Vertical Divider

|

Abramson Sees 2019 as Pivotal Year for OLEDs

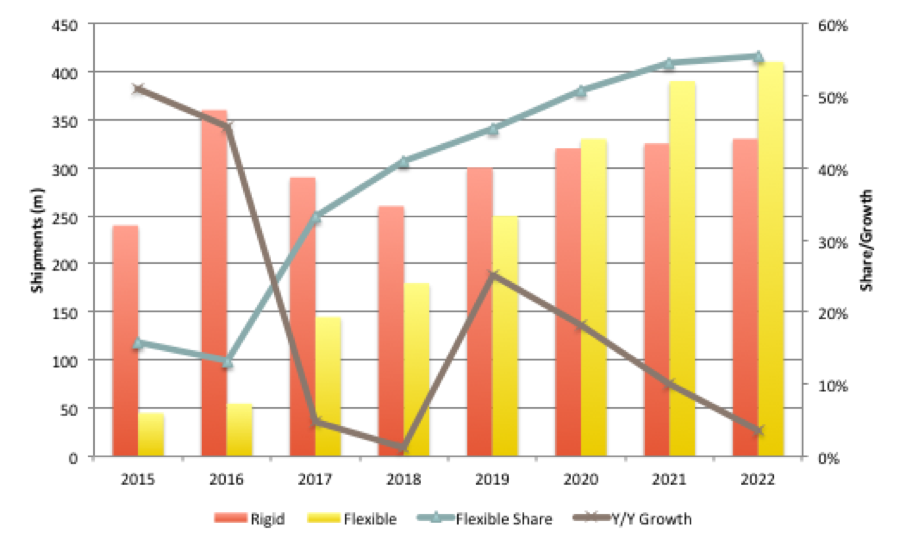

August 20, 2018 UDC CEO Steve Abramson said “2019 is poised to be a pivotal year for the OLED industry,” Abramson told an investor conference call. “As Samsung continues to lead the OLED mobile market, a number of other panel makers, including LG Display, BOE [Technology], Tianma, Visionox, and EDO [Everdisplay Optronics] are slated to commence production in their new OLED lines.” It should be noted that all of these OLED panel makers plus Truly produced displays in 2017 in the first half of 2018, but the volume in total was only 11.4m. Abramson also said that new OLED-incorporating devices from the likes of Google, Huawei, Oppo, and Vivo are all set to appear in the coming months, thanks to the much wider availability of the technology.“This new wave of capacity build is expected to drive significant growth in the OLED industry,” the CEO told investors. adding that next year's introduction of foldable OLED products by Samsung will pave the way to entirely new form factors and applications that "the imagination has yet to devise". Abramson recited LG’s expectations for the TV market growing from around 2.8 million units this year, to 4 million in 2019, 7 million in 2020, and 10 million in 2021. Although the number of TVs is miniscule compared to smartphones, they aremuch larger such that 4m TVs is equivalent in area to the 400m smartphone displays shipped in 2017. Figure 1: Rigid vs. Flexible OLED Market Share Source: IHS/OLED-A

He also added that:

All of this new construction for flexible displays has caused market research firms to reevaluate the production split between the technologies and it now appears, according to IHS that in 2020, flexible OLEDs will outsell rigid OLEDs, and by 2022, will have a 55% share of the 740m forecasted OLED panels. Given the increase in capacity form the Chinese, virtually all in flexible displays, it appears as if IHS is expecting a continuation of low yields thru 2022. In another sign that OLED panel demand is increasing, Samsung Display said it will resume production at its A4 OLED plant as early as in October as it has recently secured a new Chinese client for its flexile OLED panels, according to industry sources on Aug. 13. The plant, formerly L7-1 LCD production line, was supposed to start production early this year but the plans have been delayed for months due to shrinking demand. Sources said Samsung has recently inked a supply deal with a new Chinese client for its on-screen touch display, called Y-OCTA that has thus far been supplied to Samsung Electronics only. The monthly production capacity of the A4 is 30,000 units of the sixth-generation OLED panels. The utilization rates at A1, A2, and A3 are increasing and Samsung diversifying its customer base, particularly among Chinese smartphone brands. They are expected to supply flexible OLED displays to a Xiaomi, Huawei, Oppo and Vivo brands for the Chinese New Year, which takes place February 5, 2019. While the holiday build for non-Chinese products ends in mid-November, the Chinese market has extended that build period by an additional month, making a restart for A4 viable for this season. SDC will likely move flexible OLED capacity for such new customers, and potentially some of its production for parent Samsung Electronicsto A4, allowing much of A3’s production to be devoted to Apple, which is expected to release a 5.8” and 6.5” OLED smartphones in the fall. |

|

|

Contact Us

|

Barry Young

|