Vertical Divider

|

Aggregate November TV LCD Panel Prices Expected to be Down 1.5% to 2.5%

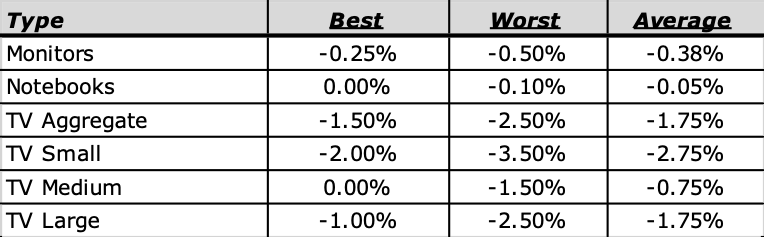

November 11, 2019 There has only been one year in the past five when panel prices increased in November (2016 after 15-month stretch of declining prices), and the overall expectation for a 1.8% decline in TV panel pricing in aggregate, is better than in the previous last two years, but that does little for panel producers who must continually push down costs to stay even. Expected November panel pricing are shown below: Table 1: November LCD Panel Prices Source: SCMR, LLC

|

|

DigiTimes published an opposing view saying, TV panel prices are set to stop falling and level off in November as panel makers reduce their output aggressively, while demand has started picking up as brand TV vendors have resumed pulling in orders in preparation for the Double-11 shopping festival in China as well as for the forthcoming Lunar New Year holiday season. TV brands in China, slashed their panel orders significantly in the third quarter as they were working to clear out inventories left over from the lukewarm sales of the 618 shopping festival. As a result, the stocks have returned to healthy levels recently, said the sources. China's TV vendors have resumed their panel purchases since the start of the fourth quarter, with their inventory returning to normal levels, the sources said, noting their panel orders are registering on-year increases in the quarter, compared to a stream of on-year declines seen in the previous three quarters. Capacity reductions were led by Samsung Display, which shut down one of its 125,000/month capacity 8.5G LCD lines in September, and it also slashed the total 7G output to 100,000 substrates/month in November from 160,000. Previously. LG Display has been adjusting downward the capacity utilization rates of its 8G lines to as low as 70% recently, said the sources. In Taiwan, Innolux lowered its capacity utilization mildly by realigning its production lines, while AU Optronics (AUO) cut its utilization rate to 80%, focusing on reducing output from its 6G and 8.5G lines. BOE is expected to maintain its utilization rate at 75-80% in the fourth quarter, the same as a quarter earlier. CSoT will lower the utilization rate of its 8.5G line to 85% in the fourth quarter from 90%. As a result, prices of most TV panel sizes will remain stable in October-November, with 32-inch models to stay at US$33, 39.5-inch panels to be flat at US$61, and 43-inch ones to hover at US$66, according to Sigmaintell Consulting. Prices of 55-inch models, which dropped US$1 to US$100 in October, are expected to remain unchanged in November, and 65-inch panels will stay flat at US$168 said Sigmaintell.

|

Contact Us

|

Barry Young

|