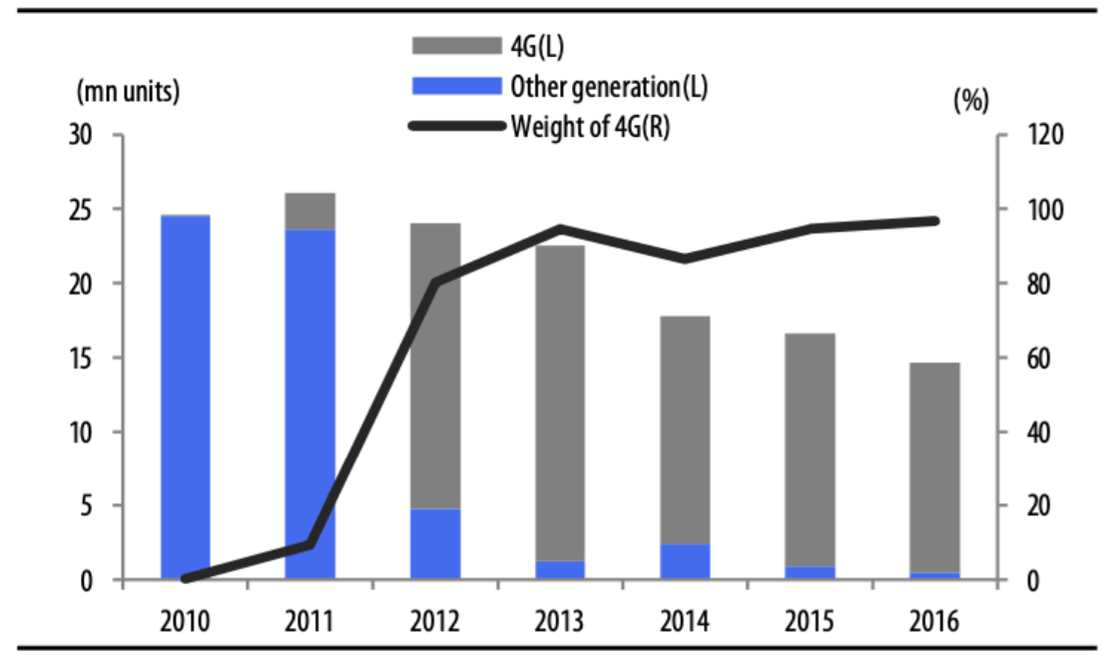

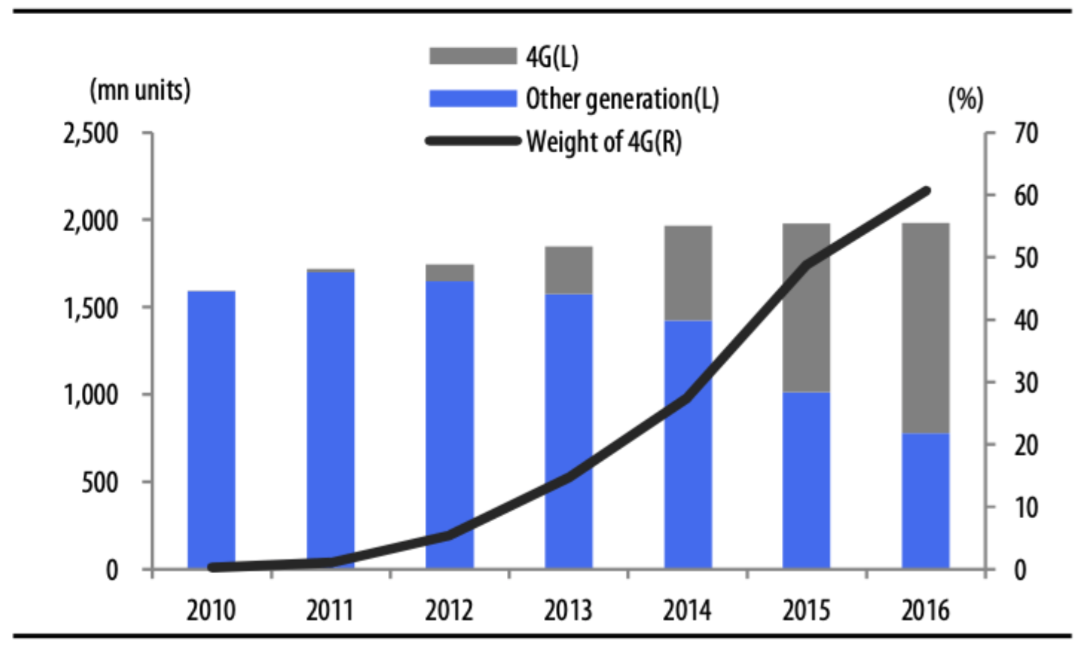

Looking at Korea, the US, and China when the 4G network was introduced, Korea finished building a nationwide network in 2012, with 4G smartphones accounting for 80% of total smartphone shipments. In the US, 4G went commercial in 2011 but as of Aug 2012 Verizon's (VZ) 4G coverage reached 75% and 4G smartphones represented 56% of total smartphone shipments in 2013. In the Chinese market, 4G commercialization began in 2013, but it was not until 2015 when 4G coverage expanded meaningfully enough to boost 4G smartphones' portion of total smartphone shipments to 88%.

|

Fig 5: S. Korea 4G Smartphone Shipments in Adoption Period

|

Fig 6: U.S. 4G Smartphone Shipments in Adoption Period

|

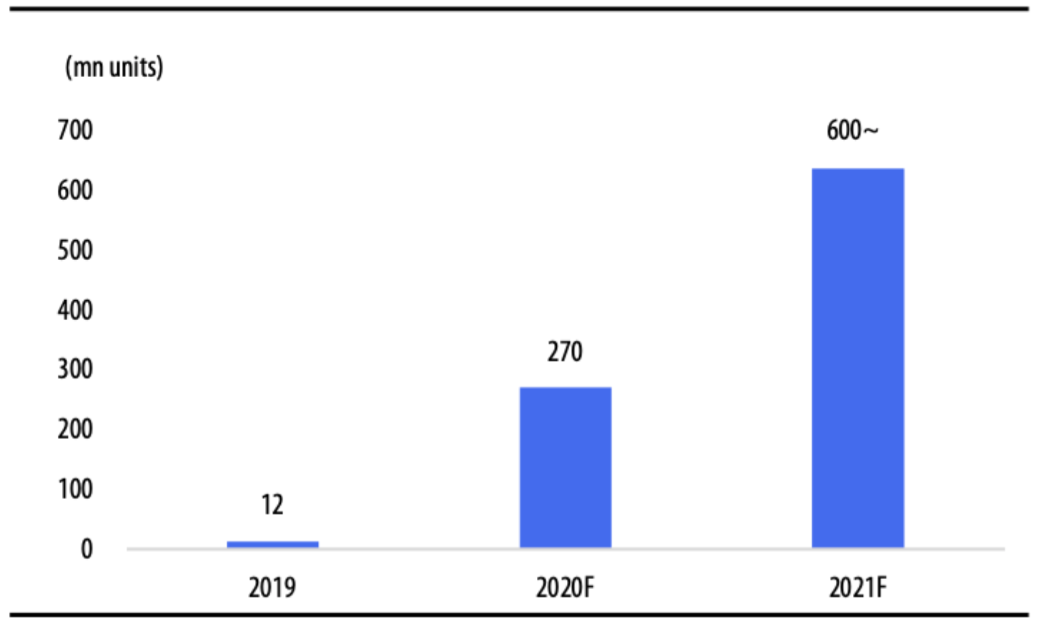

By global shipments, 5G smartphones are expected to increase faster than 4G smartphones did. They estimate 5G smartphones' global shipments to increase to 270mn units in 2020 and over 600mn units in 2021, as China is gearing up to make heavy investments in 5G.

