Vertical Divider

|

5G Phones: 5 Released & 5 Coming; Very Expensive

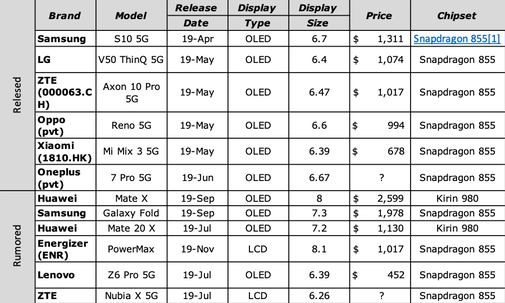

July 22, 2019 Samsung Electronics and LG Electronics recently stated that they will be releasing what they call entry-level 5G smartphones in the near future, which is a misnomer as their entry-level 5G smartphone is priced under 1millon won, which translates to ~$851 US. Samsung is expected to release a 5G version of the Galaxy A90 for between $680 and $770, sometime after the release of the Galaxy Note 10 (August), which is also anticipated to have a 5G version that is projected to cost ~$1280. LG, while a bit less specific, is expected to release lower-priced 5G models of the V50 series that will be tentatively given the “G” series brand. Of the 5G sets that are available and have an unlocked price, the least expensive is ~$680, with an average of $1,015 for the group, so currently none of the current 5G smartphones would fit into the classification of entry-level pricing, considered to be under $600. |

|

However, of all the rumored’ 5G phones, some with expected release dates and prices, the least expensive would be the $450 Lenovo Z6 Pro 5G at ~$450. All current 5G smartphones have OLED displays, which not essential to 5G, and of the rumored category, two are expected to be LCD based. All current 5G smartphones are based on the Qualcomm Snapdragon 855 chipset, however the two expected 5G phones from Huawei are expected to be based on their internally developed Kirin 980 chipset that is produced by their HiSilicon affiliate.

Table 1: Released and Rumored 5G Phones

Table 1: Released and Rumored 5G Phones

Source: SCMR, LLC

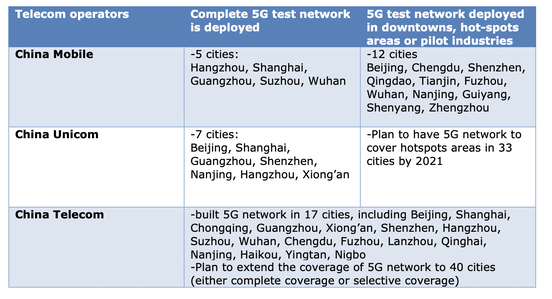

For China, 5G is an essential element for national development. China has recognized the importance of 5G to drive scientific and technological innovation, to upgrade industries, to stimulate investments, and to transform society and economy for the better. Below are the key takeaways from MWC Asia 2019:

Table 2: 2019 5G Network Deployment in China

- 5G Network Deployment Status

- Unlike the US, where operators focused on building a 5G Non-Standalone (NSA) network in the early deployment stage, Chinese operators have pursued a hybrid network strategy with NSA and Standalone (SA) coexisting. It will likely take at least five years for Chinese operators to have a nationwide coverage of 5G core (5GC), and new radio (5GC+NR) based network.

Table 2: 2019 5G Network Deployment in China

Source: Public Information

- Operators will accelerate the construction of 5G NR and gradually migrate to separate solutions using a central unit (CU), distribution unit (DU) or active antenna unit (AAU) architecture to optimize video and gaming services further. Operators will also deploy multi-access edge computing (MEC) platforms to provide local computing, storage, and other services, to help to save the backhaul bandwidth.

- Huawei and ZTE have won the largest share of network equipment contracts from China Mobile and China Telecom. Besides Huawei and ZTE, Ericsson has won 12% of China Mobile’s network equipment contracts, while Nokia has won around 6%. Ericsson has also won a big contract from China Unicom valued RMB 20 billion (roughly US$2.9 billion).

- Qualcomm has won contracts for 5G baseband and solutions from over 75 5G devices and modules OEMs/ODMs globally.

- 5G Devices Development Update

- For consumers, 5G smartphones, customer-premises equipment (CPEs), and AR/VR glasses were the major devices showcased at MWC. China Mobile announced support for multi-modes, multi-devices, multi-choices for users, and to develop a “New Industrial Ecosystem”, will be the guideline for the company to develop its 5G device business. Key points of the operator’s 5G device strategy are as follows:

- Multi-modes: China Mobile requires smartphone models, that apply to access to its 5G network, tosupport both SA and NSA network standards from January 1, 2020. In 2019, prioritized access to its 5G network will also be offered to models supporting both SA and NSA.

