|

5 billion People Have Mobile Phone Connections

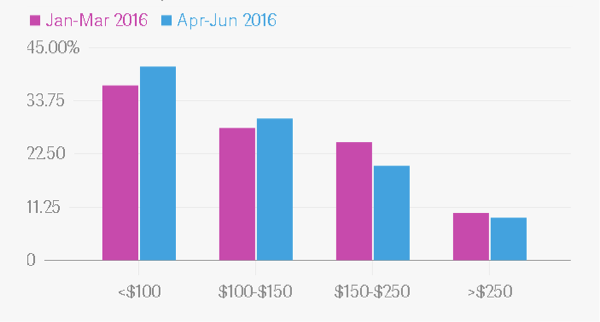

June 26, 2017 According to the latest report from GSMA Intelligence, the research division of the trade organization representing mobile networks worldwide, 5 billion people around the globe now have a mobile phone connection. That represents about two-thirds of the world’s population. Thanks to a real-time tracker for total connections and unique subscribers the world over, GSMA is capable of keeping careful tabs on the number of mobile phones in use across the globe. The organization says it calculated its 5 billion-plus figure using “extensive database of mobile statistics and forecasts,” which is updated on a daily basis. However, that the number of individual subscribers is actually significantly lower than the total number of mobile connections across the world, since there are a number of “power owners” of mobile devices who have more than one SIM card, which means that they have more than one mobile device. According to GSMA Intelligence, more than half the estimated mobile subscribers call the Asia Pacific region home, which makes sense given that China and India are the two largest mobile markets. In fact, China itself claims more than a billion of mobile phone subscribers, while India accounts for 730 million. Europe, however, boasts the highest rates of penetration — 86 percent of citizens have a mobile service subscription. In the coming years, GSMA estimates that the total number of unique mobile subscribers will hit 5.7 billion, with India comprising much of this growth. India has a population of 1.4b people with 700 million mobile subscribers (21% penetration), of which about 300 million are smartphone users. 400 million mobile phone users are still using feature phones, and could upgrade to smartphones in the near future. However, first-time smartphone buyers are likely to purchase smartphones at the bottom end of the price scale. A survey conducted by research firm Counterpoint found that two-thirds of the 1,500 mobile phone users surveyed plan to upgrade to a new device within the next year which lowers the average 24-30 month upgrade cycle to less than 20 months. Consumers wanting 4G mobile phones with more advanced features drive the trend. 30% of those surveyed were considering phones with a fingerprint sensor and a better front-facing selfie camera. This trend is positive for India's smartphone market. However, in the near term, the beneficiaries are likely to be handset makers in the sub-US$200 segment, such as Lenovo, Xiaomi and Indian brands selling handsets at rock-bottom prices, such as Micromax. Figure 1: Smartphone Shipment Share in India by ASP Source: Counterpoint Research