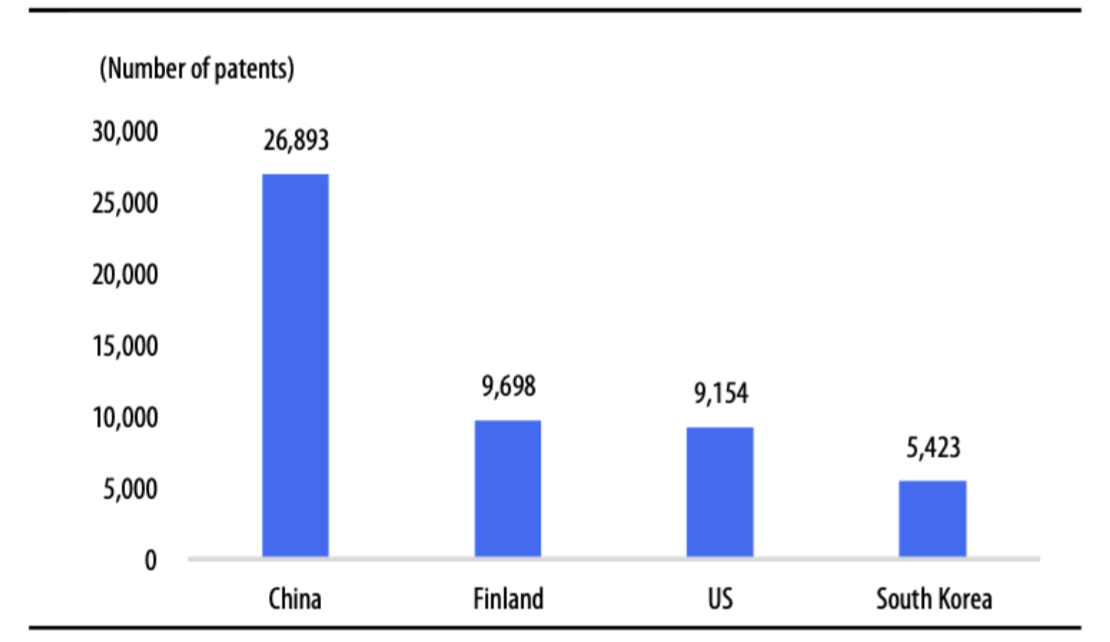

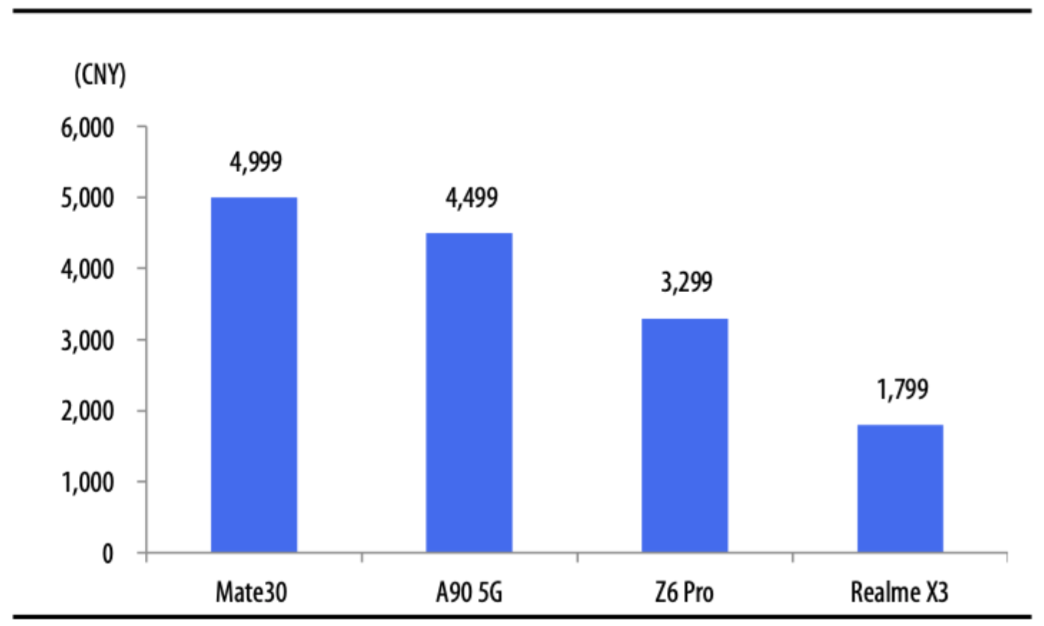

China aims to achieve two 5G objectives: securing IP rights and stimulating its economy. The first 5G service was started by Korea, followed by the US, but as of now China has the most 5G patents in the world (26,893 patents). Besides, as China's economic indicators deteriorate, it appears that the country is using 5G investments as a means to boost its economy. Indeed, Beijing expects the economic effect of 5G to surpass KRW1,071tn by 2030. China has announced plans to invest approximately CNY1.2tn to build its 5G network by 2025. It also has plans to increase the number of 5G subscribers to 200mn in 2020. In line with such plans, Chinese smartphone makers are expected to roll out a string of low-end 5G smartphones with a price tag of some CNY2,000 or more. As Beijing is actively investing in 5G and smartphone prices are moving south, 5G smartphone shipments in China should increase in 2020, along with global shipments.

China aims to achieve two 5G objectives: securing IP rights and stimulating its economy. The first 5G service was started by Korea, followed by the US, but as of now China has the most 5G patents in the world (26,893 patents). Besides, as China's economic indicators deteriorate, it appears that the country is using 5G investments as a means to boost its economy. Indeed, Beijing expects the economic effect of 5G to surpass KRW1,071tn by 2030. China has announced plans to invest approximately CNY1.2tn to build its 5G network by 2025. It also has plans to increase the number of 5G subscribers to 200mn in 2020. In line with such plans, Chinese smartphone makers are expected to roll out a string of low-end 5G smartphones with a price tag of some CNY2,000 or more. As Beijing is actively investing in 5G and smartphone prices are moving south, 5G smartphone shipments in China should increase in 2020, along with global shipments.

