Vertical Divider

BOE to Up OLED Panel Production, But Doesn’t Make a Dent in Samsung Dominance

May 04, 2020

BOE shipped seven times as many OLED panels in 2019 compared to the year earlier in an indication of the company’s commitment to the market, according Omdia on April 17. Last year, BOE shipped 39.1 million OLED panels. Among them, 22.1m were rigid types, while 17m were flexible displays. For flexible displays in China, BOE leads followed by Visionox, which shipped 2.6 million panels. Others such as Tianma and Royole also entered the flexible OLED panel market in 2019, each shipping around 10,000 panels.

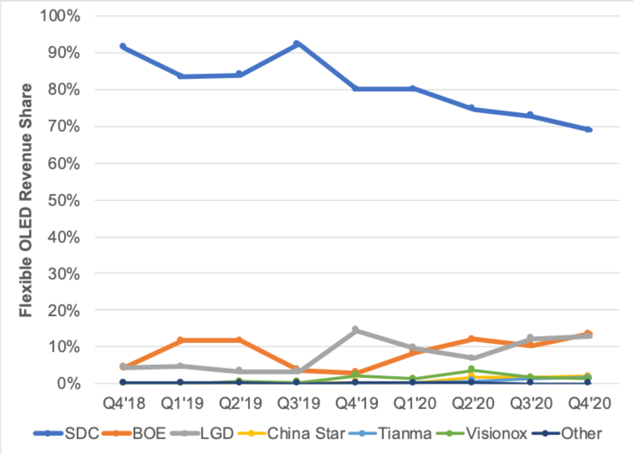

Figure 1: OLED Share by Panel Maker

May 04, 2020

BOE shipped seven times as many OLED panels in 2019 compared to the year earlier in an indication of the company’s commitment to the market, according Omdia on April 17. Last year, BOE shipped 39.1 million OLED panels. Among them, 22.1m were rigid types, while 17m were flexible displays. For flexible displays in China, BOE leads followed by Visionox, which shipped 2.6 million panels. Others such as Tianma and Royole also entered the flexible OLED panel market in 2019, each shipping around 10,000 panels.

Figure 1: OLED Share by Panel Maker

Source: DSCC

For rigid OLED panels, BOE trails EverDisplay which shipped 26.7 million, mainly for smartphones and smart watches. Truly also supplied rigid OLED panels for smart watches in 2019, with a volume of 16.7 million. In total, China’s OLED panel makers shipped 105 million panels in 2019, up from the 32 million in 2018, 53.8m for smart and 52m for smart phones. For smartphones, BOE led with 17 million OLED panels EverDisplay shipped 15.5m Visionox 14.4m and Tianma shipped 5.1m. For smart watches, BOE shipped 22.1 million, followed by Truly with 16.7 million, EverDisplay with 11.2 million, Visionox with 3.5 million and Tianma with 300,000.

In 2020, Chinese OLED panel makers are expecting to ship a total of 128m smartphone panels up 146% Y/Y. BOE, hopes to supply the 6.06-inch iPhone scheduled in the latter half of this year. Samsung and LG are both to supply this product. BOE currently services Huawei, Xiaomi, OPPO and Lenovo. Other than Visionox, BOE is the only Chinese display manufacturer supplying Huawei.

From: The Elec

For rigid OLED panels, BOE trails EverDisplay which shipped 26.7 million, mainly for smartphones and smart watches. Truly also supplied rigid OLED panels for smart watches in 2019, with a volume of 16.7 million. In total, China’s OLED panel makers shipped 105 million panels in 2019, up from the 32 million in 2018, 53.8m for smart and 52m for smart phones. For smartphones, BOE led with 17 million OLED panels EverDisplay shipped 15.5m Visionox 14.4m and Tianma shipped 5.1m. For smart watches, BOE shipped 22.1 million, followed by Truly with 16.7 million, EverDisplay with 11.2 million, Visionox with 3.5 million and Tianma with 300,000.

In 2020, Chinese OLED panel makers are expecting to ship a total of 128m smartphone panels up 146% Y/Y. BOE, hopes to supply the 6.06-inch iPhone scheduled in the latter half of this year. Samsung and LG are both to supply this product. BOE currently services Huawei, Xiaomi, OPPO and Lenovo. Other than Visionox, BOE is the only Chinese display manufacturer supplying Huawei.

From: The Elec

|

Contact Us

|

Barry Young

|