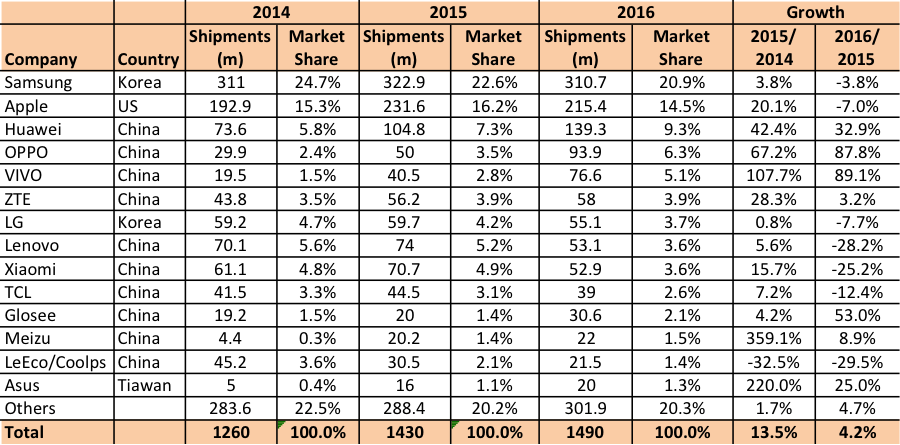

High prices of premium smartphones are partially due to duties and taxes, as well as India's weak currency. Customs duties are calculated over the total price of the product, shipping charges and handling charges. Accessories within the box are reportedly taxed separately. After customs duties, the product is charged VAT (Value Added Tax) at the borders of various states in India. A report from Deutsche Bank said that India is among the most expensive places in the world to buy an iPhone, with prices averaging 31% higher than those in the U.S. The iPhone 7 was over US$400 more expensive there than in the U.S. The upcoming iPhone 8 is expected to be no different. India’s taxing policy seems to be working as Apple has begun local manufacturing in India via Wistron's plant in Bengaluru. Most of the production will be of older models, such as the iPhone 5s and iPhone SE. The price of Apple's iPhone SE could go down by as much as 10-12% if it is manufactured locally. With the model priced at around US$350, local manufacturing could reduce the price to about US$308. This price is still likely to be relatively expensive by Indian standards, considering that per capita income is roughly US$1,600 a year (compared with China, where per capita income is about US$8,000), and about three-quarters of smartphones sold in India are in the US$150 and below price range. However, the price reduction puts the phone just within the "mid-range" (US$125-310) smartphone segment in India, which is currently witnessing very strong growth. During the first quarter of 2017, smartphone shipments grew 15%, and smartphones in the mid-range segment saw the highest growth 158% Y/Y during the same period. Apple hopes to capture market share in the short term, which would increase the iOS base in India and add users into their ecosystem. As indicated previously, India's smartphone market is still at a very nascent stage of growth, but the country has a young population (almost half are aged 25), and Apple is an aspirational brand in India. The company's products are "sticky," and by using lower-priced, currently more affordable older models as a starting point, Apple is widening India's iPhone user base. In the longer term, as the market matures, per capita income rises and the premium smartphone segment grows, these users could upgrade to newer iPhone models. The following table shows shipments and growth of the top 14 smartphone OEMs. Overall, the industry gained 13.5% Y/Y in 2015 and 4.2% Y/Y in 2016, but Samsung and Apple lost in shipment volume in 2016, as did LG, Xiaomi, TCL and LeEco/Coolps. The big gainers were Oppo and Vivo. Table 1: Yearly Smartphone Shipments by OEM Source: OLED-A

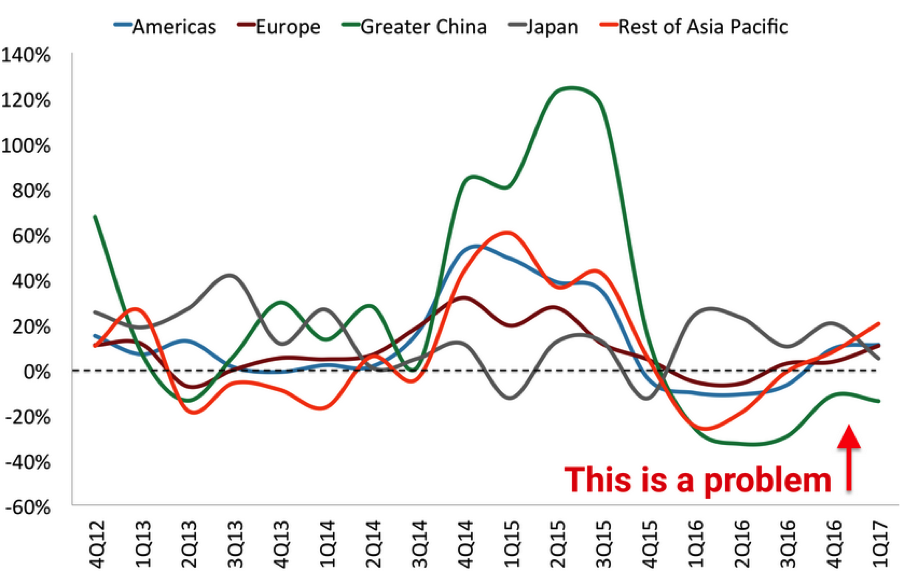

Apple’s interest in India’s derived from the large opportunity, the new installation of 4G, and the negative revenue growth in China, which started in Q116 and has continued every quarter since then. Since China remains Apple’s 2nd largest revenue source, they need a big market to make up for the lost revenue, which is likely to continue throughout 2017. Figure 2: Apple’s Y/Y Revenue Growth by Region Source: Apple

|

Vertical Divider

|

|

Contact Us

|

Barry Young

|