Vertical Divider

Apple Apparently Content with $200m Purchase of JDI Plant Assets

April 12, 2020

During the week of 31 March, we reported that Japan Display (JDI) announced a major customer (assume Apple) for ¥21.5b (around $200m). JDI had been engaged in discussions with this major customer about securing financing and the support will be extended via a purchase of the production assets, the book value of which was set to 0. The company plans to offset the purchase price and part of the upfront payments received from this major customer (¥87.9b as of end-February). As for plant assets that are not included within the scope of the purchase agreement (manufacturing equipment and buildings), JDI said it will consider selling these assets to a domestic operating company (assume Sharp). JDI plans to disclose the earnings impact of the transaction once the deal is finalized. From Apple’s perspective, the main objectives appear to be the following: 1) ensuring that it recovers the advance payments already made to JDI; 2) preventing the failure of JDI, which has strong technical capabilities and is an important supplier of LCD (iPhone) and OLED (Apple Watch) panels; and 3) supporting JDI’s transition to a system that facilitates stable ongoing business operations without severely hindering its cash flow, even if it includes support measures that reduce the timeframe for JDI’s collection of accounts receivable from Apple. The purchase of JDI production assets is one element of this. D3 has been idle for a long time, and considering that the Mobara J1 (G6) line can comfortably supply the roughly 50m iPhone panels per year that Apple procures from JDI, and also that it is questionable whether JDI even has sufficient engineers or the financial capacity to resume mass production at D3.

It is unlikely that Apple will recover its remaining prepayments since it would require the sale of D3 and the resumption of operations. Sharp supplies panels to Apple for the iPhone (Kameyama No.1 (K1) plant: G6) and the iPad and MacBook (Kameyama No.2 (K2) plant: G8). We understand it supplies 4.7” and 6.06” panels for the iPhone (8/SE2 and 11, respectively), and estimate that in 2020 it will supply roughly 55m units. Sharp has G4 (A-Si) and G4.5 (LTPS) lines that have been operating for 20 years, and products it is manufacturing in these old plants, such as automotive-use panels, need to be transferred to K1 and/or K2. Moreover, as automotive panels get larger and resolutions increase, they require G6-size substrates, so a possible strategy for Sharp is to gradually fill in K1 capacity with non-iPhone products. Although the details are unclear, even if Sharp were to invest in converting its K1 plant to LTPS, there would apparently still be some restrictions on the products it could supply to customers other than Apple, so these restrictions would have to be lifted. Additionally, because K1 would not have sufficient production capacity on its own, there would be some rationality to purchasing D3. It is a state-of-the-art LTPS plant in which JDI invested ¥170b, and it is chock-full of JDI’s expertise in both arrays and cells (e.g., optical alignment). While its current production capacity is only 25,000 substrates/month, there is sufficient space to increase capacity by an additional 25,000/month with some additional investment. Expansion of the LTPS production line is also possible, so utilizing the existing 25,000/month of LTPS substrate, it should be possible, for instance, to separately set up OLED (vapor deposition) and μLED (mass transfer) processes as well. In short, D3 is a highly expandable plant. Although it would depend on the terms, we believe it is entirely conceivable that Sharp might purchase this plant.

With regard to the possibility of Sharp buying D3, we believe the key lies with Apple rather than JDI. The first factor is demand. We expect some changes in Apple’s strategy regarding iPhone displays. For instance, up until mid-2019 we thought this year’s SE2 (upgraded iPhone 8) would be the last new LCD model, with only legacy LCD models continuing to be sold from 2021 onward. However, we now expect that Apple will introduce a new LCD model (6.06” or 5.5”) in spring 2022, as Apple strives to sustain demand across a broader customer base by offering LCD models at relatively low retail price points and high-performance OLED models at higher price points. And we expect Apple to adopt a similar strategy with the iPad as well. Although it will likely offer fewer LCD models than OLED models, the sales ratio in terms of display type will likely be 50:50 in the near term because the LCD models will have lower prices. Although it will depend on overall sales volume, we would expect LCD demand to remain in the 110m–130m range in the near term. However,

