Vertical Divider

|

Samsung/LGE Expect Strong First Quarter

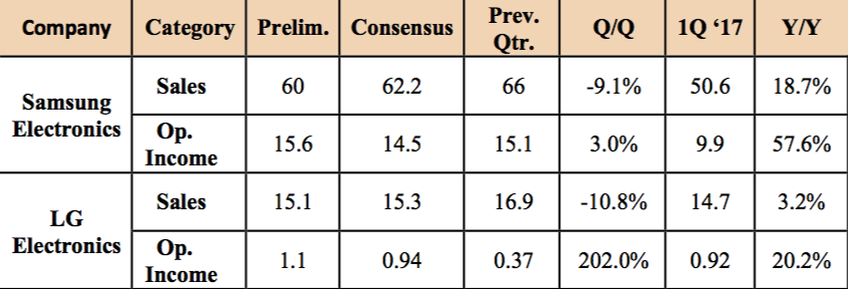

April 09, 2018 Despite a likely shortfall in OLED and LCD revenue, Samsung Electronics Co. is expected to post operating profits of 14.6 trillion won (US$13.73 billion) in the first quarter of this year. The figure is slightly lower than 15.15 trillion won (US$14.25 billion) in the fourth quarter of last year but nearly 50 percent higher than 9.9 trillion won (US$9.31 billion) Y/Y. According to market tracker WISEfn on April 1, Samsung Electronics will record revenues of 61.44 trillion won (US$57.8 billion) in the first quarter. Just a month ago, many analysts had a negative outlook for Samsung Electronics’ earnings, because the first quarter is usually a slow season for the home appliance and information technology (IT) sectors, and the Korean won is getting stronger against the dollar. In particular, there were concerns over the display sector with Apple’s cutback of OLED panel orders. Song Myung Sup, an analyst at HI Investment & Securities Co., said, “Samsung Electronics will see its operating profits for the active matrix organic light emitting diodes (AMOLED) display unit dramatically shrink due to stock-outs from sluggish sales of the iPhone X and a slowdown in the smartphone market. There is also a possibility that the company’s medium and large-sized liquid crystal display (LCD) unit will post a slight operating loss as the price of LCDs continues to fall.” Samsung Electronics’ average earnings outlook a month ago were 61.07 trillion won (US$57.45 billion) of sales and 14.6 trillion won (US$13.73 billion) of operating profits, lower than the figures now. As the day of earnings announcement approached, an increasing number of securities firms are raising their earnings estimates for Samsung Electronics. Kim Rok-ho, an analyst at Hana Financial Investment Co., said, “Samsung Electronics’ operating rate in the display sector will decrease because the sales of new models of North American customer firms will be lower than expected. Accordingly, the company’s operating profits will plunge 0.2 trillion won (US$188.15 million) from 1.4 trillion won (US$1.32 billion) of the previous quarter. For DRAM, shipments will drop compared to the previous quarter as the company has been working on a project to switch the Line 11 DRAM plant in the complex into an image sensor line. However, profitability will improve with a higher price of DRAMs. The IT and Mobile (IM) divisions expect both shipments and prices to rise from the previous quarter owing to the release of the Galaxy S9, boosting operating profits of Samsung Electronics as a whole.” Samsung Display will likely show weak results as a result of the iPhone X, but they also produce the Galaxy S9 and almost all of the rest of the Samsung Electronics smartphone lines, and thus since the Galaxy S9 seems to be selling reasonably well, it should result in a boost in average ASP, and while DRAM production has been hindered in units by the conversion of a line to image sensor production, the price of DRAM has risen, which seems to be responsible for a turn toward positive sentiment in the past few weeks. Table 1: Preliminary 1Q 2018 Results for Samsung Electronics & LG Electronics Source: Company Data, Yahoo Finance

|

|

|

Contact Us

|

Barry Young

|