|

Fig 9: 5G Standard Essential Patents by Country

|

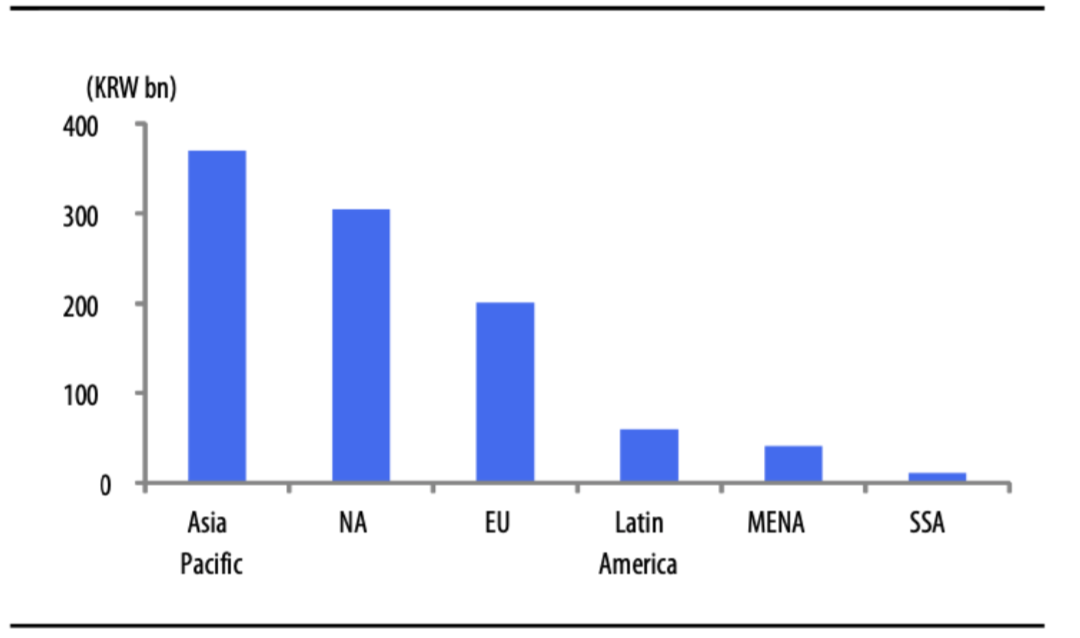

Fig 10: 2018-2025 5G CAPEX Forecasts by Region

|

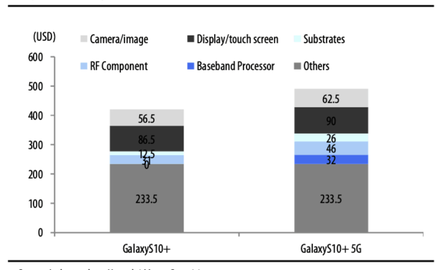

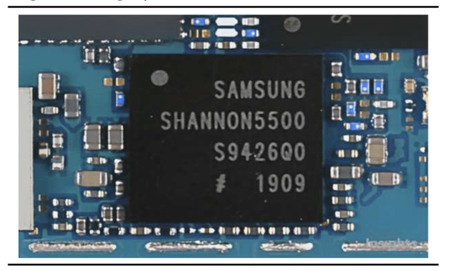

The proliferation of 5G smartphones bodes well for the smartphone parts sector. To keep up with 5G technology, smartphones need to have stronger specs and more components. The biggest change, among others, is the RF chipset, which transmits and receives radio waves. 5G smartphones require RF chipsets with enhanced performance to keep up with sub 6GHz and mmWave, and we expect the prices of baseband chipsets to rise. Indeed, the Galaxy Note 10 and its 5G version the Galaxy Note 10 5G saw an increase in BOM cost from USD420 to USD490. Of these, the increase in RF and baseband chipsets amounts to about USD47, which accounts for about 67% of the cost increase. Since the Exynos RF 5500 used in the Galaxy Note 10 5G does not support mmWave, 5G phones with chipsets that support mmWave will have a higher BOM cost.

|

Fig 13: Galaxy Note 10 vs Note 10 5G BOM

Source: Industry Data, Hyundai Motor Securities

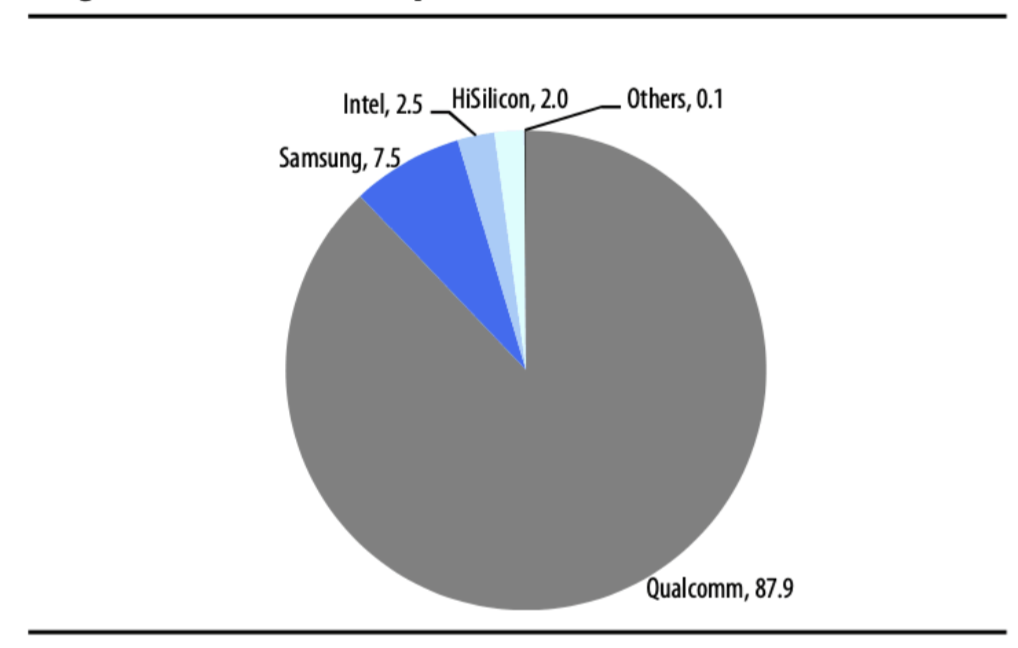

Fig 15: Global Baseband Processor Market Shares

Source: Industry Data, Hyundai Motor Securities

|

Fig 14: Samsung Exynos RF550

Source: Samsung Electronics

Fig 16: Smartphone AP Market Growth Forecasts

Source: Industry Data, Hyundai Motor Securities

|

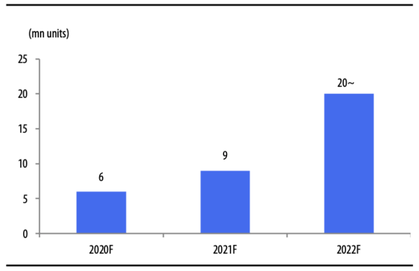

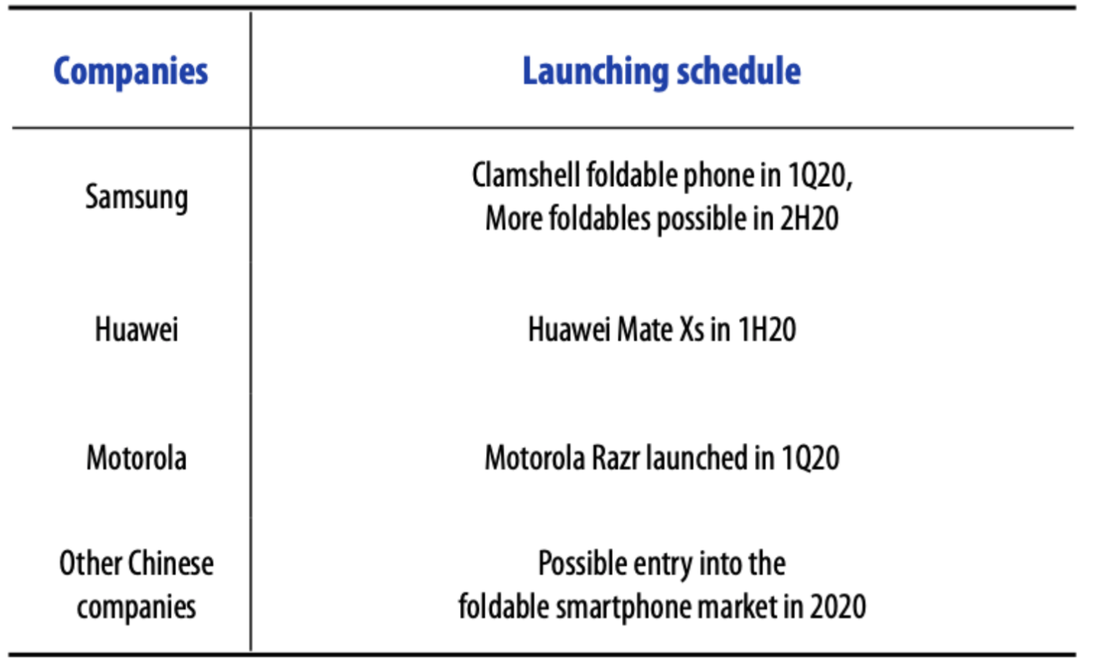

In 2020, Hyundai expects about 6m foldable smartphones to be shipped globally thanks to Samsung's strengthening foldable phone lineup and intensifying competition with Royole, Huawei and Motorola. As the foldable phone market is picking up steam, global shipments could exceed 20mn units by 2022 when Apple enters the foldable phone market.

