Vertical Divider

|

Apple and the Indian Smartphone Market – Too Little Too Late

February 04, 2019 According to The Economist, the number of Internet users in India has grown from 125 million in 2015 to 512 million connections at the end of 2018. India adds approximately 16 million new Internet connection per month, almost all of them on mobile phones. Indians are also prolific users of mobile data. In 2017, the average Indian mobile phone user consumed 4.13 GB/month, compared to the Organization of Economic Development (OECD) average of 2.8 GB/month. Counterpoint Researchreported that the smartphone segment contributed to half of the total handset market in Q3 2018. In the same quarter, India’s smartphone shipments reached a new record of 42.6 million units - an increase of 9.1% over the same period in 2017. By way of contrast, Chinese in a down quarter bought 111.7m smart phones and U.S consumers bought 37.5m smartphones. Current estimates suggest that only 24% of India's 1.3 billion citizens own a smartphone, suggesting that the country's market has a current potential for an additional 1.04 billion smartphones to reach the OECDsmartphone penetration average of 102%. India's also has a population that is still growing. In 2017, India's population growth rate was 1.1%, well ahead of China's 0.6% or the United States' 0.7% growth rates. |

|

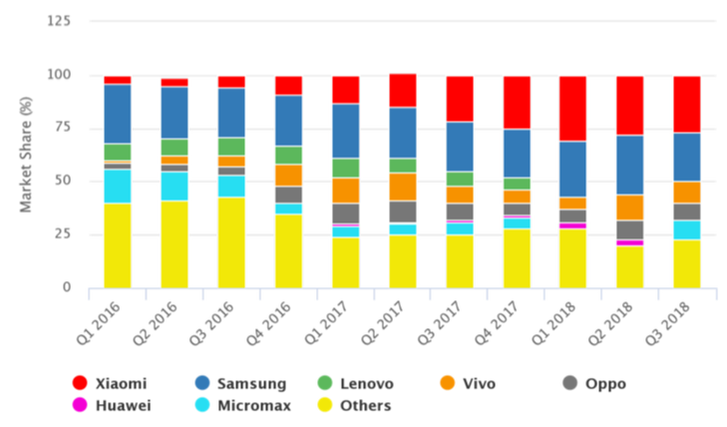

Five brands in India account for a 77% share of the total smartphone market. The market has been steadily consolidating as the largest five producers led by Xiaomi (XI) and Samsung capture more market share. Notably missing in the top 5 was Apple, which shipped fewer than 1 million iPhones in India in the first half of 2018 and the iPhone represented less than 2% of the 60 million smartphones shipped in 1H18. During the same period, Samsung and Xiaomi shipped 17.4 million and 19 million smartphones respectively.

Figure 1: India Smartphone Market Share

Figure 1: India Smartphone Market Share

Source: Counterpoint Research, Dazeinfo

Apple's new head of country, Michel Coulomb, is reversing the previous sales strategyby moving to a system of controlled distribution. Apple's previous strategy of open distribution gave significant control to re-sellers who offered iPhone products at discounted rates and offered non-standard pricing across the county. Due to the lack of control Apple has had in the Indian retail environment and the roadblocks it has encountered in the opening of its own stores, the firm has become over-reliant on online sales in India. In May 2017, the Economic Timesreportedthat 50-55% of iPhone sales in India were online, compared to the industry average of 30%. Apple is pursuingplansto open flagship retail outlets in New Delhi, Bengaluru and Mumbai. The company has long attempted to open retail stores in India but has not been able to meet the government regulations to do so. One of these barriers is a requirement to manufacture a minimum of 30% of its products in the country. With plans to start making the iPhone 6s in country, along with using more local suppliers, it is finally on track to opening these retail locations. However, this strategy does not address Apple’s fundamental problem that there phones are too expensive and that the Indian people are not interested in an older model, when the Android models are less expensive and offer comparable or better features.

As we previously reported, Apple will begin assembling its top-end iPhones in India through Foxconn in early 2019. Foxconn will begin assembly of these higher-end iPhones at a plant in Tamil Nadu in southern India. This announcement made in late December 2018 is a sign that Apple is paying attention to the Indian market. Apple’s production contractor Wistron (announced in January 2019 that it will invest $340 million in its Indian production facilities where it currently assembles iPhone SE and iPhone 6. are developments that the Indian government has long awaited.

As we previously reported, Apple will begin assembling its top-end iPhones in India through Foxconn in early 2019. Foxconn will begin assembly of these higher-end iPhones at a plant in Tamil Nadu in southern India. This announcement made in late December 2018 is a sign that Apple is paying attention to the Indian market. Apple’s production contractor Wistron (announced in January 2019 that it will invest $340 million in its Indian production facilities where it currently assembles iPhone SE and iPhone 6. are developments that the Indian government has long awaited.

|

Contact Us

|

Barry Young

|