|

Lenovo Struggles to Return to Profitability w/Smartphones

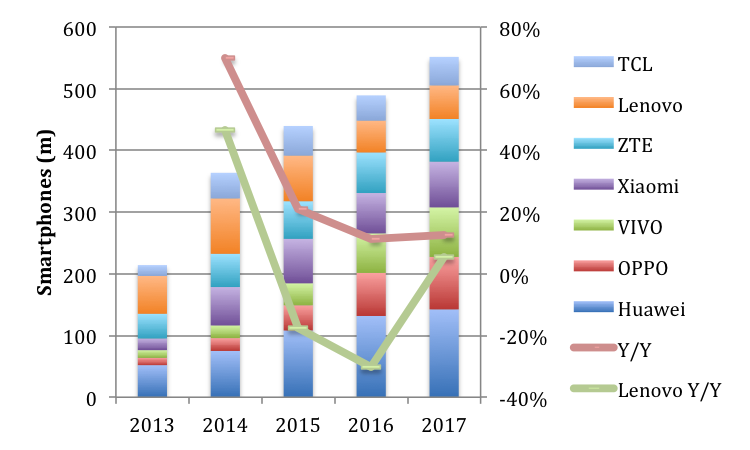

February 20, 2017 The mobile division of China's Lenovo Group Ltd is "on track" to return to profit by December, 2017 at the earliest helped by strong growth in overseas markets, its chairman said on recently after the firm posted a 67 percent drop in quarterly earnings. Yang Yuanqing also dismissed the possibility of selling the struggling division to focus on the personal computer (PC) market where Lenovo is the world's biggest maker by shipments, as widely proposed by analysts and company watchers. "No, that is not my plan," Yang said in an interview. "Mobile should be our core business as well." The smartphone market has changed markedly since Lenovo spent $2.91 billion (2 billion pounds) buying the money-losing Motorola handset business in 2014. Since then, global shipment growth has slowed, while at home in China, Lenovo's biggest market, late-comers such as Oppo and Huawei Technologies Co Ltd [HWT.UL] have risen to prominence. The mobile division now accounts for about 18 percent of Lenovo's revenue, and in October-December, reported an operating loss of $112 million - roughly the same as in the previous quarter. "I cannot say I am 100 percent satisfied (with the Motorola integration) ... but it is within my expectations," Yang said. But he said he was confident of a recovery in the second half of the fiscal year starting April, as handset shipments rose 7 percent in October-December from three months prior. That rise came even though the mobile division was hardest hit by an industry-wide shortage of components such as memory chips. Moreover, Lenovo appointed former Samsung Electronics Co Ltd executive Jaden Jiang earlier this month as vice president, in charge of mobile strategy in China. Overall, component supply constraints plus a "challenging" macro-economic environment in the third quarter pushed net profit down 67 percent on year to $98 million, on revenue which fell 6 percent to $12.2 billion, Lenovo said. The profit result compared with $159.53 million average of 14 analyst estimates in a Thomson Reuters poll. The figure below shows that Lenovo’s performance since 2013 has trailed the average of the 6 major Chinese smartphone OEMs by 10% in 2013 to 40% in 2016. The company hopes to increase growth in 2017 and become competitive-- “Hello Moto” Figure 1: Chinese OEM Smartphone Shipment Volume and Growth Source: Canaccord Genuity, OLED-A

|

Vertical Divider

|

|

Contact Us

|

Barry Young

|