|

Fig 17: Global Foldable Smartphone Shipments

|

Table 2: Foldable Smartphone Launching Schedules

|

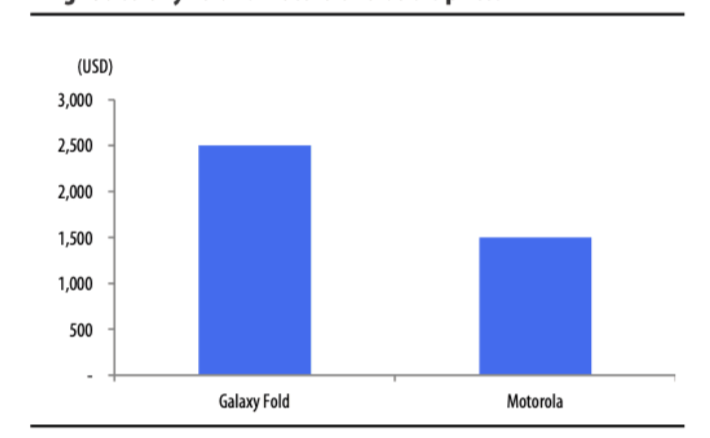

Factors that could drive foldable smartphones' shipments higher this year are an increase in the number of models and affordability. In 2019, horizontally foldable smartphones were introduced, in both in-folding and out-folding types. This year, we will see clamshell-style smartphones which are easier to make by eliminating folding hinges that had been mentioned as a flaw in previous foldable models. In addition to the clamshell phone to be unveiled on Feb 11, Samsung will likely release additional foldable models in 2H20. In the meantime, Huawei plans to launch Huawei Xs in 2Q20. Additionally, Motorola released its clamshell foldable phone in January which resembles its once popular feature phone Razr. In all, we see the foldable phone market expanding not only in shipments but also in types. In addition, the foldable smartphones that will be released in 2020 may come in a more affordable price range. Indeed, Motorola's foldable phone released in January was priced at USD1,500, cheaper than 2019's Galaxy Fold. A wider selection to choose from along with lower price ranges is expected to drive demand for foldable smartphones.

|

Fig 18: Galaxy Fold vs Motorola Foldable Prices

Source: Hyundai Motor Securities

Fig 20: Z Flip Huawei Mate Xs

Source: Hyundai Motor Securities

Fig 22: Z Flip

Source: Press Data

Fig 24: Share Prices of IT Component Companies Related to Foldable Smartphones

Source: Press Data

|

Fig 19: Samsung and Motorola Clamshell Foldable Phones

Source: Hyundai Motor Securities

Fig 21: Foldable Smartphones Launched in 2019

Source: Hyundai Motor Securities

Fig 23: Rollable Display Smartphones

Source: Press Data

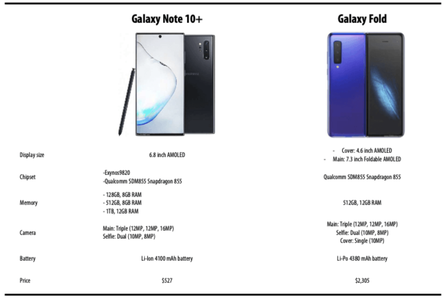

Fig 25: Galaxy Note 10+ and Galaxy Fold

Source: Press Data

|

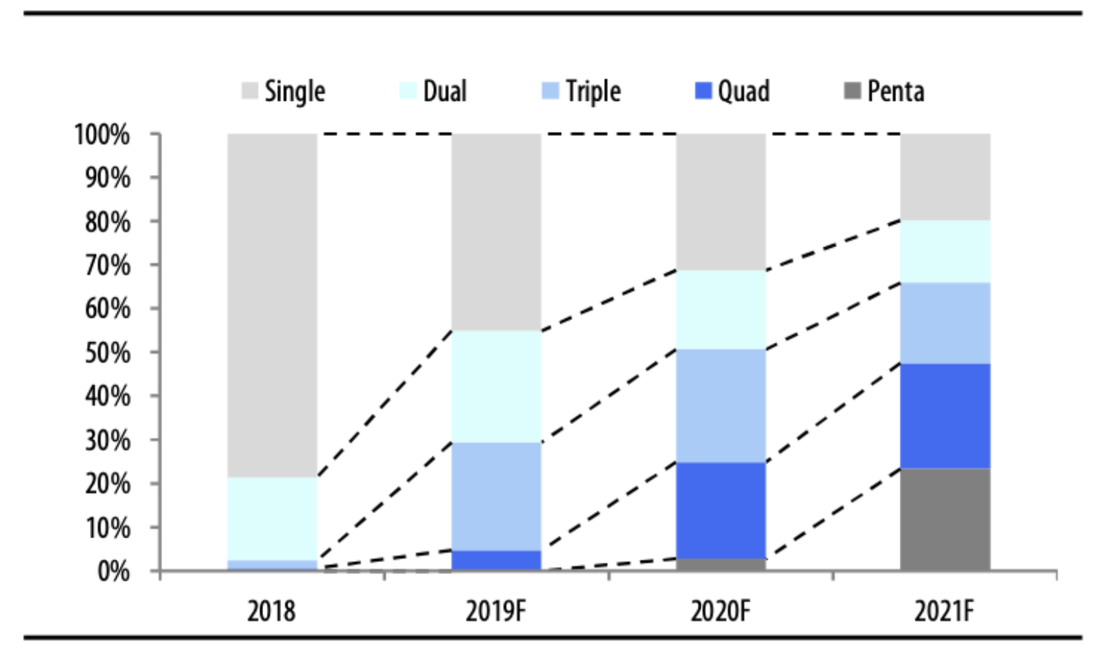

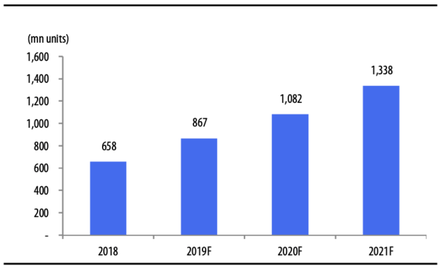

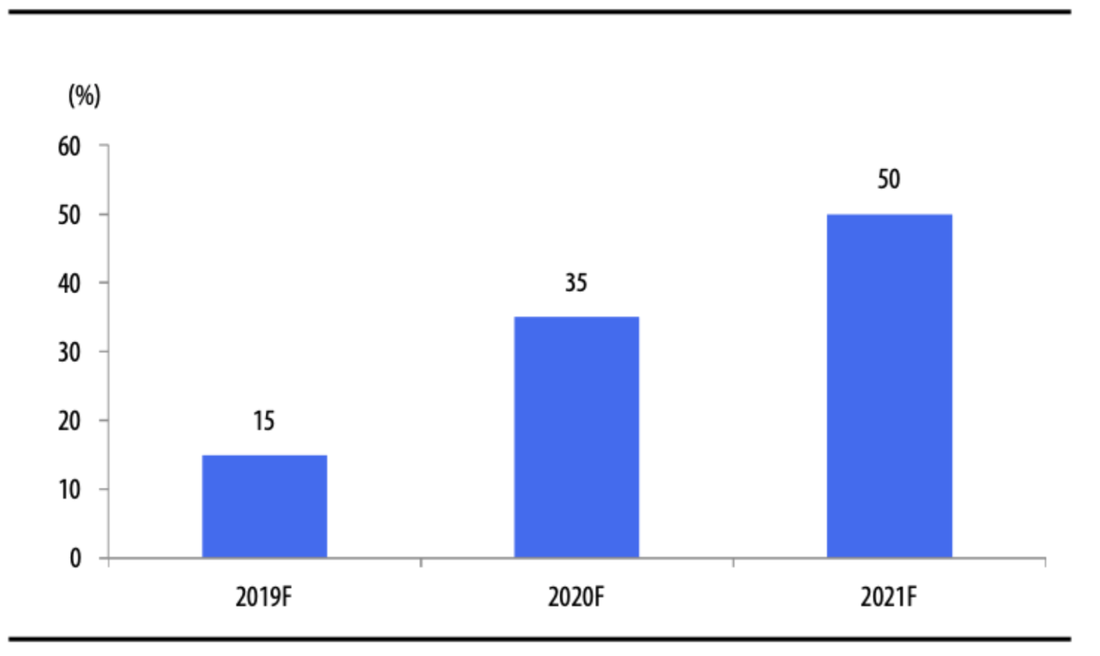

The ongoing multi-camera trend will see the birth of even penta-camera phones in 2020 with up to five cameras on the back. By brand, we expect the maximum number of cameras to be installed on the back of a smartphone to be five for Samsung (the Galaxy S20), four for Apple, five for Huawei, and five for Xiaomi. For the models with these cameras, the number of camera modules will have increased by one vs. their predecessors debuted in 2019, meaning that 2020 will be characterized by the year for triple- or quadruple-cameras. The percentage of smartphones with three or more cameras in total global shipments was 15% in 2019 but the number looks likely to grow to 50% by 2021. Samsung, proportion of multi-camera modules will increase from 55% (or 870mn units) in 2019 to 69% (or 180mn units) in 2020. Multi cameras began to gain attention when Apple (AAPL) introduced dual cameras in the iPhone 7 Plus. Apple demonstrated the potential for more advanced photography technology with the dual cameras in the iPhone 7 Plus which enabled bokeh images through multi cameras and software solutions. Since then, Huawei introduced triple cameras in the 2018 P20 series, and the number of camera modules in smartphones started increasing, signaling the beginning of the multi-camera trend. More recently, even low-end models such as Samsung's A51 and A71 series have quad cameras. There are even smartphones with penta-cameras such as Xiaomi's CC9 Pro. Korean and Chinese smartphone names should move to increase the use of penta-cameras in their smartphones in 2020.