- Multi-devices: Apart from smartphones, China Mobile is betting on the growth potential of 5G CPE and Always-Connected-PC (ACPC) from 2019-2020. Further, from 2020-2022, China Mobile will extend its 5G product portfolio to cover a wider range of accessories such as AR glasses, VR helmet, digital media streamers, and more.

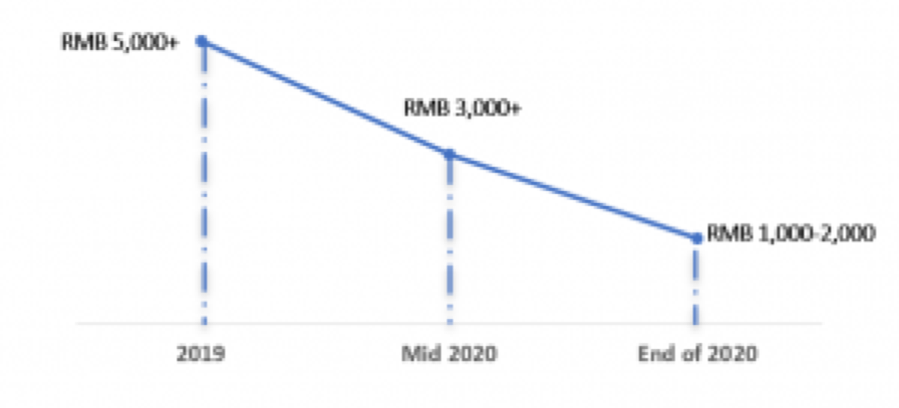

- Multi-choices for users: China Mobile will work with industrial partners to bring down prices of 5G smartphones to satisfy the budgets of users in different tiers of the market. We expect the prices of 5G smartphones in 2019 to be above RMB 5,000 (roughly US$720) in China. From mid-2020, China Mobile targets to bring down prices to RMB 3,000 (roughly US$430), and further to RMB 1,000 – 2,000 (roughly US$145-US$290) by the end of 2020.

Figure 1: 5G Smartphone Prices in China

Source: China Mobile Device Strategy 2019

With 5G smartphones launching in Q3 2019, China Mobile’s new policy, which requires smartphone models to support both 5G SA and NSA standards since 2020, could hurt sales of smartphones powered by platforms supporting 5G NSA only. Huawei and its dual-brand HONOR could be the beneficiary of this policy. Huawei is trying to convince the public on the benefits of smartphones supporting 5G SA network, with slogans such as “SA network is the only real 5G network”. OPPO and vivo emphasize on cloud gaming experiences of 5G phones. They promoted technologies that can optimize users’ gaming and video streaming experiences during MWC. Such features include a 120W fast charging technology from Vivo and under-screen camera solution from OPPO. From: Counterpoint

- New Industrial Ecosystem: In the B2B market, China Mobile is positive on the growth potential of 5G applications in four core industries namely IoV (Internet of Vehicle), Electricity and Energy, Industrial IoT, and New Media Streaming. Key hardware that will empower the digital transformation of these industries, according to China Mobile, will be 5G connectivity hardware (for example CPEs, 5G modules), platform hardware (for example system integration, software development, 5G AI boxes), and industry-customized hardware (for example industrial robots). To accelerate industrial applications in China, the company will build an industrial products library, and try to develop generic solutions for different industries.

With 5G smartphones launching in Q3 2019, China Mobile’s new policy, which requires smartphone models to support both 5G SA and NSA standards since 2020, could hurt sales of smartphones powered by platforms supporting 5G NSA only. Huawei and its dual-brand HONOR could be the beneficiary of this policy. Huawei is trying to convince the public on the benefits of smartphones supporting 5G SA network, with slogans such as “SA network is the only real 5G network”. OPPO and vivo emphasize on cloud gaming experiences of 5G phones. They promoted technologies that can optimize users’ gaming and video streaming experiences during MWC. Such features include a 120W fast charging technology from Vivo and under-screen camera solution from OPPO. From: Counterpoint

|

Contact Us

|

Barry Young

|