We therefore think it is unlikely that

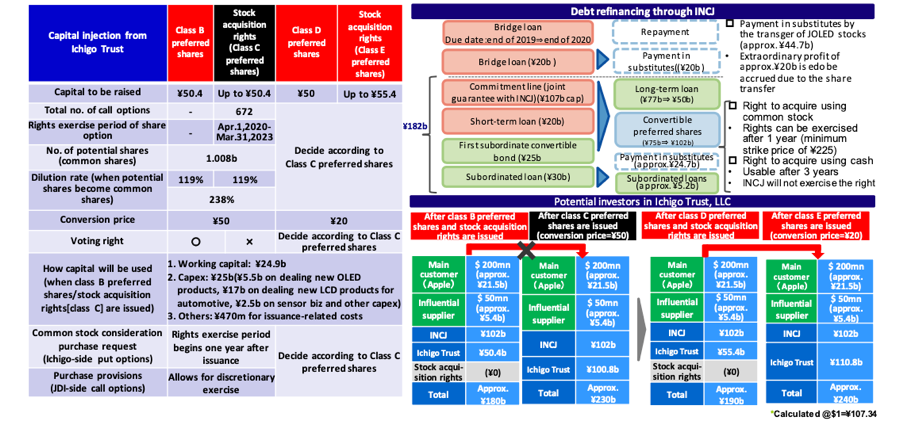

Figure 1: A Pictorial History of JDI’s Recent Financing Source

April 12, 2020

During the week of 31 March, we reported that Japan Display (JDI) announced a major customer (assume Apple) for ¥21.5b (around $200m). JDI had been engaged in discussions with this major customer about securing financing and the support will be extended via a purchase of the production assets, the book value of which was set to 0. The company plans to offset the purchase price and part of the upfront payments received from this major customer (¥87.9b as of end-February). As for plant assets that are not included within the scope of the purchase agreement (manufacturing equipment and buildings), JDI said it will consider selling these assets to a domestic operating company (assume Sharp). JDI plans to disclose the earnings impact of the transaction once the deal is finalized. From Apple’s perspective, the main objectives appear to be the following: 1) ensuring that it recovers the advance payments already made to JDI; 2) preventing the failure of JDI, which has strong technical capabilities and is an important supplier of LCD (iPhone) and OLED (Apple Watch) panels; and 3) supporting JDI’s transition to a system that facilitates stable ongoing business operations without severely hindering its cash flow, even if it includes support measures that reduce the timeframe for JDI’s collection of accounts receivable from Apple. The purchase of JDI production assets is one element of this. D3 has been idle for a long time, and considering that the Mobara J1 (G6) line can comfortably supply the roughly 50m iPhone panels per year that Apple procures from JDI, and also that it is questionable whether JDI even has sufficient engineers or the financial capacity to resume mass production at D3.

It is unlikely that Apple will recover its remaining prepayments since it would require the sale of D3 and the resumption of operations. Sharp supplies panels to Apple for the iPhone (Kameyama No.1 (K1) plant: G6) and the iPad and MacBook (Kameyama No.2 (K2) plant: G8). We understand it supplies 4.7” and 6.06” panels for the iPhone (8/SE2 and 11, respectively), and estimate that in 2020 it will supply roughly 55m units. Sharp has G4 (A-Si) and G4.5 (LTPS) lines that have been operating for 20 years, and products it is manufacturing in these old plants, such as automotive-use panels, need to be transferred to K1 and/or K2. Moreover, as automotive panels get larger and resolutions increase, they require G6-size substrates, so a possible strategy for Sharp is to gradually fill in K1 capacity with non-iPhone products. Although the details are unclear, even if Sharp were to invest in converting its K1 plant to LTPS, there would apparently still be some restrictions on the products it could supply to customers other than Apple, so these restrictions would have to be lifted. Additionally, because K1 would not have sufficient production capacity on its own, there would be some rationality to purchasing D3. It is a state-of-the-art LTPS plant in which JDI invested ¥170b, and it is chock-full of JDI’s expertise in both arrays and cells (e.g., optical alignment). While its current production capacity is only 25,000 substrates/month, there is sufficient space to increase capacity by an additional 25,000/month with some additional investment. Expansion of the LTPS production line is also possible, so utilizing the existing 25,000/month of LTPS substrate, it should be possible, for instance, to separately set up OLED (vapor deposition) and μLED (mass transfer) processes as well. In short, D3 is a highly expandable plant. Although it would depend on the terms, we believe it is entirely conceivable that Sharp might purchase this plant.

With regard to the possibility of Sharp buying D3, we believe the key lies with Apple rather than JDI. The first factor is demand. We expect some changes in Apple’s strategy regarding iPhone displays. For instance, up until mid-2019 we thought this year’s SE2 (upgraded iPhone 8) would be the last new LCD model, with only legacy LCD models continuing to be sold from 2021 onward. However, we now expect that Apple will introduce a new LCD model (6.06” or 5.5”) in spring 2022, as Apple strives to sustain demand across a broader customer base by offering LCD models at relatively low retail price points and high-performance OLED models at higher price points. And we expect Apple to adopt a similar strategy with the iPad as well. Although it will likely offer fewer LCD models than OLED models, the sales ratio in terms of display type will likely be 50:50 in the near term because the LCD models will have lower prices. Although it will depend on overall sales volume, we would expect LCD demand to remain in the 110m–130m range in the near term. However,

We therefore think it is unlikely that

Figure 1: A Pictorial History of JDI’s Recent Financing Source

Source: Mizuho Securities

|

Contact Us

|

Barry Young

|