|

Fig 26: Samsung's Smartphone Shipment Trend

Source: Hyundai Motor Securities

Fig 28: Samsung's Multi-Camera Adoption Forecasts

Source: Hyundai Motor Securities

|

Fig 27: Samsung's Camera Module Demand Forecasts

Source: Hyundai Motor Securities

Fig 29: Adoption Rate of Camera Modules

Source: Hyundai Motor Securities

|

Incased Use of 3D Sensing Cameras and ToF

The market for 3D sensing cameras is expected to continue growing. Trendforce predicts the 3D sensing camera market is forecast to expand to USD5.96bn with 20% of smartphones adopting 3D sensing cameras. Indeed, smartphone markers' use of ToF is steadily rising. Samsung first introduced ToF in 2019 through the Galaxy S10 5G model, and Apple is expected to start adopting ToF cameras with its new 2020 models. Currently, multi-cameras in smartphones not only include a viewing camera for taking pictures or videos but also a 3D sensing camera for space recognition. 3D sensing technology in smartphones has gained attention since Apple introduced Face ID through the iPhone X after forfeiting the home button and fingerprint recognition. Now, most smartphone brands have begun to adopt 3D sensing cameras.

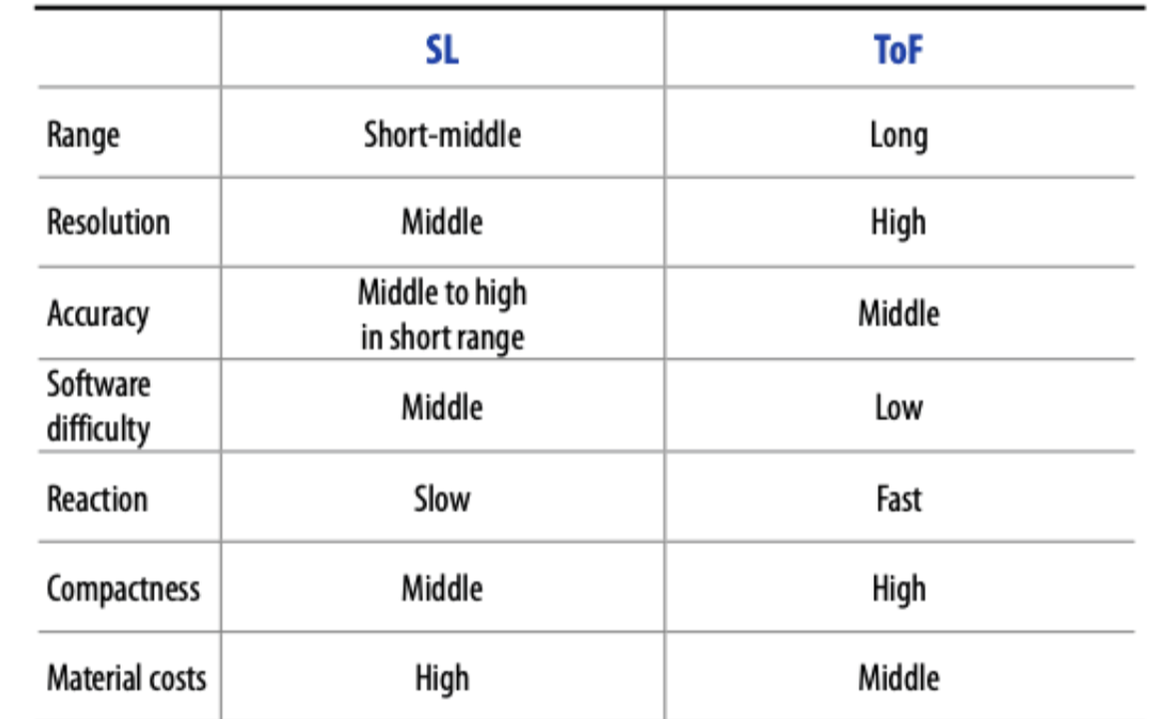

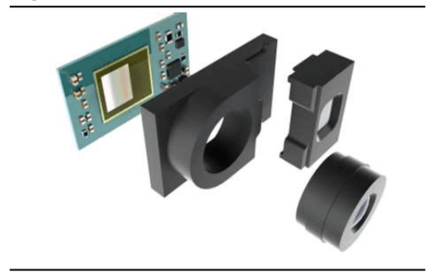

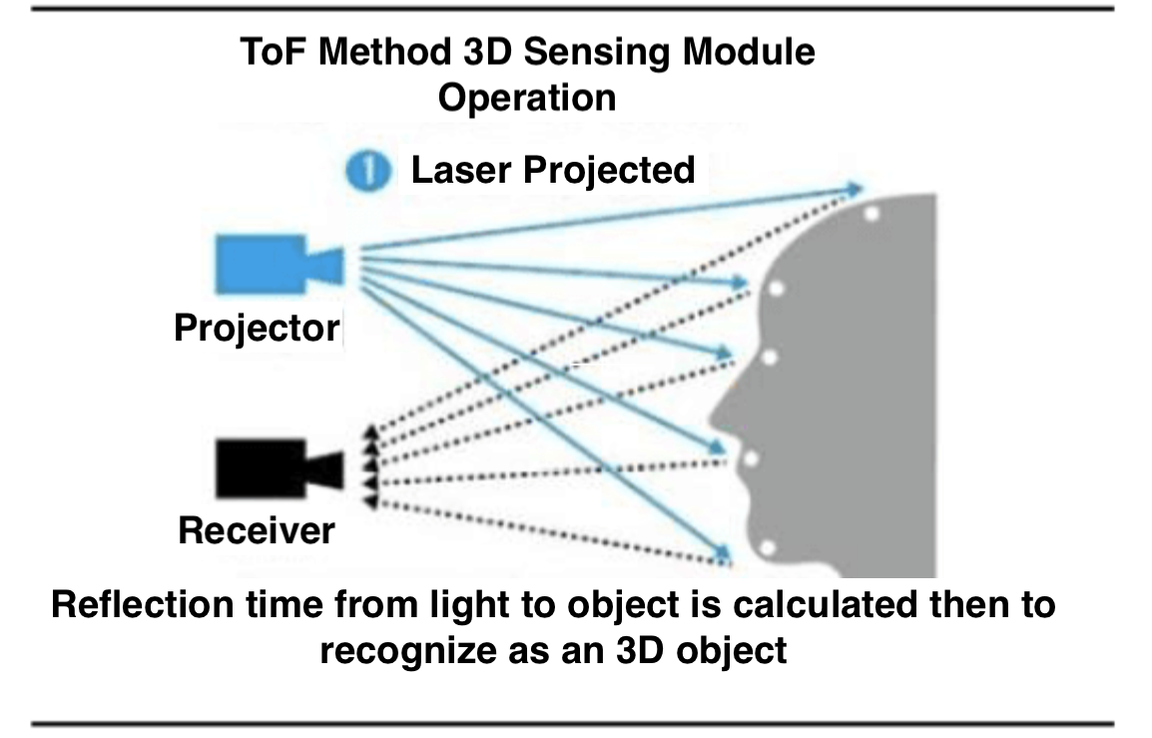

ToF is a 3D sensing camera that calculates the time of flight from the laser from a projector to the receiver. The previous structured light (SL) method is a system that receives and analyzes the surface curvature of objects using infrared rays. Requiring a processor for analysis, the method's weakness is long distance and variable factors that might happen externally. Now, ToF calculates the time of return, hence there is no need for a separate processor. It also consumes less power, responds more rapidly, and recognizes longer distances using a laser vs. the previous SL method.

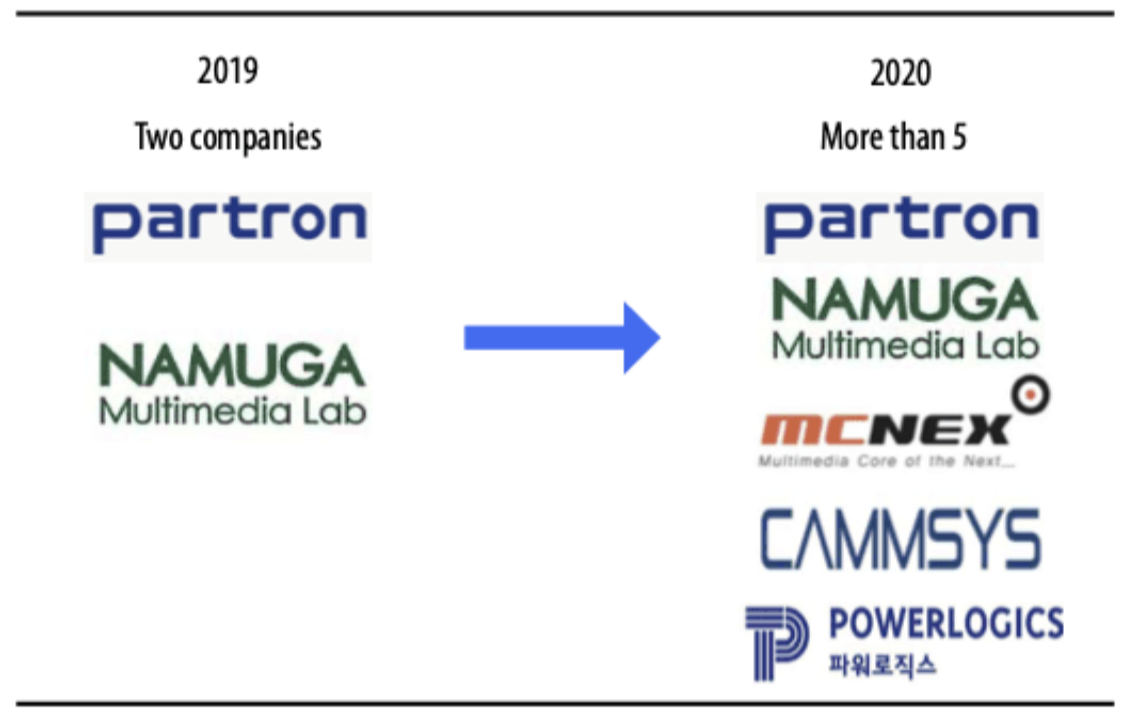

As the use of ToF increases, ToF suppliers should continue to benefit in 2020. In particular, LG Innotek is slated to enjoy larger sales and profits as it supplies Apple's ToF cameras. In 2020, we believe even mid- and low-end models will start to adopt ToF cameras, as the prices are expected to decline vs. 2019 with more suppliers beginning to supply ToF cameras.

The market for 3D sensing cameras is expected to continue growing. Trendforce predicts the 3D sensing camera market is forecast to expand to USD5.96bn with 20% of smartphones adopting 3D sensing cameras. Indeed, smartphone markers' use of ToF is steadily rising. Samsung first introduced ToF in 2019 through the Galaxy S10 5G model, and Apple is expected to start adopting ToF cameras with its new 2020 models. Currently, multi-cameras in smartphones not only include a viewing camera for taking pictures or videos but also a 3D sensing camera for space recognition. 3D sensing technology in smartphones has gained attention since Apple introduced Face ID through the iPhone X after forfeiting the home button and fingerprint recognition. Now, most smartphone brands have begun to adopt 3D sensing cameras.

ToF is a 3D sensing camera that calculates the time of flight from the laser from a projector to the receiver. The previous structured light (SL) method is a system that receives and analyzes the surface curvature of objects using infrared rays. Requiring a processor for analysis, the method's weakness is long distance and variable factors that might happen externally. Now, ToF calculates the time of return, hence there is no need for a separate processor. It also consumes less power, responds more rapidly, and recognizes longer distances using a laser vs. the previous SL method.

As the use of ToF increases, ToF suppliers should continue to benefit in 2020. In particular, LG Innotek is slated to enjoy larger sales and profits as it supplies Apple's ToF cameras. In 2020, we believe even mid- and low-end models will start to adopt ToF cameras, as the prices are expected to decline vs. 2019 with more suppliers beginning to supply ToF cameras.

|

Fig 30: 3D Sensing Camera Market Size and Adaption Rate

Source: Trendforce, Hyundai Securities

Table 3: SL Camera and ToF Camera Comparison

Source: Trendforce, Hyundai Securities

Fig 33: New iPhone in 2020 ToF Adaption Forecasts

Source: Hyundai Motor Securities

|

Fig 31: ToF Camera Structure

Source: Press Data, Hyundai Securities

Fig 32: ToF Principle

Source: Press Data, Hyundai Securities

Fig 34: Changes in Number of Vendors

Source: Hyundai Motor Securities

|

Advancements in image sensors and actuators

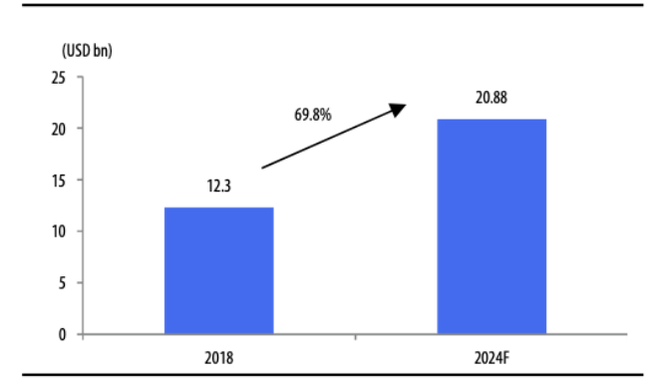

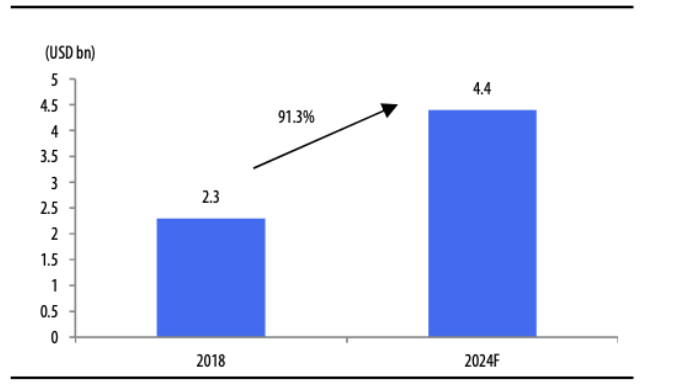

The multi-camera trend has not only increased the number of cameras used per device but also helped boost ASP. Multi cameras in smartphones are in general comprised of high pixel camera modules and low pixel camera modules. The pixel count is a decisive factor for camera module prices, and the increase in the number of pixels worked to raise ASP. Until recently, the maximum number of pixels used in smartphones is the 108mn pixels used in Xiaomi CC9, which uses the ISOCELL Bright HMX jointly developed by Samsung and Xiaomi. Samsung's Galaxy S20 series, set for a Feb 2020 release, is also expected to support 100mn pixels by adopting the same image sensor. Demand for image sensors is expected to increase as camera module and high-pixel camera demand increases. According to an industry source, the image sensor market is forecast to grow 69.8% by 2024 to form a USD20.9bn market. Along with the increase in pixel counts, advancements in actuator technology contributed to the rise in camera module prices. The autofocus (AF) function became the norm in smartphone cameras, and the advancement in actuators such as optical image stabilization (OIS) or folded zoom has also helped boost camera module ASP. AF and OIS technologies have been used before, but folded zoom lens which supports optical zooming of five to ten times have been applied to Huawei's P30 (5x) and will be applied to Samsung's Galaxy S20 and Huawei's P40 to be released in 2020. As actuators become more advanced and demand further increases, the actuator market should grow to KRW4.4bn by 2024.

The multi-camera trend has not only increased the number of cameras used per device but also helped boost ASP. Multi cameras in smartphones are in general comprised of high pixel camera modules and low pixel camera modules. The pixel count is a decisive factor for camera module prices, and the increase in the number of pixels worked to raise ASP. Until recently, the maximum number of pixels used in smartphones is the 108mn pixels used in Xiaomi CC9, which uses the ISOCELL Bright HMX jointly developed by Samsung and Xiaomi. Samsung's Galaxy S20 series, set for a Feb 2020 release, is also expected to support 100mn pixels by adopting the same image sensor. Demand for image sensors is expected to increase as camera module and high-pixel camera demand increases. According to an industry source, the image sensor market is forecast to grow 69.8% by 2024 to form a USD20.9bn market. Along with the increase in pixel counts, advancements in actuator technology contributed to the rise in camera module prices. The autofocus (AF) function became the norm in smartphone cameras, and the advancement in actuators such as optical image stabilization (OIS) or folded zoom has also helped boost camera module ASP. AF and OIS technologies have been used before, but folded zoom lens which supports optical zooming of five to ten times have been applied to Huawei's P30 (5x) and will be applied to Samsung's Galaxy S20 and Huawei's P40 to be released in 2020. As actuators become more advanced and demand further increases, the actuator market should grow to KRW4.4bn by 2024.

Fig 37: Camera Modules and Their Component Vendors

Source: Samsung Electro-Mechanics, Hyundai Motor Securities

PCBs provide space where electrical components including semiconductors are mounted; they also work as circuits through which electrical signals are transmitted. Smartphones are a culmination of many IT-based capabilities, so they require countless electronic components. In order to incorporate these electronic components into a device, there is a main board, and each component is connected to the main board through PCBs.

Among others, module RF-PCBs and display RF-PCBs should experience the sharpest growth. An RF-PCB is added to the bottom of a camera module for connection. With the increase in the number of camera modules in smartphones, the size of the camera module PCB has increased. Furthermore, multilayer PCBs are also in demand, to accommodate sensing cameras such as ToF cameras and high-pixel cameras. The resulting growth in prices means the market will continue to grow.

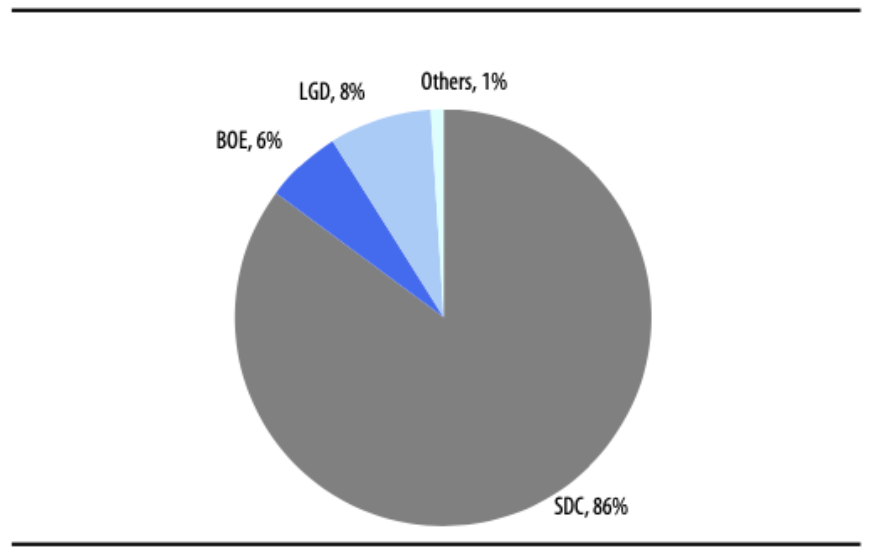

Display PCBs help transmit digitalized signals and information that was input through the touch screen. The reason that we project growth of the display PCB market is that the adoption of OLED displays in smartphones should expand. Korean PCB makers supply display PCBs to Samsung Display. Since Samsung Display's market share in small- and medium-sized OLEDs is more than 85%, Korean PCB names are slated to enjoy sales growth.

Y-Octa, a next-generation OLED technology, is also expected to increase the ASP of display PCBs. Existing OLED displays use touch screen panels (TSPs) to translate users' touch on the touch screen into electrical information, and TSPs are typically attached to displays as modules. Y-Octa technology evaporates the TSP patterning directly onto the metal mesh materials on thin film encapsulation. This way, it achieves: 1) thinner displays thanks to fewer layers than OLED; 2) cost reductions by not using ITO films, and; 3) ability to fold, via the use of metal mesh which is more durable. In the previous OLED technology, display and TSP were divided but with the Y-Octa technology, TSP is embedded in the display, which requires a circuit that can perform two functions. As the difficulty of the process increases, ASP will increase too.

Among others, module RF-PCBs and display RF-PCBs should experience the sharpest growth. An RF-PCB is added to the bottom of a camera module for connection. With the increase in the number of camera modules in smartphones, the size of the camera module PCB has increased. Furthermore, multilayer PCBs are also in demand, to accommodate sensing cameras such as ToF cameras and high-pixel cameras. The resulting growth in prices means the market will continue to grow.

Display PCBs help transmit digitalized signals and information that was input through the touch screen. The reason that we project growth of the display PCB market is that the adoption of OLED displays in smartphones should expand. Korean PCB makers supply display PCBs to Samsung Display. Since Samsung Display's market share in small- and medium-sized OLEDs is more than 85%, Korean PCB names are slated to enjoy sales growth.

Y-Octa, a next-generation OLED technology, is also expected to increase the ASP of display PCBs. Existing OLED displays use touch screen panels (TSPs) to translate users' touch on the touch screen into electrical information, and TSPs are typically attached to displays as modules. Y-Octa technology evaporates the TSP patterning directly onto the metal mesh materials on thin film encapsulation. This way, it achieves: 1) thinner displays thanks to fewer layers than OLED; 2) cost reductions by not using ITO films, and; 3) ability to fold, via the use of metal mesh which is more durable. In the previous OLED technology, display and TSP were divided but with the Y-Octa technology, TSP is embedded in the display, which requires a circuit that can perform two functions. As the difficulty of the process increases, ASP will increase too.

|

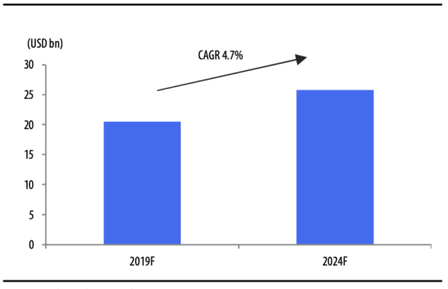

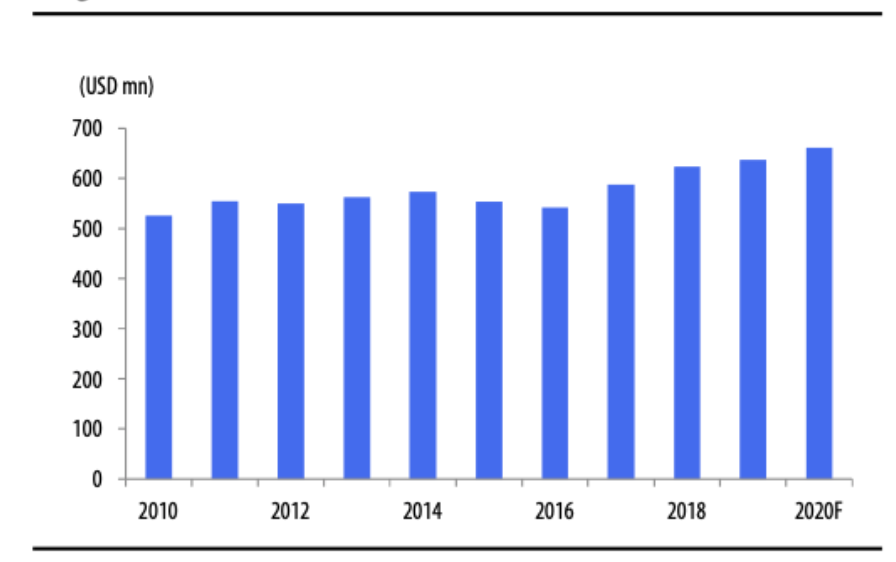

Fig 38: Global PCB Market Size Forecast

Source: Industry Data, Hyundai Motor Securities

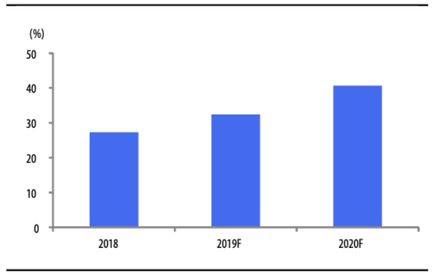

Fig 40: OLED Adoption Rate in Global Smartphones

Source: Stone Partners, Hyundai Motor Securities

|

Fig 39: PCB Market Sizes by Application

Source: AT&S, Hyundai Motor Securities

Fig 41: Mobile OLED Market Shares

Source: Stone Partners, Hyundai Motor Securities

|

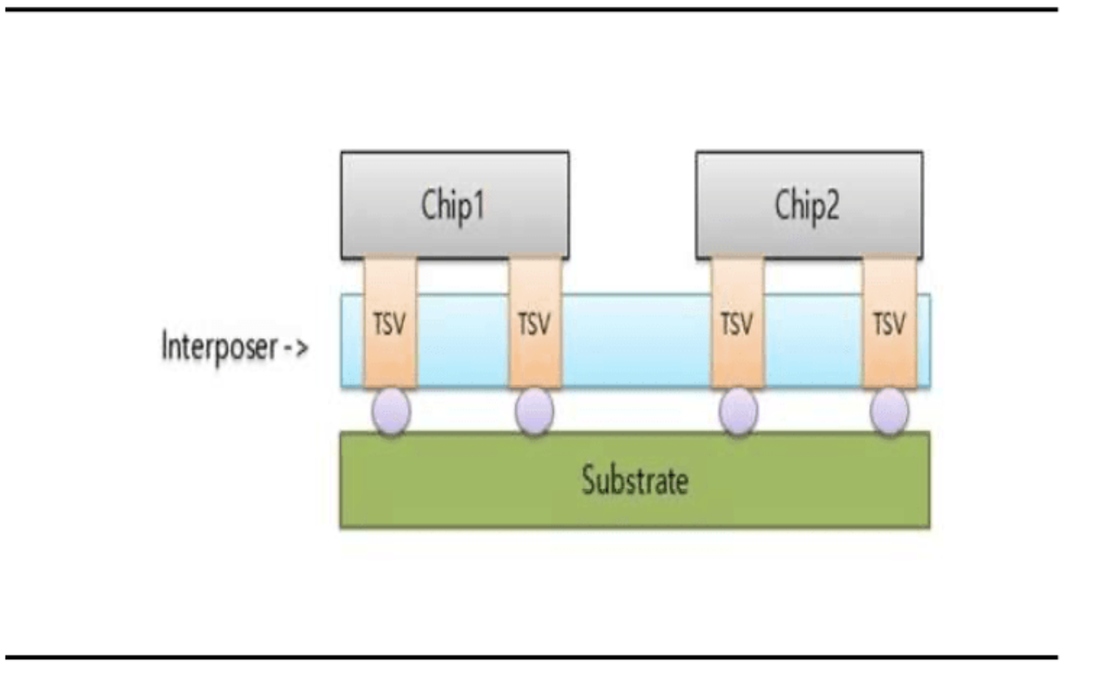

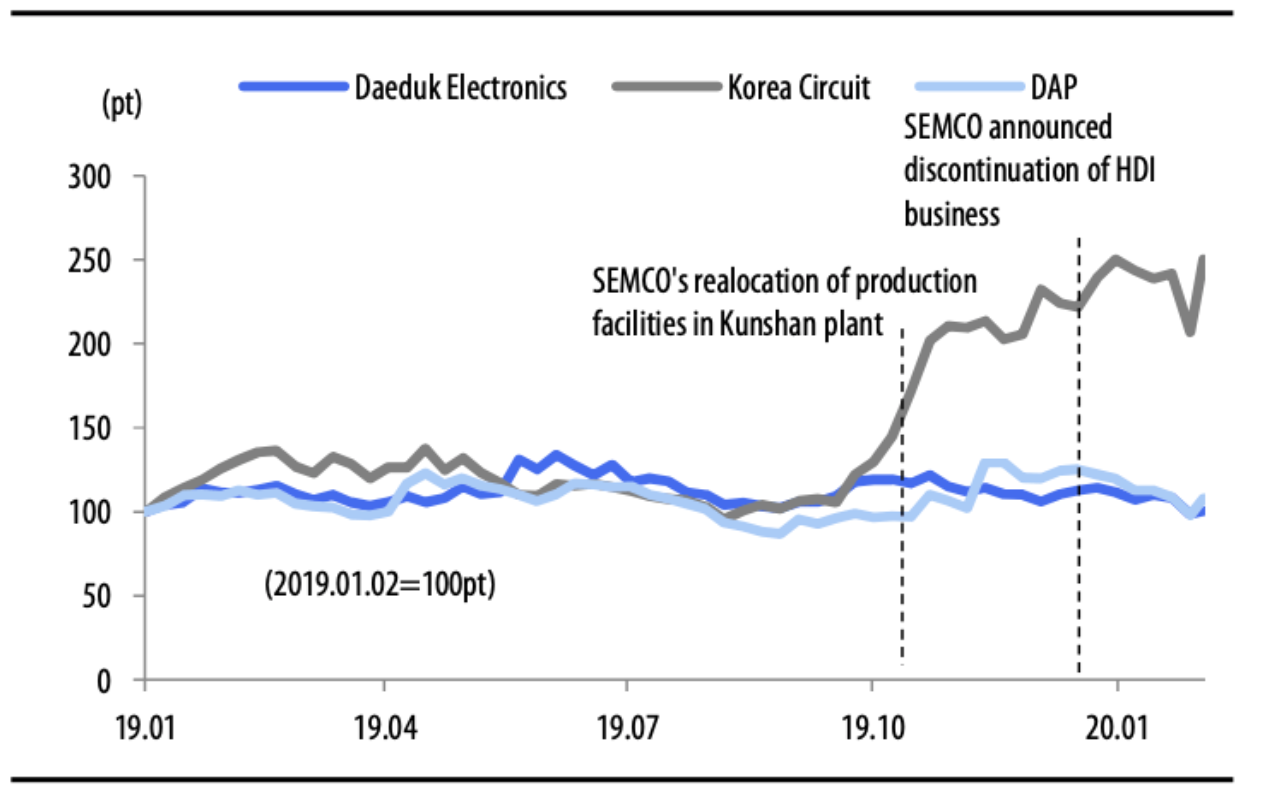

Substrate-Like-PCB (SLP) that was used as the main board in the Samsung Galaxy S9 was replaced by HDI in 2019's Galaxy Note 10. SLP is a substrate in which the line width is reduced by using mSAP, a semiconductor processing method for PCB. Since lines have become thinner, there is more room for advanced chipsets more I/O chips. Recently, however, HDI is used as the main board in smartphones. We believe the problems caused by the wide circuit width of HDI have been solved with the interposer method. The comeback of HDI can be explained by 1) BOM cost burden stemming from the rise of other component prices; and 2) HDI, which uses the interposer method, is a good value for the money vs. SLP. First, BOM cost is steadily rising. With the introduction of 5G, BOM cost has climbed due to the increased use of 5G parts; the multi-camera trend has also worked to boost camera module cost; there has been advancement in AP and memory chips; and more batteries are being used. Under such cost pressure, SLP has become a burden for smartphone manufacturers because of its higher ASP vs. HDI. Once it was thought that SLP with its thinner line width would help make more efficient use of space for batteries and other parts, but it is now also possible with HDI through the use of interposer method. In contrast, the HDI market has seen some changes. Competition has intensified as Chinese PCB makers entered the HDI market, and SEMCO and LG Innotek withdrew from the HDI substrate business in 2H19 as it was unprofitable. Thus, we expect other Korean PCB makers to replace them to supply PCBs for Samsung's flagship models. Daeduck Electronics, Korea Circuit and DAP are slated to benefit as they have the capacity to fill the gap.

|

Contact Us

|

Barry Young

|